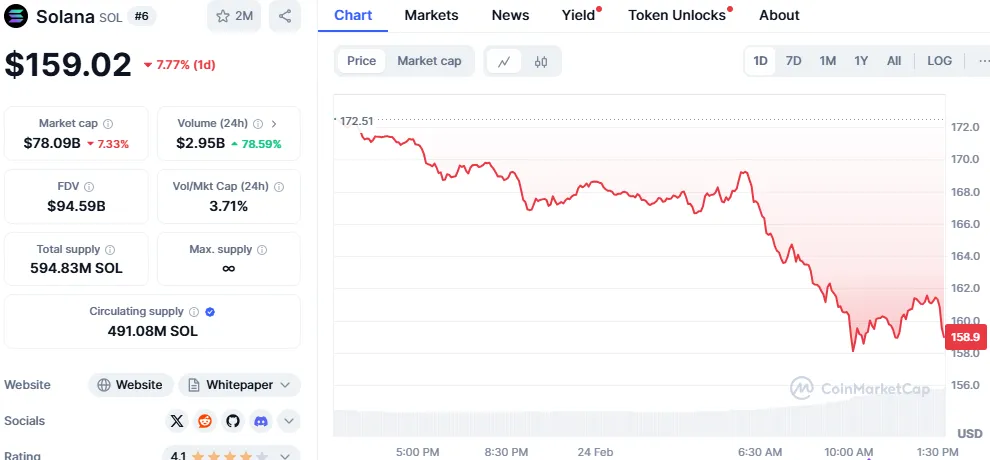

Solana has recently experienced a significant price drop, causing concern among investors and crypto enthusiasts. At the time of writing, Solana (SOL) is trading at $159.02, reflecting a sharp intraday decline of 7.77% and a weekly drop of over 12%. With a market cap of $78.08 billion and a 24-hour trading volume of $2.96 billion, many are wondering why Solana is going down and whether it will bounce back.

Source: CoinMarketCap

The recent downturn in Solana’s price can be linked to two major controversies that have shaken investor confidence:

Solana’s Involvement in Bybit Hack : One of the primary reasons why Solana crashed is its indirect connection to the largest-ever virtual asset hack on Bybit. On February 21, hackers stole $1.5 billion worth of virtual assets, leading to a $4 billion bank run on Bybit. It was revealed that the notorious North Korean hacker group, Lazarus, used Solana-based meme coins for money laundering.

According to blockchain analyst ZachXBT, Lazarus created around 500,000 Qin Shihuang coins on Pumpfun, a Solana-based trading platform. The coin’s trading volume spiked to $26 million within just three hours, fueling concerns about Solana’s security.

Once the news broke, Pumpfun removed the Qin Shihuang coin, but the damage was done, contributing to why Sol is going down.

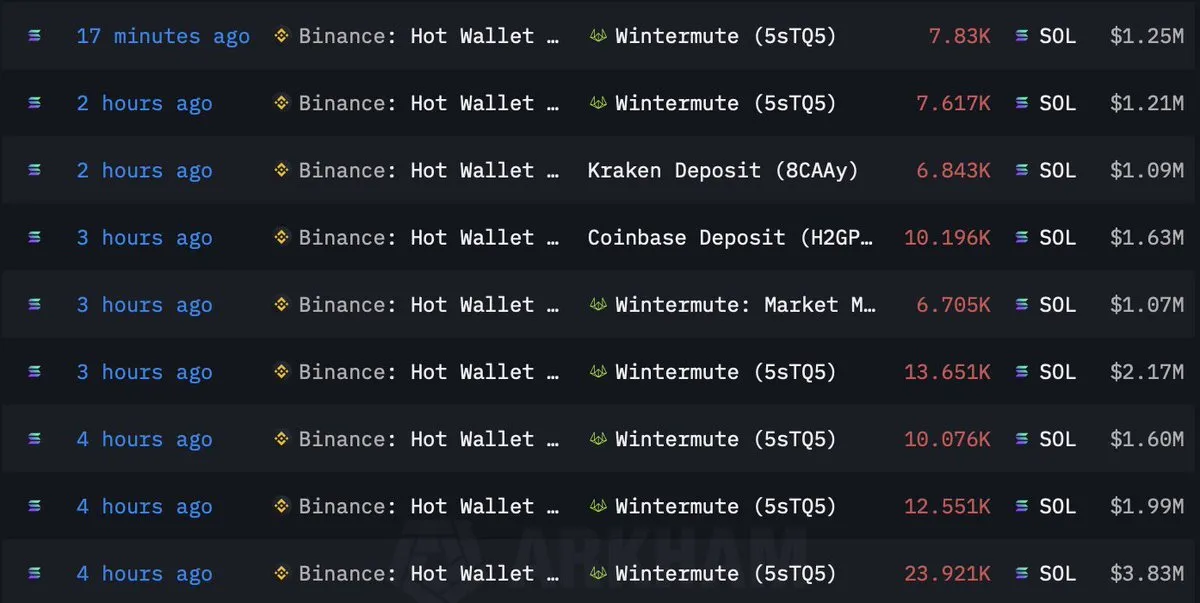

Binance’s Large $SOL Sell-Off via Wintermute: Binance has offloaded massive amounts of Solana ($SOL) in the last 4 hours through market maker Wintermute. Its hot wallet transferred 6.7K–23.9K SOL ($1.07M–$3.83M) to Wintermute, Kraken, and Coinbase, signaling major sell-offs.

