The global crypto market cap has surged to $3.24 trillion, reflecting a 0.60% increase over the last day. While the total crypto market volume has declined by 29.50% to $118.19 billion, market sentiment remains strong, especially with significant inflows into Spot Bitcoin ETF and Spot Ethereum ETF.

At the time of writing, Bitcoin (BTC) is trading at $98,816.05, marking an intraday surge of 0.80%. Bitcoin’s dominance has risen to 60.57%, a 0.39% increase, highlighting its stronghold in the market. Ethereum (ETH) is also on the rise, trading at $2,816.71, up 0.61% intraday.

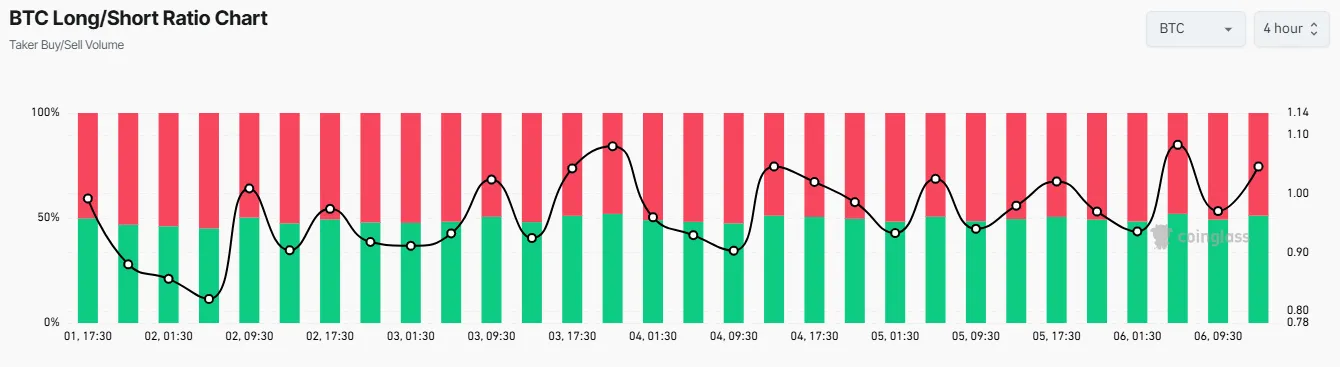

One of the key drivers behind the rally is the BTC long-short ratio, which currently stands at 51.13% long vs. 48.87% short. This suggests that market participants are nearly split, but the slightly higher short interest could lead to a short squeeze, further driving Bitcoin’s price upwards. This uncertainty is keeping traders on edge as they watch for what is going on with crypto today and where prices might head next.

Source: CoinGlass

A major factor why crypto market is going up today is the continuous inflow into ETFs. The Spot Bitcoin ETF recorded a daily net inflow of $66.38 million, pushing its cumulative total net inflow to $40.67 billion. Additionally, its total traded value reached $2.04 billion, while total net assets hit $114.71 billion, making up 5.95% of Bitcoin’s market cap.

Source: SoSoValue

Similarly, the Spot Ethereum ETF saw an inflow of $18.11 million, with a cumulative net inflow of $3.17 billion. The ETF’s total traded value stands at $298.61 million, while total net assets are valued at $10.49 billion, covering 3.15% of Ethereum’s market cap. These inflows suggest growing institutional confidence, further reinforcing the market’s strength.

Source: SoSoValue

MicroStrategy, now rebranded as Strategy, remains the largest corporate holder of Bitcoin. The company has acquired 218,887 BTC worth $20.5 billion since Q3 and currently holds 471,107 BTC, approximately 2% of Bitcoin’s total supply. This continued accumulation supports why BTC is going up today, as institutional players remain bullish.

With the Fear and Greed Index crypto indicating strong bullish sentiment, traders and investors are watching for the next move. If ETF inflows remain strong and institutional interest persists, the market could continue its upward trajectory. However, volatility remains a key factor, making it essential for investors to stay informed about what next for crypto.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.

1 month ago

Cryptocurrency industry insights