As the crypto market witnesses a massive demand surge with Trump’s political win, Bitcoin hits $93k and inches closer to the $100k target. On the other hand, Ethereum, the biggest altcoin, shows a bull run struggling to take off. Despite surpassing the $3k barrier, the bull run peaks at $3,446 and retests the $3,100 level.

As the Ethereum rally fails to reach the 52-week high at $4,093, the broader market questions the possibility of a $10k price target. In this article, we have gathered all the necessary market data, price analysis, and institutional support to clear this doubt.

As Trump promises a new age of crypto in the United States, institutional support is increasing. Floods of inflows in the Bitcoin and Ethereum ETFs are boosting the market price. As of November 14, the Ethereum ETFs recorded six consecutive days of net inflow.

Further, the Ether ETFs achieved positive cumulative flows, which were last seen on the second day of inception. The cumulative flows of the nine US Spot-based Ethereum ETFs stand at $241.51M. As the rising Bitcoin ETF inflows support the bull run in BTC prices, growing inflows in Ether ETFs can fuel the ETH rally to create new peaks.

Further, the promised age of crypto in Trump’s second term could increase regulatory acceptance and boost global adoption.

Ethereum price prediction based on the current market trend expects a post-retest reversal rally from the $3,000 psychological mark. The pullback from $3,446 forms three consecutive bearish candles and hits the $3,170 support.

However, before the pullback, the ETH price surged by ~32% in 30 days from $2,613 to $3,385. The recovery run aligned with the increased inflows in the Ethereum ETFs.

Furthermore, whales' interest in Ethereum has increased as the daily count of large transactions surpasses 10,000. This marks the highest level seen on the Ethereum network since August.

Additionally, since the Ethereum Merge, the ETH supply has decreased by 103,249 ETH tokens. This marks a supply change of –0.040% per year. With 800,000 ETH tokens issued and 848,000 ETH tokens burned, the Ethereum network has entered a deflationary state. This, in turn, will likely increase the demand for ETH if it remains deflationary.

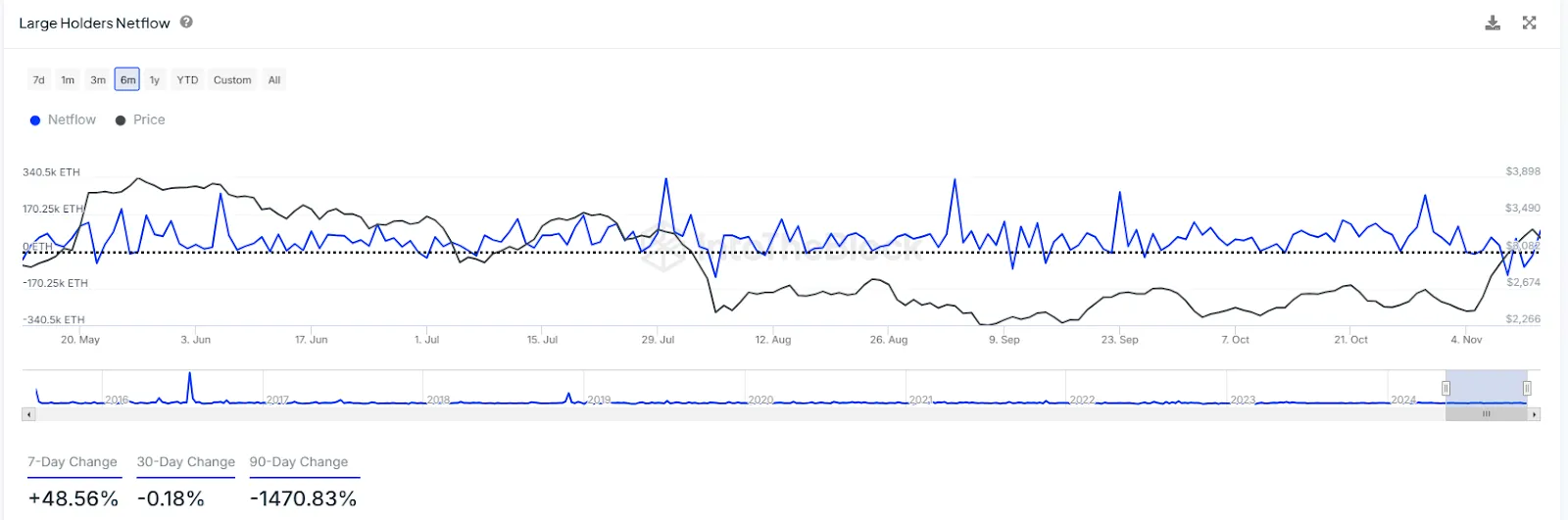

As the daily count of large transactions over the Ethereum network surpasses 10k, the Large Holders NetFlow also spikes up. The Netflow currently stands at 97.05k ETH, which results in a 7-day change of 48.56%.

However, the 30-day change shows near zero flow, and the 90-day change reveals a major outflow of 1470%. Hence, the short—and medium-term trend shows a bullish recovery, but the long-term data reveals a long road to recovery ahead.

The novel deflationary model of the Ethereum platform makes it a super network ready to explode in the coming times. It all started with the London Fork launching the EIP-1559 mechanism on August 5, 2021. However, the merge happened on September 15, 2022.

Since the merge, the network has transitioned to PoS from the PoW mechanism. The rewards for validators result in smaller issuance of ETH compared to the miners' reward system. This helps the ETH burn rates outpace issuance, resulting in a net deflationary state during high usage periods.

As a net deflationary network, the declining supply can lead to a direct increase in demand. Metrics like total ETH burned, net supply change, and daily burn rate are crucial to measuring deflation. A surge in total ETH burned and daily burn rate is a positive signal that results in a supply drop.

The perfect storm for Ethereum’s growth will require multiple factors to align with the broader market recovery. A broader market recovery is set as Trump’s win boosts positive sentiments and increases the chances of regulatory acceptance.

In a prolonged bull market, the total Ethereum burn must increase to boost the demand, making it a lucrative asset for institutional investors. Further, the boost must be reflected in the ETH ETFs to boost the Ethereum price trend. If the majority and not all of the mentioned factors align, the bull run in Ethereum could reach a new all-time high and aim at the $10k price target.

Dharmendra Vishwakarma is an experienced English News Writer and professional content creator with a strong focus on cryptocurrency, blockchain, and digital asset reporting. Associated with Coin Gabbar, Dharmendra delivers accurate, engaging, and insightful articles that help readers stay updated on the latest developments in the crypto world. Passionate about storytelling and research, he combines thorough analysis with easy-to-understand content, making complex topics accessible. Outside of writing, Dharmendra enjoys reading books, which fuels his creativity and broadens his perspective. His work reflects professionalism, clarity, and a dedication to delivering value to readers and the wider crypto community.

1 year ago

Good news