Ripple Labs-backed XRP led in the mild cryptocurrency rebound in the past 24 hours following the regulatory clarity from the U.S. SEC. The large-cap altcoin, with a fully diluted valuation of about $246 billion and a 24-hour average trading volume of about $10.5 billion, pumped over 7.7 percent in the past 24 hours to trade about $2.48.

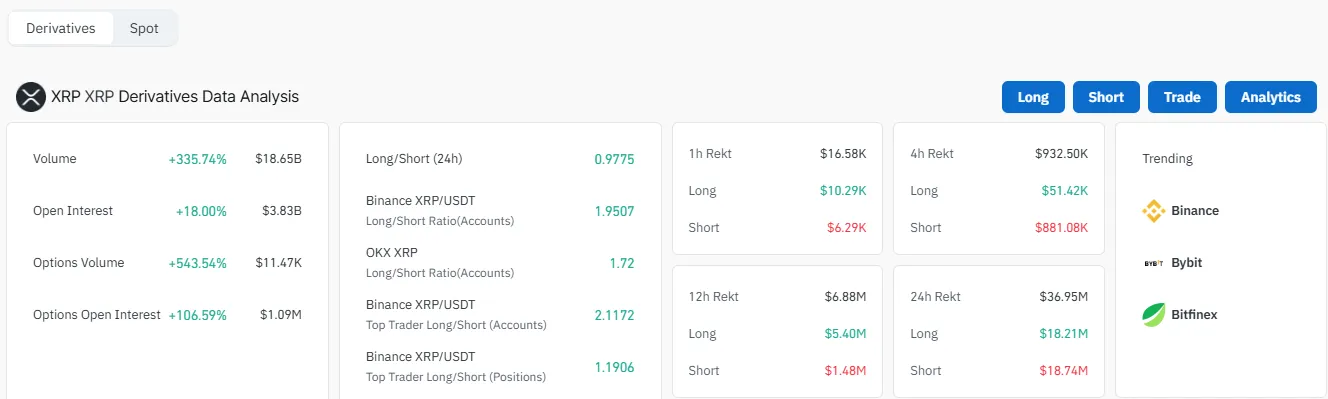

Open interest (OI) on the token futures has increased by 18% to $3. 82 billion, reflecting increased volatility in the market. Liquidations of over $36 million have occurred from this volatility, suggesting the potential for over-leveraged traders.

The coin has already confirmed the break from the 6-year triangle consolidation pattern and this suggests the opening of the new bullish trend. Its analysts are thinking that if the altcoin can consistently close above $2. 70 to $3 resistance, the price could make a parabolic rally. However traders should keep in mind the newly emerging head and shoulders (H&S) pattern together with bearish RSI divergence; this could lead to some short-term correction.

If that pullback happens the token has already built up some decent support at $2. 00 which could act as the key barrier for market stability before another rally.

Though the SEC lawsuit was dismissed, increasing optimism is not being generated as the derivatives market appears to be overly leveraging: data from Coinglass.

Trading volume surged 355.74% to $18.65 billion.

Open interest increased by 18% to $3.83 billion.

Long/short ratio was still locked in at 0. 9775. Binance though shows extreme longs tending toward the market with top traders holding a 2.1172 ratio.

Institutional Adoption & Speculation On ETF Application: Bitwise and Franklin Templeton have both applied for a spot ETF. Ripple CEO Brad Garlinghouse expects SEC approval in Q2 2025.

XRPL Ecosystem Growth New Ripple USD (RLUSD) Launch, increasing activity on the blockchain & Web3 development on the XRP Ledger.

Whale Accumulation & Network Growth: As per Santiment data, Wallets holding at least 1M XRP now control 46.4 billion coins, a 6.5% increase in just two months. Additionally, unique wallet interactions have surged 6x in March, reflecting rising network adoption.

Conclusion: Will XRP Hold Above $2.40 or Face a Correction?

Recent price action signals strong bullish momentum, but the rising leverage introduces risks of liquidations. Traders should watch the $2.40 support level closely. If the coin consolidates above it, the next target is $2.70–$3. However, a breakdown below could trigger sharp declines. With growing institutional interest and ecosystem expansion, the altcoin remains one of the most closely watched assets in the crypto space.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.