Bitcoin is at a critical juncture, with former BitMEX CEO Arthur Hayes reaffirming his bullish stance, predicting a massive price surge to $110,000. With institutional investors buying the pioneer currency at record highs and a major U. S. inflation report coming this Friday, the next couple of days could be crucial for the world’s largest cryptocurrency.

Arthur Hayes has long worked to secure Bitcoin for future growth, and his latest estimation put BTC at $110,000 (before a potential retest of $76,500), according to Hayes. The primary support — according to Hayes — will come from the Federal Reserve, which is expected to change from quantitative tightening (QT) to quantitative easing (QE) as its policy changes.

Hayes also dismissed concerns about Trump’s tariffs, calling the inflation that followed “transitory. ” And as Federal Reserve Chair Jerome Powell has said before, he has also noted that the coin probably has already bounced off its $77,000 bottom by the end of last week and is poised for a robust rebound.

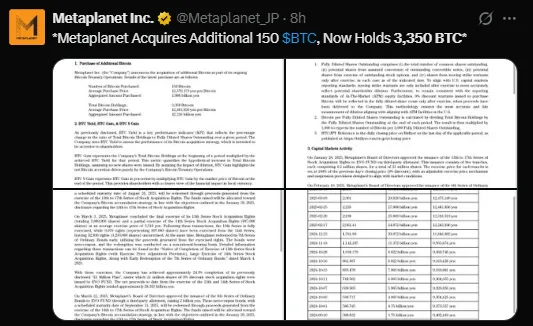

Institutional interest in BTC is rife with the continued rise and more of the latter, pushing upwards the bullish momentum. Recently Japanese investment firm Metaplanet acquired an additional 150 bitcoins worth $12.6 million. At the moment the company holds 3,350 bitcoins, valued at around $291.3 million. The firm has significant backers like Eric Trump and Michael Saylor, making Metaplanet a very noteworthy institutional Bitcoin investor

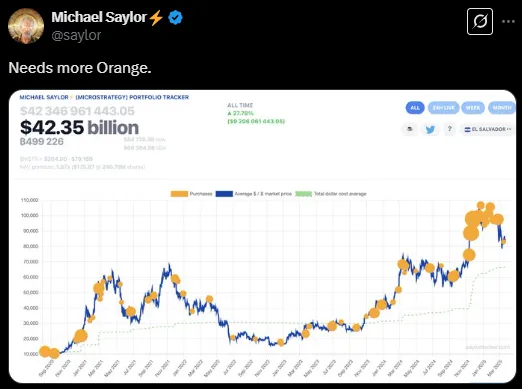

Since the First crytocurrency has gained 68% year to date, institutional demand and a more bullish macroeconomic picture could be reason enough to push BTC higher in the near term.

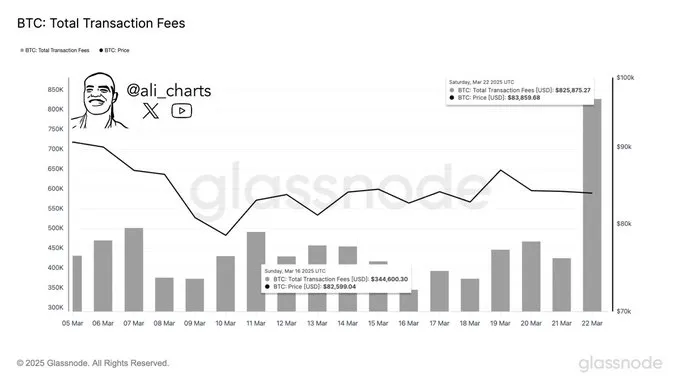

BTC has some fantastic traffic on its network. Transaction fees have almost tripled this past week, which means even more use and demand.

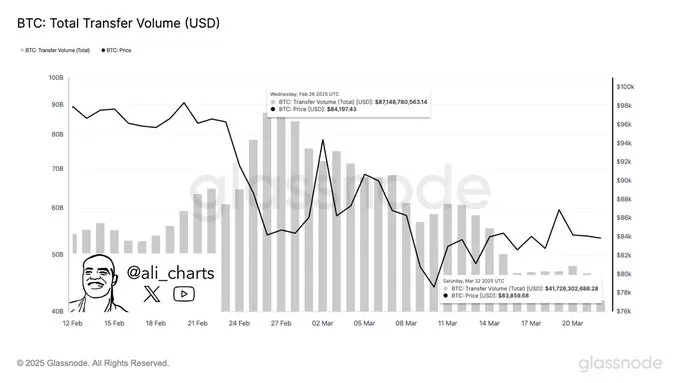

But on-chain data, as well, shows another noteworthy decline in crypto king transfer volume, dropping from $87 billion to $42 billion over the past month.

