After experiencing a notable price decline in recent days, the overall market sentiment appears to be shifting back into positive territory. Leading the charge in this recovery is Aave (AAVE), which is showing strong bullish momentum. Recent price action on the daily chart suggests that AAVE could be gearing up for a significant double-digit price gain.

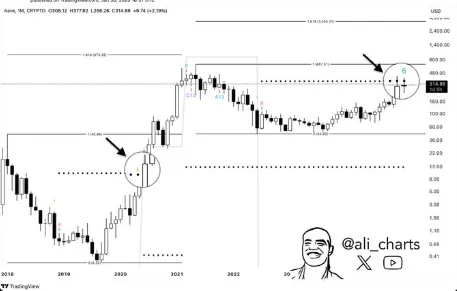

Crypto analyst Ali Martinez highlighted an intriguing historical pattern in a recent post on X (formerly Twitter). According to Martinez, the last time AAVE broke above the TD Sequential resistance trendline on the monthly chart was in June 2020. This breakout triggered a staggering 6,400% rally to the 1.618 Fibonacci level.

Fast forward to today—AAVE is once again testing this key resistance level. If it manages to break through, historical precedent suggests that a similar rally could drive its price as high as $3,500.

Another well-known analyst pointed out that AAVE has been maintaining strong upward momentum, having already gained approximately +444% since its latest breakout. Technical indicators suggest that this rally could still have plenty of room to run.

With a key breakout target set at $628.50, AAVE could see an additional +99% price increase, further solidifying its bullish trajectory. Traders are keeping a close watch on whether AAVE can maintain its momentum and push higher.

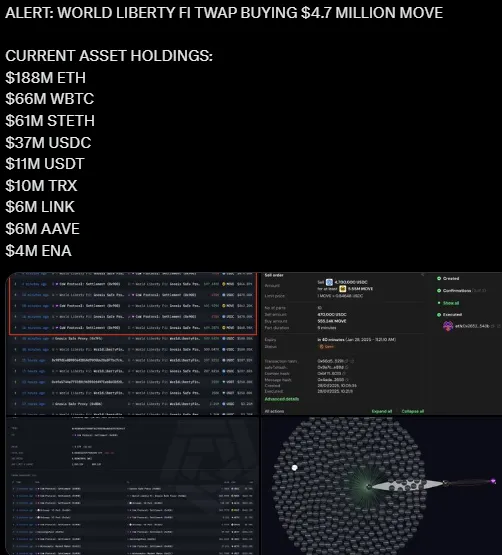

An on-chain analytics report from Arkham Intelligence reveals that Donald Trump’s Project World Liberty FI currently holds $6 million worth of AAVE. This is in addition to its other major crypto holdings, including ETH ($188M), WBTC ($66M), STETH ($61M), and USDC ($37M).

This accumulation suggests that institutional investors may be strategically positioning themselves in AAVE, potentially signaling strong confidence in its long-term value.

At the time of writing, AAVE price is trading at $318.30, reflecting a 4.30% surge in the past few hours. The token is forming a bullish double-bottom pattern, but this setup is not yet fully confirmed. AAVE has gained significant investor support, successfully forming its second bottom, and is now building upward momentum.

If AAVE holds above this level, analysts predict it could surge 25% to reach the neckline at $375 in the near future. Additionally, a prolonged consolidation phase between $300-$400 is expected to end with an expansion toward $500+.

Key Levels to Watch

Buy Zone: $270 remains a strong support and potential buying opportunity.

Breakout Confirmation: A move above $370 could signal the next leg up toward $500.

RSI Indicator: Currently standing at 52, the Relative Strength Index (RSI) indicates rising buying pressure, reinforcing the potential for AAVE to soar even higher.

With strong technical indicators, historical precedence, and institutional accumulation, AAVE is setting up for a significant bullish move. While traders should always exercise caution, the current market dynamics suggest that AAVE has the potential to break out and possibly reach new highs in the months ahead.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.