The accumulation of spot Bitcoin ETFs has seen a dramatic surge, coinciding with the recent upward momentum in BTC prices. According to data from Coinglass, spot Bitcoin ETFs recorded inflows exceeding $900 million in a single trading day, marking one of the largest inflow events in history.

As the U.S. dollar shows signs of weakening in the coming days, many analysts believe this could further support Bitcoin's bullish momentum. A weaker dollar often drives increased interest in alternative assets like Bitcoin.

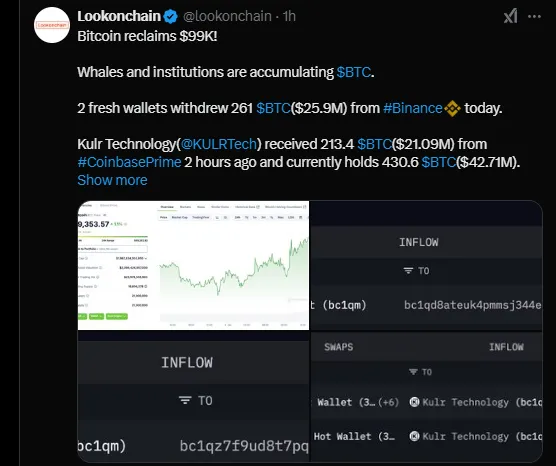

In Lookchain's post, it is highlighted that Bitcoin has reclaimed the $99,000 mark. The post mentions that whales and institutions are actively accumulating Bitcoin.

Specifically, two fresh wallets withdrew a total of 261 BTC, worth approximately $25.9 million, from Binance today. Additionally, Kulr Technology (@KULRTech) received 213.4 BTC, valued at $21.09 million, from Coinbase Prime two hours ago and currently holds a total of 430.6 BTC, valued at $42.71 million.

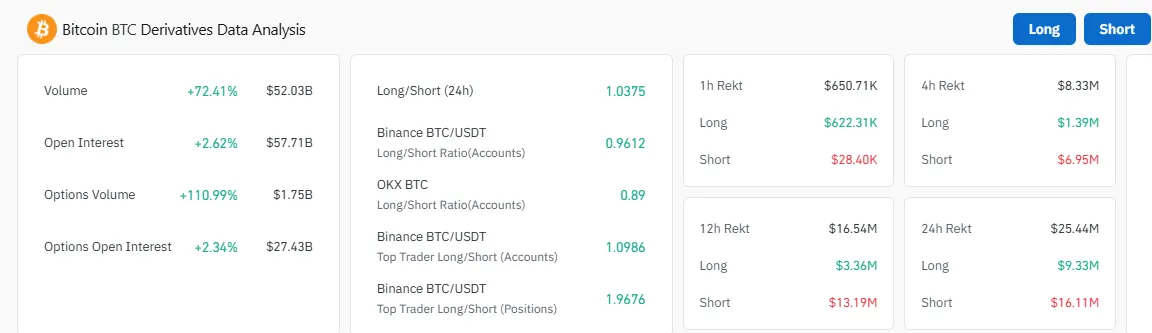

In the past 24 hours, a total of 66,100 traders faced liquidations, amounting to $150.59 million. Over the last 4 hours, Bitcoin liquidations reached $8.33 million, with $6.95 million coming from short positions and $1.39 million from long positions.

Open Interest has risen by 2.57%, now standing at $57.72 billion, while trading volume has surged by 71.52% to $52.00 billion.

Thielen cautions about a potential Bitcoin pullback later in January as the Federal Reserve’s January 29 FOMC meeting may hold interest rates steady, potentially slowing BTC's momentum. He predicts Bitcoin trading between $97,000 and $98,000 by the end of January, reflecting macroeconomic influences.

John Glover of Ledn forecasts a short-term dip to $89,000, followed by a rebound to $125,000 by the close of Q1. He also predicts BTC reaching $160,000 by late 2025. These estimates slightly lag VanEck and Bitwise's projections of $180,000–$200,000.

Despite short-term caution, Bitcoin recently spiked to $98,850, demonstrating robust investor confidence. The Crypto Fear and Greed Index has risen to "Extreme Greed" at 76/100, reflecting high levels of market optimism.

According to Benjamin Cowen, Bitcoin’s recent behavior mirrors its pattern from one year ago. Historically, BTC saw an early January spike, a late-January dip, and a more sustained recovery in February, suggesting a similar trajectory this year.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.