But on-chain data, as well, shows another noteworthy decline in crypto king transfer volume, dropping from $87 billion to $42 billion over the past month.

This divergence also means that although network activity is high there might be large amounts of investors who are holding BTC instead of actively trading it — this could indicate bullishness and hope for a higher price.

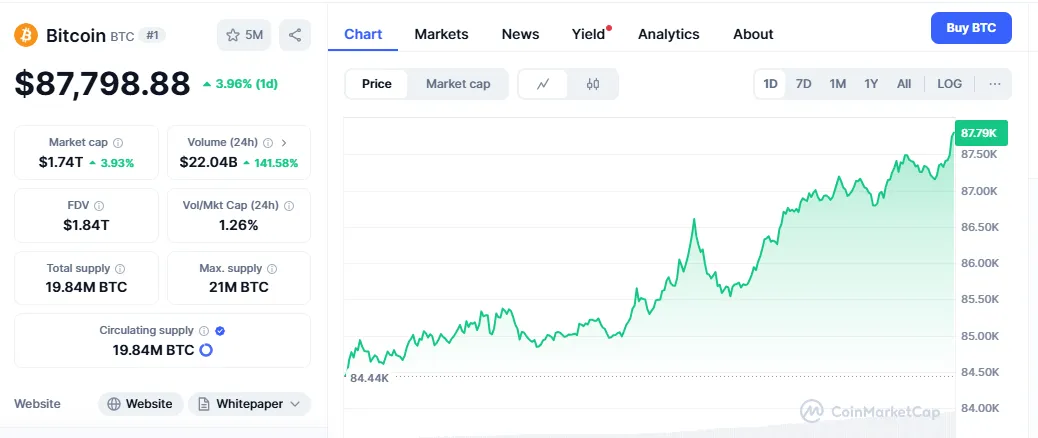

Currently, The price is trading at $87,800 up $3.93% over the past 24 hours. Daily volume has increased by 140.45% to $ 21.95 billion. The current cap is near $1.74 trillion up by 4% in the past 24 hours.

Source: Coinmarketcap

Support from $82,590 to $85,150, where 1.16 million investors bought 625,000 #BTC.

Resistance, from $95,400 to $97,970 where 1.77 million buyers bought 1. 44 million $BTC.

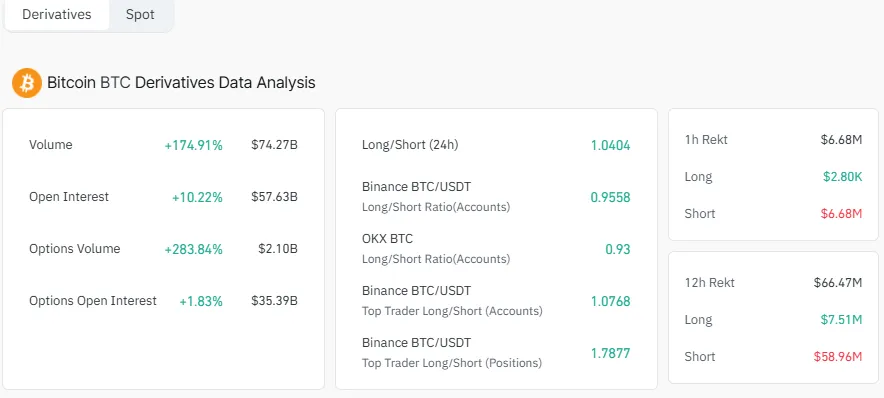

As per Coinglass data, The First crypto currency futures open interest up 10.22% to over $57.63 billion, plus $58.96 million in short liquidations, we have a pretty good bullish backlash going on.

With all the institutional support and Federal Reserve policy change affecting the currency and strong market fundamentals looks set to break $110,000. As long as momentum holds and macroeconomic factors are aligned may break key support levels in the next step toward its next breakout.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

9 months ago

I want to express my gratitude to Barry White for his incredible assistance in helping me recover my lost funds. His professionalism, persistence, and expertise made what felt like an impossible situation manageable. Barry kept me informed throughout the entire process and was always available to address my concerns. Thanks to him efforts, I was able to regain what I thought was lost forever. Highly recommend his services! Email : barrywhite4390 @-gmail.com