The cryptocurrency market is on high alert as it approaches a critical week filled with macroeconomic events and a $10 billion crypto options expiry. Recent optimism, driven by Donald Trump’s election win and Elon Musk’s strategic spending cuts, has fueled market rallies. However, investors are bracing for potential volatility ahead.

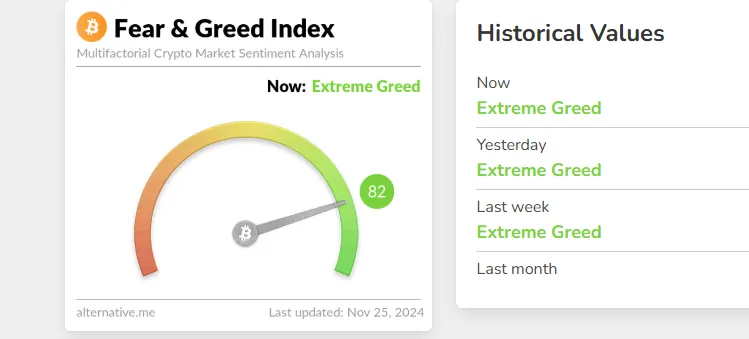

The Bitcoin Fear & Greed Index has soared to "Extreme Greed," reflecting strong investor confidence with a score of 82. While this bullish sentiment highlights market optimism, it also raises concerns about a possible correction, as such high levels often precede significant price volatility. Traders are advised to exercise caution.

Bitcoin (BTC) is drawing attention as it approaches the key $100,000 milestone. After reaching $99,800 on Friday, the cryptocurrency saw a slight weekend pullback and is now trading below $98,000. The psychological $100,000 level remains a critical focus for traders, signaling potential market volatility ahead.

On Tuesday, November 26, all eyes will turn to the Federal Reserve’s (Fed) FOMC meeting minutes from November 6. Market participants are keen to gain insights into the Fed's assessment of the economy, which could provide clues about future monetary policy decisions.

US PCE Inflation Data

The US PCE inflation report, scheduled for Wednesday, November 27, is expected to show annual inflation rising to 2.3%, with core inflation hitting 2.8%.

Market Expectations:

- Monthly PCE: +0.2%

- Annual PCE: 2.3%

- Core PCE Monthly Increase: +0.3%

- Core PCE Annual Increase: 2.8%

Rising inflation data could sway market sentiment across traditional and crypto markets.

US Q3 GDP Revision

The first revision of the Q3 GDP report will also be released on Wednesday. This update will provide a clearer picture of the US economy's performance and influence broader market trends, including cryptocurrency prices.

Initial Jobless Claims

Initial jobless claims data, expected the same day, will offer fresh insights into the U.S. labor market. A recent decline in the unemployment rate from 4.3% to 4.1% and stronger-than-expected claims data, such as the 213,000 reported for the week ending November 16, indicate a resilient labor market. This may ease concerns over economic weakness.

Bitcoin and Ethereum Options

On November 29, crypto options worth over $10 billion are set to expire. The max pain price for Bitcoin is $77,000, while Ethereum’s is $2,800. This significant expiry could trigger short-term volatility, despite long-term optimism within the market.

$6 Billion Bitcoin Outflow

Bitcoin saw a massive $6 billion outflow from exchanges last week, with $3.9 billion leaving on November 19 alone, according to IntoTheBlock data. This accumulation pushed Bitcoin to a new all-time high (ATH) of $99,655 on November 23, signaling strong investor confidence.

Whale transactions, defined as those exceeding $100,000 in BTC, dropped significantly, with transactions falling from 32,000 to 19,500 between November 21 and 24. Additionally, transaction volumes decreased from $136.4 billion to $53.6 billion, reflecting reduced activity among large holders.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

1 month ago

Cryptocurrency tax news

1 month ago

Altcoin news

1 month ago

Central bank digital currency news

1 month ago

Crypto news for beginners

1 month ago

News on digital wallets

1 month ago

Institutional investment in crypto

1 month ago

Cryptocurrency market updates

1 month ago

Bitcoin halving news

1 month ago

Cardano news

1 month ago

Latest blockchain projects