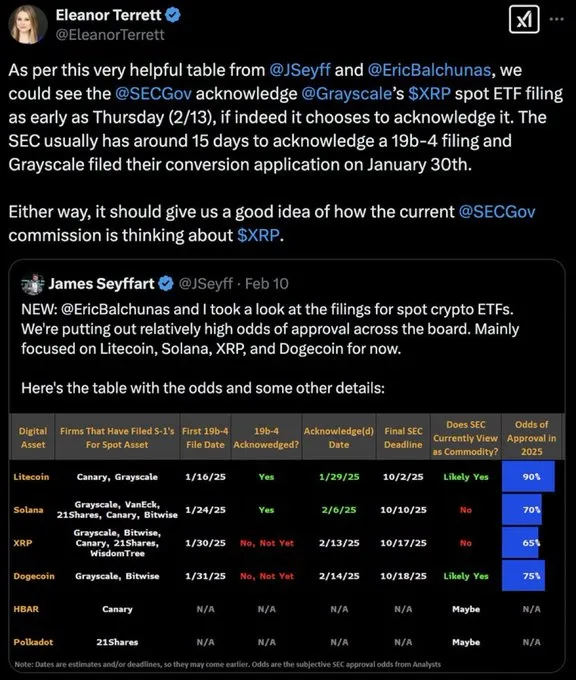

XRP is surging in price, defying broader crypto market corrections and gaining strong momentum. With the SEC expected to acknowledge Grayscale’s XRP ETF filing by February 13, 2025, institutional investors might soon flood the market, increasing demand for Ripple’s token.

Can XRP reach $15, $50, or even $110? Experts analyze XRP’s price trajectory, market sentiment, and potential ETF impact. Let's break it down.

While the SEC's final decision remains uncertain, the mere acknowledgment of Grayscale’s XRP ETF filing could act as a bullish catalyst for XRP. In the U.S., major financial institutions hesitate to invest without SEC clarity. SEC acknowledgment could unlock billions in liquidity, driving XRP demand in the U.S. market

At the time of writing, XRP is trading at $2.44, with a 0.35% daily change. More notably, trading volume has surged by 20.23% to $5.5 billion, while XRP Futures Open Interest has climbed 0.93% to $3.56 billion. These indicators suggest strong investor confidence despite minor price fluctuations.

Renowned crypto analyst Ali Martinez has intensified speculation with a bold price forecast, claiming XRP has broken out of a symmetrical triangle, setting the stage for a rally toward $15. This breakout aligns with previous historical trends where similar patterns led to parabolic price surges.

While the SEC acknowledgment and broader market trends play a role, technical indicators suggest that XRP’s bullish trajectory is independent of regulatory developments. This strengthens the case for a potential rally.

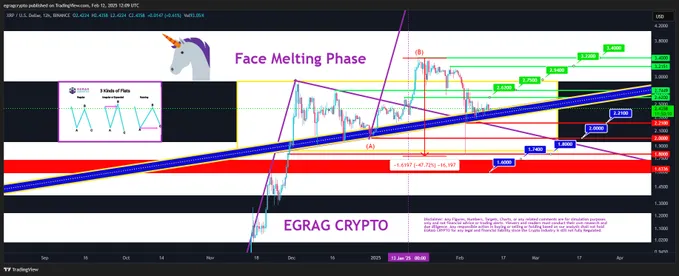

XRP’s price action remains within a critical range that traders should monitor:

Lower Support Levels:

1️⃣ $2.21

2️⃣ $2.00

3️⃣ $1.80

4️⃣ $1.74

5️⃣ $1.60

If XRP closes below any of these levels, it could indicate a trend reversal, potentially dampening the bullish momentum.

Upper Resistance Levels:

1️⃣ $2.62

2️⃣ $2.75

3️⃣ $2.94

4️⃣ $3.22

5️⃣ $3.40

A confirmed breakout above these resistance levels would further solidify XRP’s strength, reinforcing a bullish continuation.

Crypto analyst Egrag Crypto has gone a step further, suggesting XRP could reach $110 in the next bull cycle. His technical analysis points to a well-formed cup pattern, with XRP currently validating its breakout trajectory.

XRP could reach $13 in the current cycle.

Price targets beyond this include $32 to $48, then $60 to $70, and ultimately $95 to $110 in the next bull cycle.

Before aiming for triple digits, XRP is expected to break past $4, setting a new all-time high (ATH). Analysts predict that after surpassing this key milestone, XRP could climb to $5.50, with additional targets of $5.85 and $8.76.

For this bullish move to stay intact, XRP must maintain support above $2.20, making $1.88 and $1.75 crucial levels to watch in case of a retracement.

XRP is at a crucial breakout point, with technical indicators, institutional adoption, and ETF speculation fueling optimism. Whether it’s $4, $15, or even $110, XRP investors should closely monitor key resistance levels.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

5 months ago

best Article