This week marks a crucial phase in the ongoing legal battle between the SEC and Ripple. By Wednesday, the SEC is expected to file its appeal-related opening brief, which could significantly influence market sentiment and XRP's price action.

On Saturday, XRP broke out of its Bullish Pennant, surging by 11% as it surpassed its upper trendlines, supported by increased trading volumes. However, as of January 13, XRP is showing signs of retreating toward the triangle’s lower trendline, hovering near $2.40.

If XRP drops below this support level, it could invalidate the symmetrical triangle breakout scenario, potentially triggering a decline toward the pattern's lower trendline. Conversely, holding above the upper trendline would maintain the bullish outlook and increase the likelihood of XRP reaching its $4 target.

On Sunday, XRP experienced a surge in spot outflows, with over $41.44 million worth of the token sold. This aligns with its resistance level, as selling pressure continues to mount. The increase in spot outflows suggests that short-term profit-taking is still dominant, potentially reinforcing current resistance levels and raising the probability of further downside.

The increase in spot outflows suggests that short-term profit-taking is still dominant, potentially reinforcing current resistance levels and raising the probability of further downside.

XRP's Open Interest currently stands at $5.37 billion, close to its all-time high of $5.42 billion, signaling strong market activity and heightened trader engagement. This elevated Open Interest suggests that market participants are closely watching XRP's next move, whether it holds support or breaks below it.

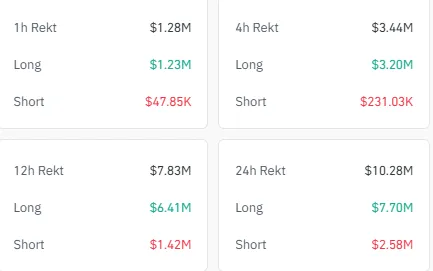

According to Coinglass data, the last 24 hours saw $10.28 million in liquidations. Of this, $7.70 million came from long positions, while $2.58 million originated from shorts. The higher liquidation of longs reflects the volatile price action and the challenges faced by bullish traders in maintaining their positions.

The key question for XRP is whether it will hold above the critical $2.40 support level or face a deeper correction. Sustaining the support would likely keep the $4 symmetrical triangle target within reach, while breaking below could lead to further declines. The market remains on edge, with high levels of speculation and trading activity shaping XRP's next price movement.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.