Solana (SOL) has been on a steep decline, plunging over 14% in the past 24 hours to trade at $138.38. The cryptocurrency has been losing ground for five consecutive weeks, falling more than 47% since its all-time high of $295 on January 19. As bearish momentum strengthens, investors are left wondering: Will SOL recover, or is there more downside ahead

What’s Driving Solana’s Price Drop?

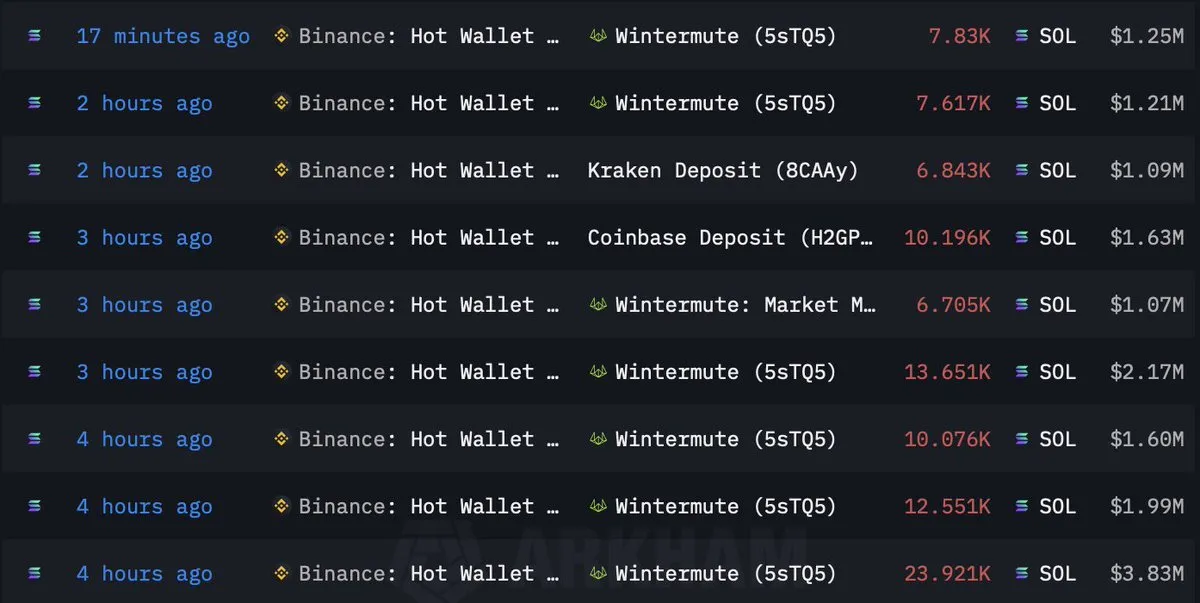

One of the main catalysts behind Solana’s price crash is the impending $2 billion token unlock, the largest in the network’s history. Market maker Wintermute recently withdrew $40 million in SOL from Binance, sparking fears of heightened selling pressure.

Adding to the bearish sentiment, a Solana whale moved 5,056,172 SOL—worth approximately $757 million—to an unknown wallet. While some traders interpret this as a precursor to a large sell-off, others speculate it could signal strategic accumulation before a market breakout.

Binance’s massive offloading of SOL through Wintermute has further worsened market conditions. In the last four hours, Binance’s hot wallet transferred between 6.7K–23.9K SOL ($1.07M–$3.83M) to major exchanges like Kraken and Coinbase. This surge in supply has contributed to the downward pressure, exacerbating the bearish momentum.

The "Libra Coin" scandal involving Argentine President Javier Milay has also dented investor trust in Solana. After publicly endorsing the Solana-based meme coin Libra, the token crashed by 94% following what many labeled a rug pull scam. The controversy surrounding Milay’s endorsement and subsequent denial has only deepened skepticism among investors.

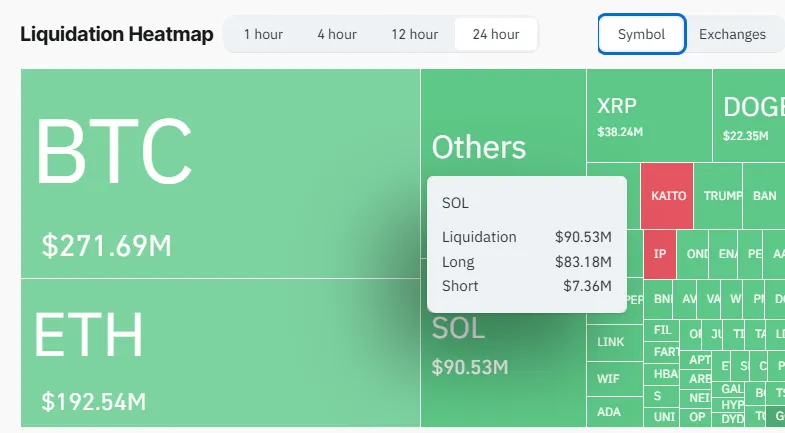

As per Coinglass data, Over the past 24 hours, Solana has seen $90.53 million in liquidations, with $83.18 million from long positions and $7.36 million from shorts. This wave of liquidations highlights the immense pressure on bullish traders and underscores the prevailing bearish sentiment.

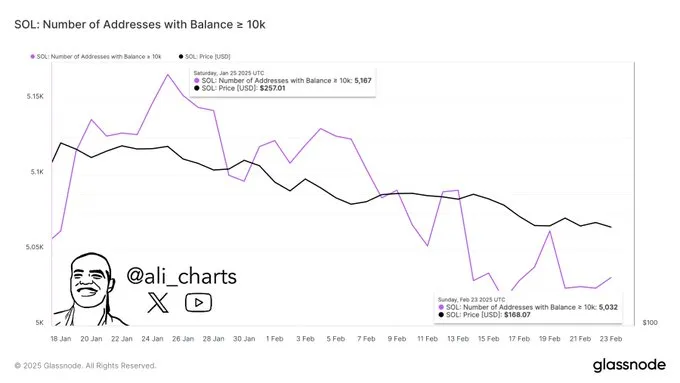

Glassnode data reveals that during Solana's recent price decline, around 135 major investors, each holding over 10,000 $SOL, have either sold off or redistributed their assets within the past month.

Solana continues to trade within a descending channel, with its current price sitting below all major moving averages—the 20-day, 50-day, 100-day, and 200-day SMAs—signaling sustained bearish momentum.

Relative Strength Index (RSI): At 24.55, SOL is deep in oversold territory, suggesting a potential for a short-term bounce.

Support Levels: Immediate support lies at $120, with psychological levels around $100 acting as a crucial floor.

Resistance Levels: A breakout above the descending channel’s upper trendline near $160 could pave the way for a rally toward the $184-$205 range, where the 50-day and 100-day SMAs converge.

Given the current market dynamics, Solana’s near-term outlook remains bearish. However, the deeply oversold RSI indicates that a short-term relief rally is possible. If SOL manages to break above $160, it could spark bullish momentum, targeting the $184-$205 resistance zone.

On the downside, failure to hold the $120 support could open the door to further declines, potentially testing the psychological $100 level or even lower.

Solana’s recent price plunge has sparked fear among investors, but the oversold RSI hints at a possible short-term rebound. While the bearish trend remains strong, long-term investors may see this dip as an opportunity to accumulate SOL at lower levels. However, with market sentiment fragile, caution is advised.

Keep an eye on the $120 support and the $160 resistance in the coming days, as they will be key indicators of Solana’s next move.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.