The crypto market is presently experiencing a marginal decline, with many investors wondering why. The crypto world capitalization is currently at $2.85 trillion, with a slight 0.16% drop within the last 24 hours. Interestingly, the volume rose by 16.29%, standing at $79.6 billion in a day.

Although this shift can appear to be minor, there are some massive things going on in the background that are frightening traders and investors. One of the largest explanations for the most recent crypto crash has to do with Mt. Gox, a defunct cryptocurrency exchange, and its large Bitcoin transactions.

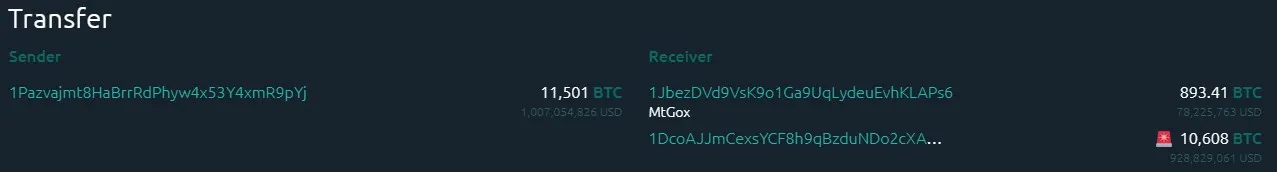

One of the main reasons behind the current market decline is the activity of Mt. Gox, which once was the largest crypto exchange before it went bankrupt in 2014. The company is now in the process of returning money to its former users. In March alone, it has made three major Bitcoin transfers:

March 6: 12,000 BTC (about $1 billion)

March 11: 11,833 BTC

March 25: 10,608 BTC ($929 million), with 893 BTC moved to a cold wallet

Source: Whale Alert

These transfers are making the market uneasy, as investors wonder if a large-scale coin sell-off is coming. Mt. Gox still holds around 35,000 BTC, valued at approximately $3.1 billion, and people are unsure when or how this will be released. Any further large moves could shake the sector again.

According to CoinMarketCap, BTC price is currently hovering at $87,074.74, after an intraday drop of 0.50% with $1.72T in market cap.

This uncertainty is reflected in the Fear and Greed Index, which now shows “Fear” with a score of 46, up slightly from 45 yesterday and 34 last week. Last month, it was at a more neutral position of 50. This indicates that investors are still apprehensive, although the fear is not extreme.

Source: Fear and Greed Index

When there is high fear, some investors view it as an opportunity to buy, while others avoid it to prevent losses. Therefore, this conflicting emotion is keeping the cryptocurrency on tenterhooks.

Looking forward, a number of significant events may determine if the market recovers or declines further. Based on The Kobeissi Letter, the following economic releases are due out this week:

Consumer Confidence reading (Tuesday)

February New Home Sales (Tuesday)

Atlanta Fed GDPNow update (Wednesday)

US Q4 GDP report (Thursday)

February PCE Inflation report (Friday)

All of these can have an impact on investor attitudes, particularly if the readings reflect economic resilience or weakness.

Another important development is the news that former President Trump is not expected to introduce “sector-specific tariffs” on April 2, as reported by The Wall Street Journal. This has brought a sense of relief, as earlier talks about Trump tariffs were making the global markets anxious. If this good news holds, it might help restore some confidence to the token space and better the overall sentiment.

The cryptocurrency market is under pressure from Mt. Gox's ongoing Bitcoin transfers, increasing trading volumes, and overall investor concern. Although the drop is not gigantic, the fear remains. The way the sector responds next will largely be influenced by this week's economic indicators and if additional large crypto transfers occur.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.