XRP’s recent drop in price has raised a lot of eyebrows in the crypto community, with one researcher recently accusing it of being the “biggest financial scam in history. ” Though some are wondering if Ripple is chasing too high, CTO and analysts are predicting token may rise to $5, $13, or even $27. Is this possible? Let’s explain.

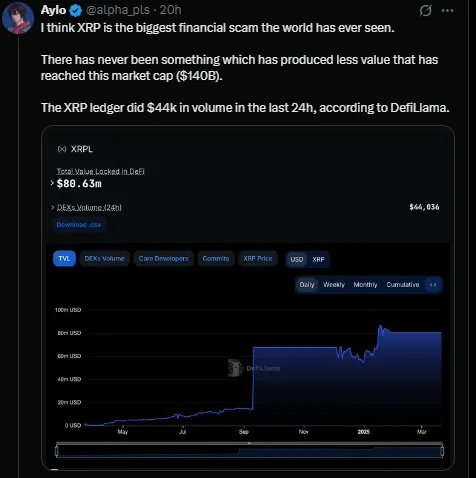

On-chain researcher Aylo recently weighed in on the altcoin as the biggest scam due to the low volume of trading. In the post he wrote on Reddit, Aylo mentioned that Ripple volume on its decentralized exchange (DEX) is only $44,000 and it feels like there’s no immediate use of the token. “In addition, the total value locked (TVL) of XRP Ledger was only $80.63 million — that is not even close to any other major blockchain network”, said Aylo.

However, Altcoin supporters think that the statistics from DeFiLlama are incomplete and may not accurately reflect trading activity. Vet, a validator of dUNL, told me that the actual 24-hour DEX volume on XRPL was around $9 million. This suggests that there may be more activity in XRP’s ecosystem than is reported at first.

Ripple Chief Technology Officer, David Schwartz spoke out on Thursday about these claims, saying that Aylo's data only included Automated Market Makers (AMMs) on XRPL. “AMMs make up only a small proportion of the network’s total volume and the overall ecosystem of the coin is strong, ” Schwartz added in a statement to CNBC.

Schwartz also noted that the utility of the altcoin goes beyond its DEX, including cross-border payments, liquidity services, and enterprise adoption, so even if people are skeptical about the token’s future, Ripple’s ongoing efforts in legal battles and partnerships should be a good reason to expect it to succeed.

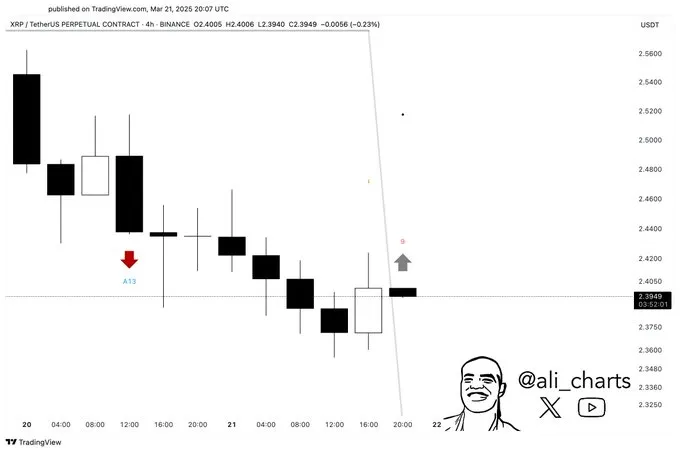

Technically, the altcoin recently showed a TD Sequential buy signal on the 4-hour chart which suggests a rebound is coming. The breakout pattern seen in 2017 by EGRAG Crypto seems to be similar, along with a parabolic price upturn.

As of now, the altcoin trades for $2.39 with a market cap of $139.20 billion and is the fourth-largest cryptocurrency after Bitcoin, Ethereum, and Tether. Its impressive ranking makes it easy to overlook that ripple is currently trading at a major downturn in the larger cryptocurrency market, but analysts are expecting the price to rebound as several factors emerge such as:

SEC v. Ripple developments: Legal certainty might lead to increased investor confidence and institutional adoption.

Donald Trump's Crypto Reserve Planning: The debate surrounding a U.S. Strategic Crypto Reserve serves to fuel demand.

Potential XRP ETF Approval: Exchange-traded fund (ETF) could open the door to large inflows of capital.

The token price may follow historical trends and can surpass previous all-time highs, according to analysis from EGRAG Crypto. The paper also includes key Fibonacci levels that indicate bigger price targets.

$5.30 – First significant resistance level

$8.50 – Fibonacci 1.272 extension

$13.76 – Fibonacci 1.414 extension

$27.46 – Fibonacci 1.618 extension (parabolic breakout scenario)

If coin manages to break above the “Green Line” resistance (as it did in 2017) then the odds of exponential growth could be very high. If things are going right, the answer to this would be likely to be in the next 2+ years with strong adoption and regulatory pressures supporting Ripple growth.

Despite criticism, The Altcoin remains a dominant altcoin with strong institutional backing and a growing use case. If Ripple secures regulatory clarity and broader adoption, a surge toward $5, $13, or even $27 isn’t out of reach. However, market conditions, legal decisions, and overall crypto sentiment will play a crucial role in determining its future trajectory.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

9 months ago

God