The cryptocurrency market is heating up, and XNO (Nano) is making headlines! With a 31.36% surge in the last 24 hours, XNO is showing strong momentum, backed by high trading volume on Binance. This rally has caught the attention of traders, as bullish technical patterns emerge, suggesting further gains.

But how high can XNO go? Analyst Javon Marks predicts a potential 780% upside, targeting $10.663. Let's dive into the market data and technical indicators to see what’s next for XNO.

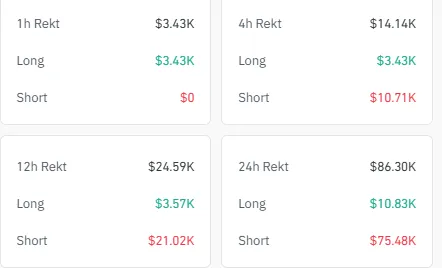

According to Coinglass data, XNO’s recent surge has resulted in $86.30K in liquidations, with $75.48K from short positions alone. This indicates that bears were caught off guard, forcing liquidations and fueling further price growth.

Typically, high short liquidations suggest that the market is experiencing an aggressive upward move, as traders betting against XNO are forced to buy back at higher prices. This dynamic often leads to sustained bullish momentum, pushing prices even higher.

Further confirming this bullish momentum, Coinglass reports a 60.29% surge in open interest, reaching $2.10 million. Additionally, trading volume has skyrocketed by 408.35% to $22.61 million, a strong indication of growing market participation and increased liquidity.

When both open interest and trading volume rise together, it signals that new money is entering the market, often supporting a continued uptrend. This aligns with the bullish breakout pattern seen on XNO’s charts.

The 4-hour XNO/USDT chart shows a classic Bullish Falling Wedge pattern, which has already broken out to the upside. This technical pattern typically leads to a strong rally, and if momentum holds, XNO price could soon hit $2.20.

The height of the wedge is added to the breakout point, leading to an expected short-term price target of $2.20. If bullish momentum continues, higher targets may come into play.

Crypto analyst Javon Marks has set an ambitious target of $10.663 for XNO, marking a potential 780% upside from current levels. While this may seem bold, similar price surges have happened in past bull runs when technical breakouts aligned with high market participation.

Strong breakout from bullish technical pattern

Increasing open interest and trading volume

Heavy short liquidations, fueling upward pressure

Growing investor interest in XNO’s fundamental

With technical indicators flashing bullish, high liquidation of short positions, and a major breakout confirmed, XNO is showing strong potential for further upside.

In the short term, traders should watch for a move toward $2.20, while in the long run, if the momentum continues, $10.66 could be a realistic target.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

5 months ago

best Article