The crypto market is taking a serious hit today, with prices plunging across the board. The total global crypto market cap has dropped by 8.10% in the last 24 hours, now sitting at $2.88 trillion. Despite the price fall, trading activity has surged, with total market volume shooting up by 105.60% to $177.38 billion. So, what’s causing all this chaos? Let’s break it down.

Even with big players like MicroStrategy buying more Bitcoin, the BTC price keeps falling. MicroStrategy recently bought 20,356 BTC for nearly $2 billion at an average price of $97,514, pushing their total holdings to 499,096 BTC worth over $33.1 billion.

But here’s the twist—this massive purchase didn’t help Bitcoin’s price at all. It’s left investors scratching their heads. Is this just a short-term dip before a bounce-back, or is Bitcoin losing its shine?

Ripple’s legal battle with the SEC might finally be nearing a positive conclusion. The $1.3 billion lawsuit has been dragging on for a while, but with the SEC softening its stance under Acting Chair Mark Uyeda, investors are hopeful.

XRP’s price recently dipped to $2.10 but bounced back to $2.28. However, its market cap dropped 11.7% to $131.92 billion, even as trading volume skyrocketed by 139.7% to $8.26 billion. If Ripple wins the case and an XRP ETF gets approved, a big price surge could be on the horizon.

Citadel Securities, led by billionaire Ken Griffin, is making a major move into the crypto world. The firm is now acting as a liquidity provider—helping balance buyers and sellers, reducing price swings, and improving trading efficiency.

This step signals growing trust in digital assets, especially with rising political support. President Trump backing crypto has boosted confidence, and Citadel’s entry could shake up the market.

The crypto market panic has hit PolitiFi tokens hard, especially the TRUMP and MELANIA tokens. Big investors, known as whales, dumped millions of these tokens during the market crash, causing even more fear.

Whale "DNTpo" sold 13.98 million MELANIA tokens for 14.32 million USDC, losing $14.9 million (51%) in just one month.

Whale "EwkH5" sold 763,483 TRUMP coins for 9.47 million USDC, taking a massive $25.5 million (72%) hit.

These massive sell-offs sparked fears of further losses in the PolitiFi space.

Shiba Inu (SHIB) has been under serious pressure, dropping 29% over the past month and 9.12% in the last 24 hours alone. Its current price is $0.00001476, with a market cap of $8.7 billion.

But all hope isn’t lost. Some analysts believe SHIB could stage a massive 400% rally if it holds key support levels. This would be a major comeback, especially given the coin’s oversold conditions.

The total crypto market cap has plunged 8.10%, now at $2.88 trillion.

Trading volume has soared by 105.60% to $177.38 billion, as investors rush to buy and sell amid the chaos.

Stablecoins are dominating the market flow, with $168.91 billion traded, making up 95.22% of all trading volume.

DeFi is also active, with $11.93 billion in volume, representing 6.73% of the market’s 24-hour activity.

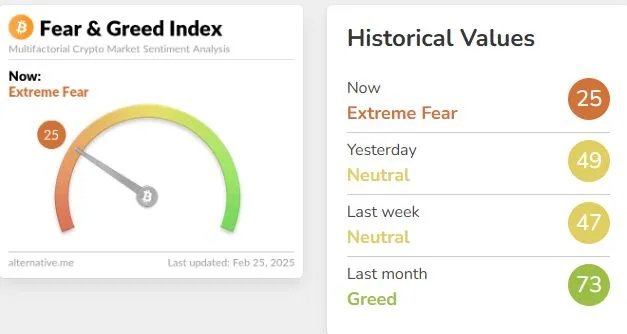

The Crypto Fear & Greed Index is flashing "Extreme Fear" at 25, showing that investors are seriously worried. Just yesterday, the index was at 49 ("Neutral"), and last month it hit 73 ("Greed"). This sharp drop in sentiment reflects the growing anxiety among crypto investors.

The crypto market is bleeding today, but this isn't the first time. Massive sell-offs, legal uncertainties, and shifting investor sentiment have created a perfect storm. While some assets, like SHIB and XRP, hint at potential rebounds, the overall market remains shaky.

Will we see a quick bounce-back or a deeper crash? Only time will tell. For now, investors are keeping a close eye on key developments, hoping for brighter days ahead in the crypto world.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

1 month ago

Cryptocurrency tax news

1 month ago

News on crypto lending

1 month ago

Web3 news

1 month ago

Bitcoin halving news

1 month ago

New cryptocurrency releases