The global cryptocurrency market has witnessed a downturn, with the total market capitalization dropping by 1.68% to $3.15 trillion. Bitcoin’s dominance has increased slightly to 60.20%, while Ethereum and other major cryptocurrencies have suffered losses. Investors are questioning, What is going on with crypto today? Several factors, including economic concerns and regulatory developments, have contributed to the decline.

Milei Meme Coin Controversy: A significant factor behind today’s market dip is the Milei meme coin controversy. Argentine President Javier Milei recently endorsed a little-known cryptocurrency, $LIBRA, through a post on X (formerly Twitter). This endorsement caused a brief price surge before he deleted the post, distancing himself from the coin. Following the deletion, the cryptocurrency’s price crashed, leading to allegations of a potential rug pull scam. Legal proceedings have been initiated against Milei, and the controversy has created uncertainty in the broader crypto market.

U.S. Inflation Concerns: Another reason why crypto is crashing is persistent inflation in the United States. The latest Consumer Price Index (CPI) report indicates that inflation remains above the Federal Reserve’s 2% target, reducing hopes for near-term interest rate cuts. Investors tend to move away from volatile assets like cryptocurrencies when inflation remains high, adding pressure to the market. The crypto industry remains highly sensitive to macroeconomic factors, making inflation one of the core reasons why crypto is falling today.

Fed Meeting January 2025 & Market Uncertainty: The upcoming Fed Meeting news is another source of market anxiety. If the Federal Reserve maintains its hawkish stance, investors may continue offloading riskier assets, including cryptocurrencies. Speculation around future interest rates has created uncertainty, leading to hesitation among traders and investors.

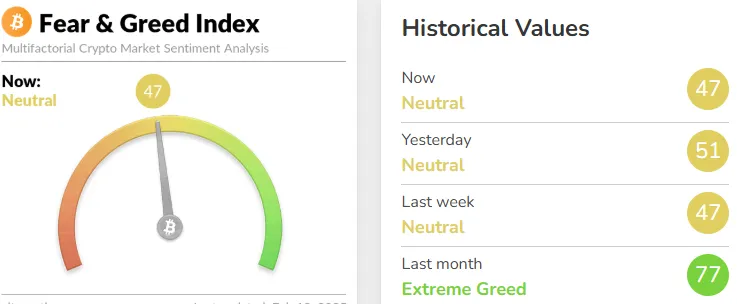

The Fear and Greed Index has dropped from Yesterday’s Neutral of 51 to Neutral of 47, indicating increasing caution among investors. A week ago, the index was at Neutral-47, and just a month ago, it was at Extreme Greed-77.

This shift shows that investor sentiment has cooled significantly, contributing to the ongoing decline in crypto prices. Historically, extreme fear can present a buying opportunity, while extreme greed often precedes a market correction.

Bitcoin is currently trading at $95,601.94 after dropping 0.64% in the last 24 hours. Ethereum saw a bigger decline, falling 2.25% to $2,688.00. Meanwhile, XRP price is hovering at $2.58, recording a 3.68% intraday drop. The market is experiencing slight pullbacks, with all three cryptocurrencies facing losses.

Bitcoin's dip is mild compared to Ethereum and XRP, which have seen steeper declines. Investors are closely watching price movements as the market reacts to ongoing trends and external factors. These price drops have raised concerns about why crypto is crashing and will it recover in the short term.

Despite the current market dip, there are factors that could lead to a recovery:

FOMC Meeting Insights: If the Federal Reserve signals future rate cuts, investors may regain their risk appetite, leading to a potential rebound in cryptocurrency prices. Lower interest rates generally drive investment into riskier assets, including crypto.

SEC Crypto ETF Approvals: Regulatory developments remain a crucial factor in the future of crypto in the next 5 years. The U.S. SEC is actively reviewing proposals for ETFs, including a potential XRP ETF. If approved, these ETFs could attract institutional investors, driving market growth.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.

1 month ago

News on crypto lending

1 month ago

News on crypto exchanges

1 month ago

News on crypto lending

1 month ago

Crypto market predictions

1 month ago

Cryptocurrency market updates

1 month ago

Bitcoin halving news

1 month ago

Blockchain updates

1 month ago

News on crypto adoption

1 month ago

Metaverse and crypto

1 month ago

News on crypto lending