Pi Network price has plunged nearly 16% over the last 24 hours, to $1.14. The selloff comes with an overall market sell-off, with Bitcoin and Ethereum both showing significant weakness. However, the altcoin has been weighing heavily in recent days due to other factors such as the impending massive token unlock, and disappointment at its lack of presence on Binance.

Can the trending token go back up or will a dive below $1 be the inevitable direction? Let’s see what the trends, market sentiment, and technical indicators say.

1. Massive Token Unlock Incoming

According to PiScan, there are more than 129 million Pi token to be unlocked this month -- worth roughly $175 million. In the past, such large unlock events usually caused immense selling pressure which resulted a lower price of altcoin.

2. No Binance Listing: Shaken Investor Confidence

As overwhelming as 87.10% of the community voted for a Binance listing, the exchange has yet to announce any plans to list token, which puts all of our doubts about the project’s legitimacy and prospects for eventual adoption in jeopardy.

3. Weak Market Sentiment and Pi Day Disappointment

Pi’s Core Team was expected to announce major milestones on the day of March 14th, but for the most part, the community is disappointed - coupled with persistent market volatility, share prices have been puffed up.

Over at Binance, speculation about Coinbase listing has been on the rise. Coinbase's Chief Legal Officer Paul Grewal recently put out a cryptic tweet that featured pie featuring in it, leading Pioneers to speculate that Coinbase may be readying for:

A potential 30%+ price surge

Increased liquidity and global recognition

A major step toward mass adoption

There's been no official confirmation yet though, and investors should be careful.

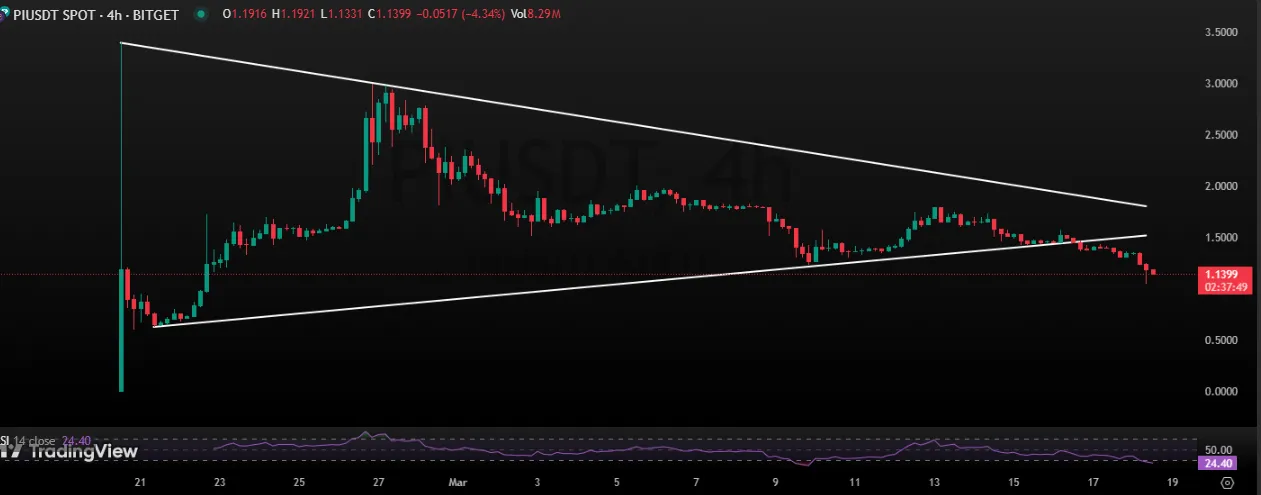

Technical indicators suggest continued bearish momentum:

Daily Chart: The altcoin is now showing a series of red candles which erases previous weekly gains. The token is down 37% from its trading high of $1. 80.

4-Hour Chart: the altcoin has been trading in a pretty similar triangle pattern. It broke the lower boundary on March 16, as well as the major $1. 20 support level.

The token market cap stands at $8.05 billion, while its one-day trading volume surged 57.54% to $574.92 million.

Liquidation Data – Coinglass reports that 104, 153 traders have been liquidated during the past 24 hours, and total liquidation is worth $194.89 million. Open interest in Pi has also plummeted by 16. 10% suggesting a loss in confidence in the market.

Source: TradingView

Given all of that then, the odds of Coin declining below $1 are increasing and this seems especially likely with selling pressure building.

The current headwinds certainly won’t convince Pi Network’s founder – Dr. Nicolas Kokkalis – who points out that the platform’s value – as it currently stands – rests on its ecosystem being “driven not by the market but by community members”. With more than 60 million users and 25 million KYC-verified accounts, the trending coin is still growing.

A confirmed major exchange listing (Binance or Coinbase)

Stronger adoption within its ecosystem

Reduced market uncertainty following the token unlock event

The short-term trend towards altcoin is Bearish, likely to drop below $1 if selling pressure deepens, but confirmation of exchange listing or positive ecosystem trends could be signs of recovery.

But for now, investors should monitor certain support levels and wait for the announcement. Will PiNetwork bounce back from the collapse? We'll have to wait and see.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.