The global cryptocurrency market capitalization has surged by 1.14% over the past 24 hours, reaching $3.43 trillion as of January 6. This upward trend coincides with the growing trading volume, which has climbed 9.45% to $95.72 billion, reflecting heightened demand-side pressure.

The Fear & Greed Index, a popular sentiment analysis tool for the cryptocurrency market, currently indicates a sentiment of Extreme Greed with a score of 76. This suggests heightened bullish behavior among market participants, often fueled by optimism and confidence.

Historically, the index shows a progression in positive sentiment. Yesterday's score was 72 (Greed), while last week's score of 65 also reflected Greed. Last month's sentiment score was 75, closely mirroring today's extreme sentiment level.

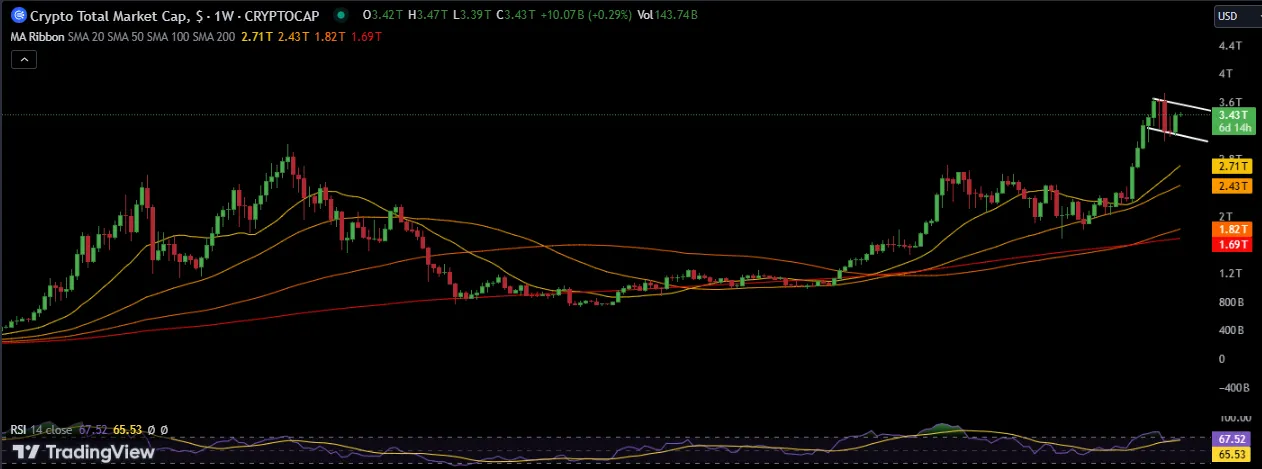

From a technical analysis perspective, the total cryptocurrency market capitalization (TOTAL) is showing signs of a bull flag pattern on the daily chart. This pattern indicates the possibility of an extended upward trend in the near future.

After hitting a peak of $3.73 trillion on December 17, the market experienced a sharp correction, dropping to $3.05 trillion before rebounding to its current level of $3.44 trillion. The formation of the bull flag suggests that further gains could be on the horizon.

The critical resistance level for the market lies at the upper boundary of the bull flag, around $3.62 trillion. A strong weekly close above this level could confirm a breakout, potentially pushing the total market capitalization toward the $4 trillion milestone.

Source: TradingView

In a related development, market participants are assigning a 90.90% probability that the U.S. Federal Reserve will maintain the benchmark interest rate within the 4.25% to 4.5% range during its upcoming FOMC meeting on January 29.

Source: CME Group

Anticipation is building as the cryptocurrency markets gain momentum ahead of Donald Trump’s second inauguration as U.S. President on January 20. Investors are optimistic about the potential pro-crypto stance of the incoming administration and its impact on the industry.

Ripple CEO Brad Garlinghouse has expressed confidence in the changing regulatory environment, stating that “75% of Ripple’s open roles are now U.S.-based.” He attributes this shift to the expected pro-crypto policies of the upcoming Republican administration and Donald Trump’s favorable rhetoric toward digital assets

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

1 month ago

Central bank digital currency news