Source: X

This aggressive selling is a key factor behind $SOL’s price decline, as increased supply pressures the market. The move aligns with broader market trends, where liquidity providers adjust positions amid uncertainty, contributing to heightened volatility and downward price action for Solana.

Libra Coin Scam Linked to Argentine President: Another blow came from the "Libra Coin" scandal involving Argentine President Javier Milay. On February 14, President Milay announced support for a Solana-based meme coin, Libra, on social media, claiming it would fund startups. However, the coin plunged by 94% within hours after a massive sell-off from a few wallets, leading many to label it a "rug pull" scam. Milay later deleted his post, claiming ignorance about the project. This incident further eroded investor trust, adding to why Solana is falling.

Despite the recent setbacks, there are promising developments that could help Solana recover:

Solana ETF Filing by Franklin Templeton

Franklin Templeton recently filed an S-1 prospectus with the SEC to launch a Solana ETF. This move signals growing institutional interest in Solana and could attract more investors. The growing list of asset managers, including Grayscale and VanEck, seeking approval for Solana-based products, highlights Solana’s potential.

Continuous Expansion and Acceptance

Solana remains a strong competitor in the blockchain space, offering lower fees and faster transactions compared to Ethereum. Popular meme coins like OFFICIAL TRUMP (TRUMP), Bonk, and Official Melania Meme (MELANIA) further showcase Solana's market relevance.

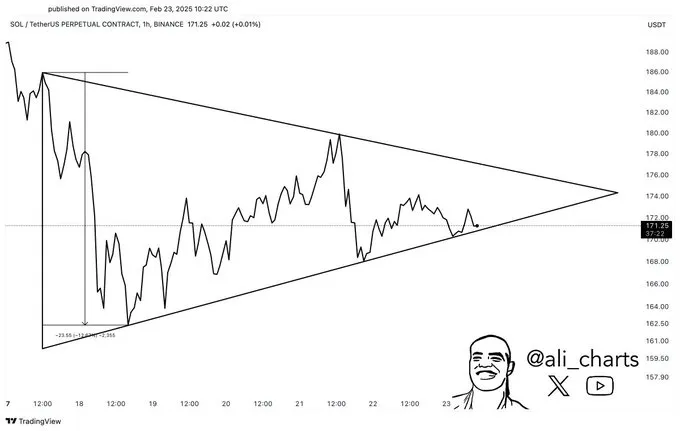

Crypto analyst Ali Martinez has predicted that Solana is gearing up for a 13% price move. Based on a symmetrical triangle pattern on the 1-hour chart, a bullish breakout could push Solana to $193.5, while a bearish move could see it drop to $149.

Source: X

Looking further ahead, Solana price prediction 2025 suggests that SOL could trade between $250.00 and $300.00 by the end of 2025, with the potential to reach $500 before 2030. Some optimists even speculate, will Solana reach $10000 in the distant future.

While the Bybit hack and Libra Coin scam have caused short-term damage, developments like the Solana ETF filing and continuous adoption provide hope for recovery.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.

1 month ago

News on crypto adoption

1 month ago

Crypto market trends

1 month ago

New cryptocurrency releases

1 month ago

Cryptocurrency market updates

1 month ago

Best crypto news sources

1 month ago

Cryptocurrency regulation updates

1 month ago

Its quite unfortunate how many unlicensed and unregulated crypto investments are being used to steal crypto assets from people who dont have an idea of how crypto works. I was once a victim and Im here to speak out because the pump and dump schemes made me lose $1.2M worth of crypto in November last year, and if I didnt carry out my research together with the assistance of Morphohack Cyber Service who was able to help me withdraw my crypto after it was frozen in their crypto investment platform, my crypto assets would have been gone forever. Morphohack Cyber Service detected their price was artificially inflated only to have it drop, this is usually done to cheat customers out of their hard-earned money. If you are ever in need of a professional and reliable crypto assets recovery specialist, Morphohack Cyber Service is the best. You can rest assured that your privacy and security are protected, everything is done professionally and both parties are protected. My crypto was recovered successfully and Morphohack has since then improved my security, and secured my account from any future financial loss. You can contact them via WhatsApp: +1 (213 - 672 4092) Email: Morphohack@Cyberservices.com

1 month ago

Crypto news and analysis

1 month ago

A CREDIBLE HACKER TO HIRE How to Safeguard Your Wallet and Get Back Lost Bitcoins with Captain Jack Crypto Recovery Company, l am Anthony Bill from Spain. I do dubbing, acting, and singing. I lost $235,000 to a cryptocurrency wallet due to forgetting my security words and passcode. After hearing about my predicament from a colleague, he advised me to get in touch with the Captain Jack Crypto HACKER team, a reputable hacker group that successfully recovered 95% of my funds. I am happy to inform you that there is a 100% likelihood that your dollars will be returned to your wallet as a personal testimonial. They are the best, and I know a lot of others who have also lost TETHER, BTC, USDT, and ETH in similar circumstances. That's why I'm sharing this to everyone in need of their assistance. These are the ways to get in touch with them. +4915782317112 on Whatsapp @captainjackcrypto11 on Telegram Captainjackcryptorecovery@outlook.com is the email address