Cardano (ADA) has been making a strong recovery , surging 15% and currently trading around $0.80. The recent price increase follows a successful retest of its key support level, fueling optimism among traders. Adding to the momentum, Grayscale has officially filed for a Cardano exchange-traded fund (ETF) with the New York Stock Exchange (NYSE), further boosting investor confidence.

With a growing trading volume and strong market support, all eyes are now on whether ADA can break past its crucial resistance at $0.82 and aim for the psychological $1 mark.

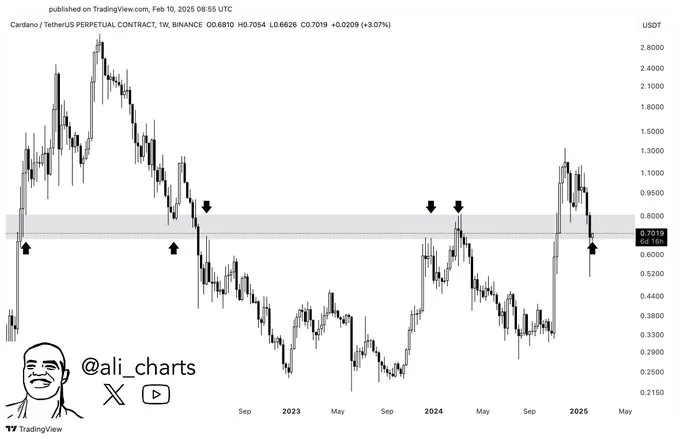

Analysts Ali Martinez highlights that ADA’s price movement revolves around a critical support-resistance range of $0.67–$0.81. Historically, this zone has served as a turning point, influencing ADA’s price direction in previous cycles.

The latest technical indicators suggest that ADA is battling its 61.8% Fibonacci retracement level, a crucial point for determining whether the rally will continue. If Cardano's price breaks and closes above $0.82, it could trigger a further push toward $1 in the near term.

On the flip side, if ADA faces rejection, the price might consolidate within its current range or experience a pullback toward the lower support at $0.67.

Source: TradingView

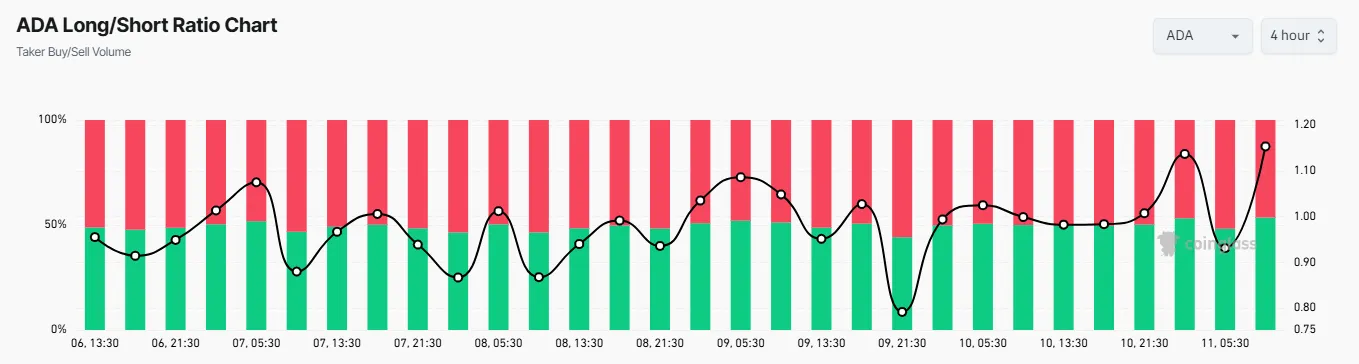

The market has responded positively to ADA’s price action, with:

- Trading volume increased by 43.90% to $1.1 billion – signaling strong buying interest.

- Market capitalization rising to $28.34 billion, reflecting investor confidence.

- ADA’s Long-to-Short Ratio surged from 0.9309 to 1.1533 – indicating that more traders are betting on further upside.

These bullish indicators suggest that market sentiment remains optimistic, and a breakout above resistance could accelerate ADA’s recovery.

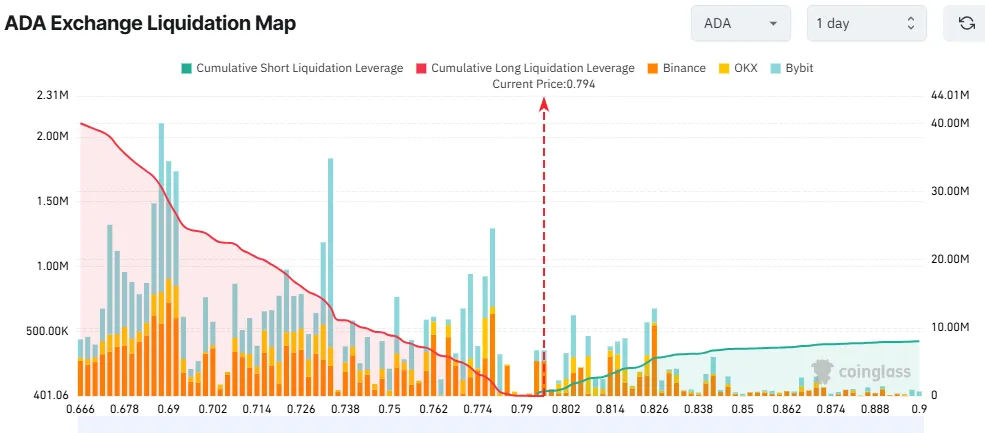

According to the ADA Exchange Liquidation Map, key price levels to monitor include:

- Upside target: $0.826 – A breakout above this level could liquidate approximately $5.56 million in short positions, further fueling the rally.

- Downside risk: $0.688 – A dip to this level could result in $30.63 million in long liquidations, increasing downside pressure.

With high trader leverage in play, market volatility is expected, making ADA’s next move crucial for short-term price direction.

Given the strong market momentum and positive technical outlook, ADA’s price could extend toward $1 if it successfully breaks $0.82 and sustains the bullish trend. However, traders should watch for potential corrections if resistance holds.

In summary, Cardano is at a decisive point. The next few trading sessions will be crucial in determining whether ADA continues its uptrend or faces temporary setbacks. As always, investors should stay informed and manage risks effectively in this volatile market.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

5 months ago

best Article