Bitcoin’s price faced significant downward pressure as traders anxiously prepared for the release of US jobs data and shifting Federal Reserve policy expectations. The market saw heavy liquidations, further fueling volatility. Amid the turbulence, speculations continue over Bitcoin’s future, with some still predicting a long-term rise.

The cryptocurrency market saw a steep decline, with Bitcoin’s price dropping over 6% in the past seven days. At the time of writing, BTC price stood at $96,105.71, reflecting a 1.38% decrease within 24 hours. The total market cap was recorded at $1.9 trillion, with a 24-hour trading volume of $51.74 billion. Many investors are asking, “Why Bitcoin is Falling Today?”, as this sudden drop raises concerns over market stability.

One of the primary factors behind the Bitcoin crash is a wave of liquidations. In the past 24 hours alone, 112,440 traders were liquidated, with the total liquidation amounting to $281.25 million. The largest single liquidation occurred on OKX involving a BTC-USDT-SWAP worth $2.41 million.

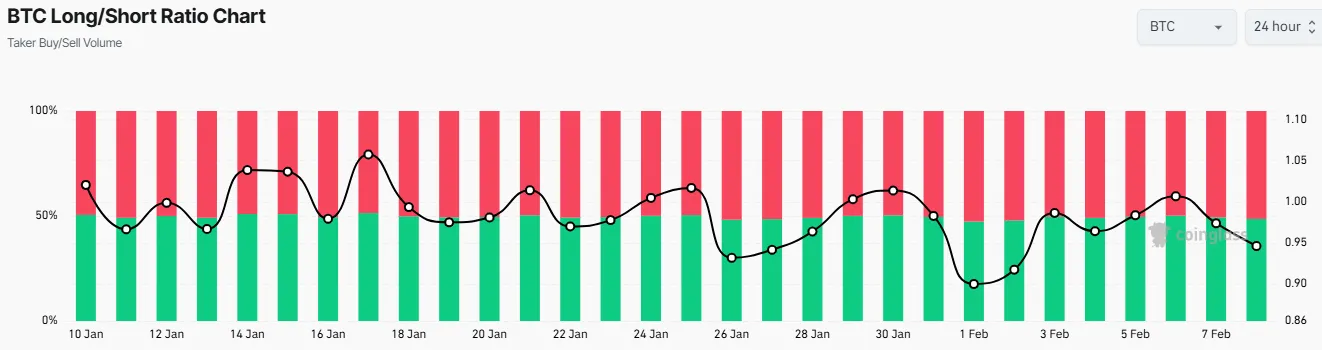

Notably, the BTC Long/Short ratio took a hit, indicating a shift in sentiment. On Feb. 7, BTC long positions stood at 49.34% versus 50.66% in shorts, and by Feb. 8, BTC long dropped further to 48.64%, while BTC shorts rose to 51.36%.

Source: CoinGlass

A major reason why Bitcoin is going down today is the anticipation of the US jobs data release. Traders and investors are on edge, as key labor market indicators such as job openings, unemployment rates, and wage growth could shape the Federal Reserve’s next moves. Market analysts project a drop in job openings to 170,000 from December’s 256,000. Meanwhile, the unemployment rate is expected to remain at 4.1%, and average hourly earnings are forecasted to rise by 0.3% month-on-month.

The Kobeissi Letter, a capital markets commentator, suggested there is a 28% chance that over 300,000 jobs were added in January. If this happens, it would be the first time since March 2024, potentially pushing the Federal Reserve towards a less dovish stance.

Current FOMC Meeting 2025 predictions suggest an 85.5% probability that interest rates will remain unchanged in March, with the earliest possible rate cut expected in June (44.8% probability). If the jobs report is weaker than expected, traders may price in faster rate cuts, which could trigger renewed interest in riskier assets like Bitcoin.

Despite the recent downturn, market analysts remain divided on BTC price prediction. While some believe further corrections are imminent due to macroeconomic uncertainties, Bitcoin miner IREN’s CEO, Daniel Roberts, remains bullish. He argues that increasing institutional adoption could drive Bitcoin price higher over time. According to him, “Bitcoin will reach $1 million by 2030” if current trends persist.

As trump tariffs news and economic shifts continue to impact the market, traders are left wondering: Will Bitcoin rise again? The coming weeks will be crucial, as the interplay between US economic data, Fed Rate Cut predictions, and investor sentiment will shape BTC price.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.

1 month ago

Cabinet IQ Cedar Park 2419 Bell Blvd, Cedar Park, TX 78613, United tates +12543183528 Efficientinstall

1 month ago

Ethereum news

1 month ago

Cryptocurrency scams and hacks

1 month ago

Top crypto influencers

1 month ago

Ethereum news

1 month ago

Cryptocurrency tax news

1 month ago

Decentralized finance trends