The cryptocurrency market is bleeding, with the global market cap tumbling 1.64% to $3.19 trillion, signaling panic among traders. Despite this, trading volume has surged 8.02% to $127.49 billion in the last 24 hours as whales and retail investors scramble to make sense of the chaos.

With Bitcoin, Ehtereum, and XRP crashing, massive options expirations shaking the market, Russia’s crackdown on miners, XRP ETF filings, and the Nonfarm Payroll report fueling uncertainty, traders are asking: When will the crypto market go back up?

Bitcoin ($BTC) is on shaky ground, plummeting to $97,369.43—a 1.50% drop in 24 hours. With its market cap at $1.93 trillion, traders are grasping at any sign of reversal. Trading volume has jumped 2.36% to $47.06 billion, suggesting dip buyers are eyeing their next move.

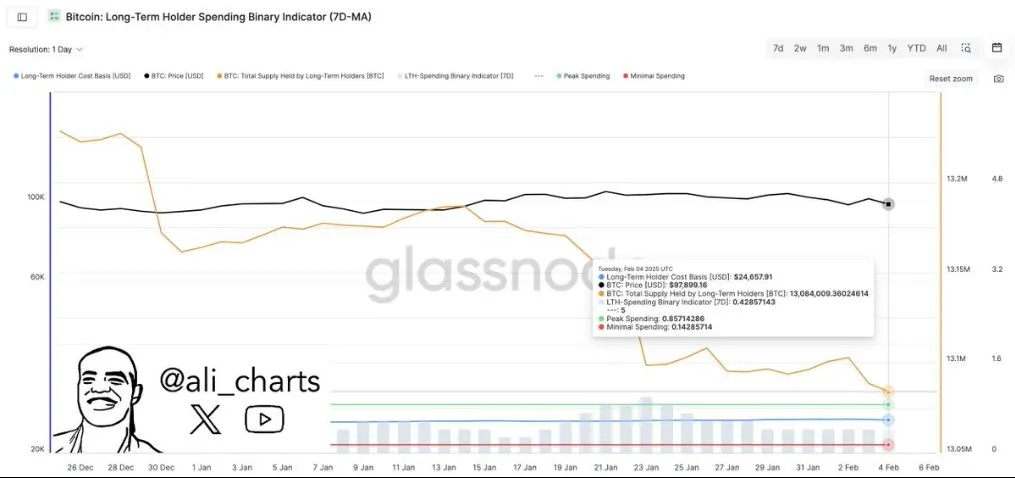

However, a shocking revelation by analyst Ali reports over 20,000 BTC being dumped by long-term holders in just 96 hours! Is this a sell-off before the storm or the ultimate accumulation opportunity? The next few days will be crucial.

Brace for impact! At 08:00 UTC, 26,000 Bitcoin option contracts worth a staggering $2.57 billion are set to expire today, along with 204,376 Ethereum ($ETH) contracts valued at $560 million. Historically, options expirations trigger extreme volatility, and with BTC already in a nosedive, we could be staring at a weekend wipeout.

Adding fuel to the fire, U.S. jobs data is expected to add further market turbulence. Will crypto survive the onslaught, or is the worst yet to come?

Russia’s Bitcoin miners are in full-blown panic mode as the government aggressively tracks wallet addresses through a new registry. Fears are mounting that leaked data could lead to sanctions or worse—a major clampdown on mining operations. The registry, active since November 2024, is supposedly “secure,” but not everyone is buying it. Lawmaker Anton Gorelkin warns that the system could be a “big gift” to geopolitical opponents.

In a historic move, the Cboe BZX Exchange has filed an application for spot XRP ETFs on behalf of asset managers Canary Capital, WisdomTree, 21Shares, and Bitwise. With XRP currently trading at $2.39, down 2.97% today, the ETF news is fueling speculation. Could XRP finally break out of its regulatory limbo and follow in Bitcoin and Ethereum ETF-approved footsteps? With the SEC facing increasing pressure, crypto traders are on edge, awaiting a decision that could send XRP soaring—or crashing further.

The U.S. Bureau of Labor Statistics’ Nonfarm Payroll (NFP) report is set to release today, and it’s adding another layer of uncertainty to an already rattled market. Economic strength boosts risk appetite, but a weaker-than-expected report could send investors fleeing from crypto into safer assets like gold and bonds.

The relentless market downturn has traders questioning: Is the crypto bull market over? Analysts argue that upcoming macroeconomic events, regulatory approvals, and ETF launches could shift the tides, but the short-term outlook remains grim. With crypto ranked by market cap bleeding red, eyes are on Bitcoin to see if it can reclaim ground or fall further. Buckle up. The next moves in this volatile market will define the future of digital assets.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

1 month ago

Institutional investment in crypto

1 month ago

Blockchain technology news

1 month ago

Top crypto influencers

1 month ago

Cryptocurrency tax news

1 month ago

Ripple news

1 month ago

Cryptocurrency scams and hacks

1 month ago

Cryptocurrency security updates

1 month ago

Central bank digital currency news

1 month ago

Central bank digital currency news

1 month ago

Crypto market predictions