XRP is navigating a pivotal moment as it forms another higher low while successfully retesting the $2 level. Now, the cryptocurrency is testing the upper trendline of its bullish pennant, signaling a potential breakout or rejection.

In the last 24 hours, XRP's Open Interest (OI) skyrocketed by 71.95%, jumping from $2.71 billion to $4.66 billion. This sharp increase underscores growing investor activity and optimism, as traders position themselves for a possible price surge.

The rise in OI also brings fresh liquidity to the market, reinforcing a bullish outlook as anticipation builds ahead of key events, including Donald Trump's January 20 inauguration.

The rise in OI also brings fresh liquidity to the market, reinforcing a bullish outlook as anticipation builds ahead of key events, including Donald Trump's January 20 inauguration.

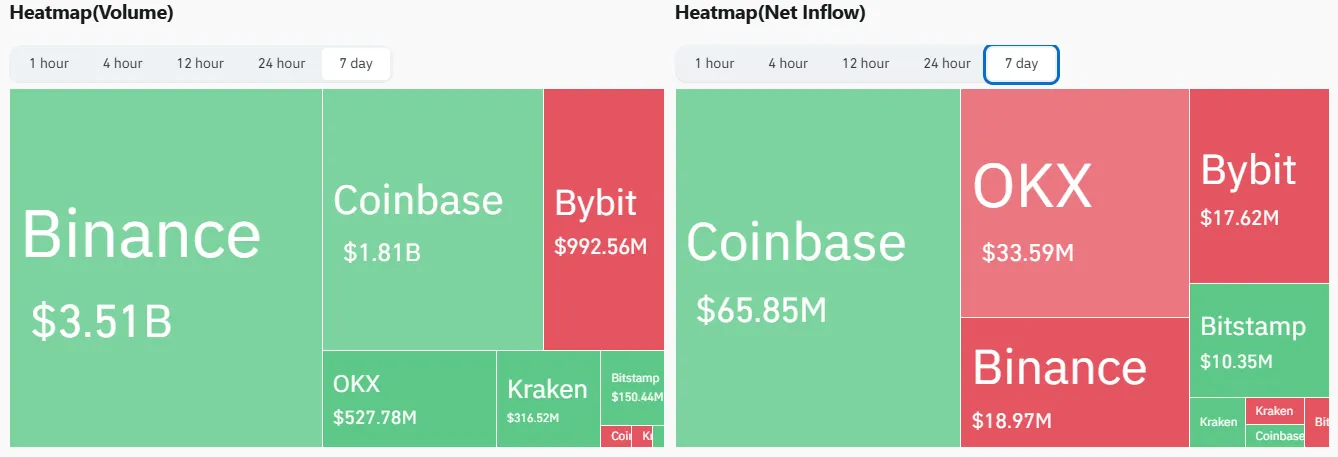

Recent exchange net flow data reveals contrasting investor sentiment:

Bullish International Investors: Binance, OKX, and Bybit recorded combined net outflows of $70.18 million, suggesting strong buying pressure from global traders.

Bearish U.S.-Based Investors: In contrast, Coinbase saw net inflows of $65.85 million, reflecting bearish sentiment among U.S. investors during the same period.

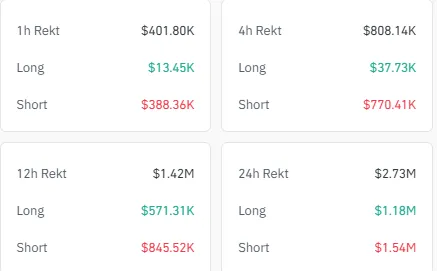

According to Coinglass, XRP experienced $2.73 million in liquidations over the past 24 hours, reflecting intense market activity:

Long Liquidations: $1.18 million, indicating forced exits from bullish positions.

Short Liquidations: $1.54 million, revealing losses for traders betting on a price drop.

These figures emphasize the dynamic nature of XRP's current trend.

XRP is testing its bullish pennant's upper resistance for the second time in three days. If a high-volume breakout occurs, XRP could aim for a new all-time high near $5.00. However, a rejection might lead to a retest of support at the lower boundary, close to the 50-day Simple Moving Average (SMA).

Veteran trader Peter Brandt recently highlighted XRP's flag pattern, describing it as a "half-mast flag." He noted that such formations typically resolve within six weeks to retain validity. Prolonged consolidation could weaken the pattern, but a successful breakout could propel XRP's market capitalization to $500 billion, showcasing its immense potential.

With XRP at a critical technical and sentiment-driven juncture, the next breakout or rejection will be pivotal. Traders and investors should closely monitor volume trends and key resistance and support levels to capitalize on this evolving market opportunity.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

1 month ago

Cryptocurrency mining news

1 month ago

Central bank digital currency news