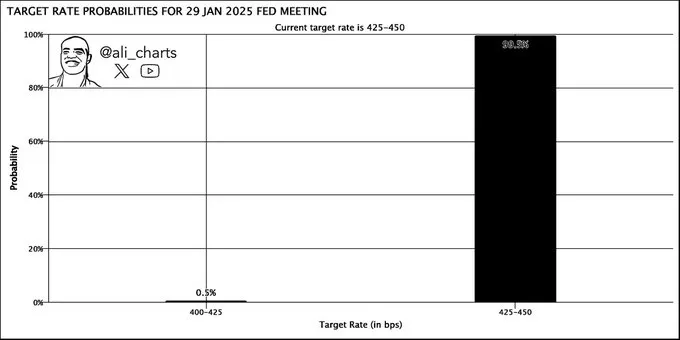

The cryptocurrency market remains on edge as investors anticipate the outcome of the Federal Open Market Committee (FOMC) meeting. With the Federal Reserve expected to keep interest rates steady at 4.25%-4.5%, the CME FedWatch Tool indicates a 99.50% probability of no change.

This uncertainty has led to a 1% decrease in the global cryptocurrency market capitalization, which now stands at $3.48 trillion. Additionally, the global market volume has dropped significantly by 27.70%, reaching $112.05 billion.

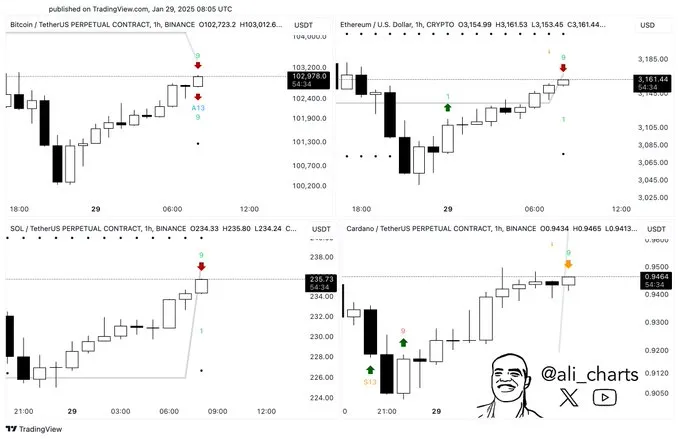

Prominent crypto analyst Ali Martinez has warned of potential market turbulence as the FOMC meeting approaches. The TD Sequential indicator suggests possible sell-offs on the hourly charts of major cryptocurrencies, including Bitcoin ($BTC), Ethereum ($ETH), Solana ($SOL), and Cardano ($ADA).

According to Ali Martinez, investors are offloading their holdings in anticipation of the FOMC decision. Bitcoin ETFs have liquidated nearly 8,000 BTC, equivalent to approximately $800 million, signaling cautious market sentiment. Traders are closely watching Federal Reserve Chair Jerome Powell’s speech later today, as it may impact price movements. Analysts predict Bitcoin price could retest recent lows around $99,000. However, if the Fed adopts a dovish stance, a potential rebound may follow.

Ali Martinez has highlighted the emergence of a head-and-shoulders pattern on Ethereum ($ETH), sparking discussions among traders on X. If this pattern materializes, Ethereum could drop to $2,900, creating a possible buying opportunity. Martinez advises traders to implement a tight stop-loss strategy within the $2,700–$2,500 range to mitigate risks.

According to Artemis, a well-known blockchain analytics platform, Solana has been experiencing a drop in network activity. This is reflected in the decline of daily active addresses over the past seven days, along with a decrease in daily transactions, indicating lower overall usage.

The 1-hour chart highlights two possible scenarios for SOL’s short-term movement. Either the price has completed a corrective phase at the Jan 27 low or still needs another drop to interact with the 0.618 Fib level.

If the correction is complete, SOL follows a WXY pattern, with its last leg forming a three-wave correction. Alternatively, the recent 9% rise could be wave (iv), leading to a final wave (v) low. Key support is at $216 (0.618 Fib), where buyers may step in for a breakout.

A breakout from the descending wedge could trigger a rally, with resistance at $246, followed by $264 and $294. If momentum continues, SOL could reach $330 (1.618 Fib extension).

The RSI shows bullish divergence, reinforcing a potential reversal. However, failure to hold above $231 may lead to a $216 retest. A breakdown below $216 weakens the bullish case, with $195 (0.786 Fib) as the last major support.

Cardano ($ADA) has formed a symmetrical triangle on the 1-day timeframe, signaling an impending breakout or breakdown. If a breakout occurs, $ADA could surge to $1.16 due to strong liquidity at that level. Conversely, if the support trendline breaks, a short position may be viable after a confirmed retest. Market sentiment remains cautious, with investors closely watching the Federal Reserve’s next move for potential impact.

Market analysts predict a dovish tone from Fed Chair Jerome Powell at today’s press conference. This expectation arises from recent inflation metrics, including Core PPI and Core CPI, which have both come in lower than anticipated since the last FOMC meeting. Additionally, the 47th U.S. president has expressed interest in lowering interest rates, potentially providing a positive boost to the cryptocurrency market.

As investors await clarity from the FOMC meeting, market participants should stay vigilant and monitor key technical levels to navigate potential price movements effectively.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.