Bitcoin (BTC) briefly surpassed $100,000 for the first time on Thursday, but the price quickly dropped by about 10%, nearly retesting the support level above $92,000. In the past hour, Bitcoin experienced a flash crash, falling from over $102,000 to $97,640. The exact cause of this rapid sell-off remains unclear, but it contributed to a $649 million liquidation across the entire cryptocurrency market in the past 24 hours.

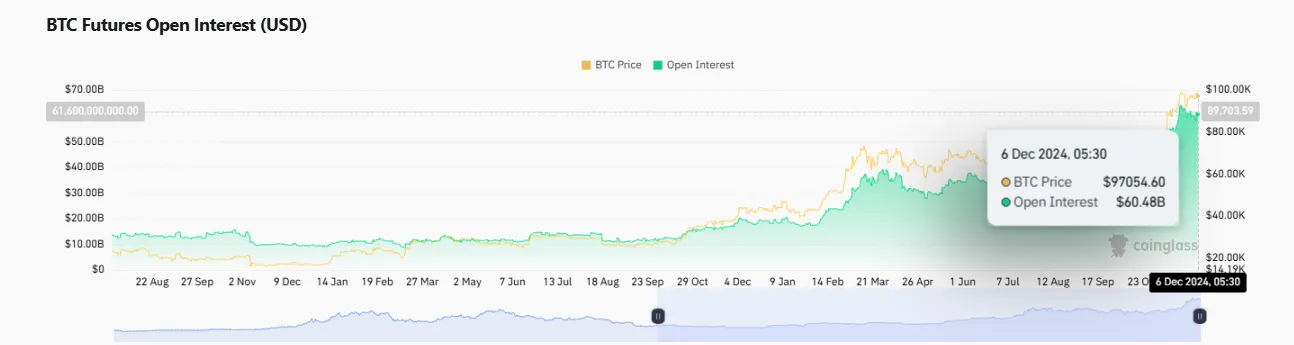

According to data from CoinGlass, over 158,249 traders were liquidated, totaling $883.39 million. Long traders accounted for over half of these liquidations, totaling $130 million, while the remainder was due to short traders. Bitcoin's open interest also saw a slight drop, falling by 4.8% to $61.20 billion from $61.18 billion.

The recent Bitcoin meltdown followed a period of low trading volume, despite growing social media hype. Tether, one of the leading stablecoins, printed $1 billion on Ethereum, but the low trading volume and market uncertainty led to a sharp decline in Bitcoin's price.

On-chain data revealed that some whale investors took profits after Bitcoin's recent pump, while retail traders continued to buy, expecting further bullish trends. Notably, Meitu, a major Chinese institutional firm, disclosed that it had sold off its entire 948 BTC holdings in the past 24 hours.

However, after Bitcoin's price retracement below $100k, some whales returned to purchase more BTC in anticipation of a potential fresh bull run.

Despite Bitcoin's setback, the altcoin market is showing signs of bullish momentum. The total market cap excluding Bitcoin, known as TOTAL2, surged by over 3% in the last 24 hours, reaching $1.57 trillion. Meanwhile, Bitcoin's dominance slipped by 1%, dropping to about 55%, signaling a shift toward the altcoin market.

Traders are also keeping a close eye on upcoming U.S. economic data, including Average Hourly Earnings m/m, Non-Farm Employment Change, and the Unemployment Rate, which could impact market sentiment and Bitcoin's price trajectory in the near term.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

1 month ago

Crypto market trends

1 month ago

Crypto market cap updates

1 month ago

Cryptocurrency tax news