The market reacted quickly to Tornado Cash's removal from the US blacklist. The TORN token jumped 60% in just hours. Investors saw this as good news for the privacy-focused crypto project.

The US Treasury Department has removed Tornado Cash from its sanctions list of OFAC. This decision follows a court ruling in January that stated its smart contracts are not foreign property. The court ruled that OFAC overstepped its authority by blacklisting the crypto mixer.

A US appeals court ruled that Tornado Cash's smart contracts do not belong to any foreign group. This means they cannot be sanctioned under current laws. The decision helped remove it from the blacklist.

Following the delisting announcement, its value skyrocketed. Within a few hours, the token's value increased by 60%, from $7.71 to $15.26. Investor's positive reaction pushed the market up, the market cap jumped by $55M, and increasing trading activity.

According to the analysts, the price could keep rising. The delisting boosted demand for Tornado Cash and increased the confidence of the trader in the token.

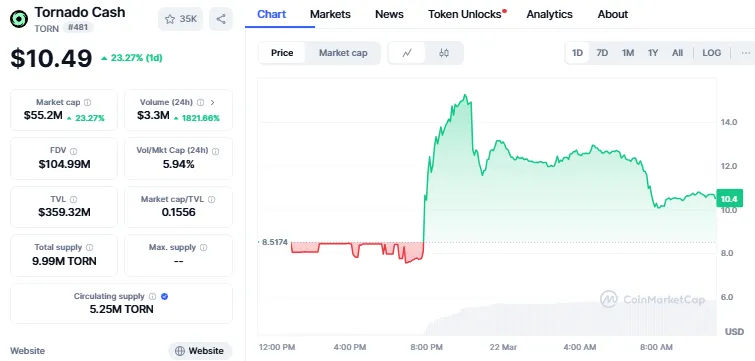

It is currently floating for $10.49 and had a price rise of 23.27%, with a market cap of $55.2M. Its total supply is 9.99 million TORN tokens with 5.25M tokens in circulation.

Source: Tornado Cash Coinmarket Cap

The recent price jump after Tornado Cash’s delisting mirrors past trends. This time, the rise is smaller. TORN jumped 60% but is still lower than the big spike in November 2024.

It jumped after big legal events. In November 2024, TORN rose from $3.4 to $19.2 after a court ruled against OFAC. In January 2025, it gained 20% when developer Alexey Pertsev was released. The climb is slower now, but the market cap is growing. Analysts expect a bigger surge as confidence increases.

Although the delisting is encouraging, there are still legal risks. Regulators continue to watch Roman Storm, a co-founder, as he faces trial in 2025. Nonetheless, the crypto community anticipates a more advantageous legal future as a result of Trump administration policy changes.

Tornado Cash’s delisting has lifted investor confidence. Analysts expect a bigger price rally soon. Despite legal challenges, the market has shown good support. The growing market cap shows strong trader interest in the token.

TORN jumped after being delisted, but the US has not fully cleared it. Without approval, the rise may not last. Investors stay careful because rules are still unclear.

If TORN’s team stays silent, its price could fall. Investors need clear updates and legal approval for trust and stability.

TornadoCash’s delisting gave investors hope. It jumped after past legal wins, and experts think it could rise more if confidence stays strong. But risks remain—co-founder Roman Storm faces trial, and Roman Semenov is still sanctioned. If privacy crypto gains support, this token could see more adoption.

Mohit Raghuwanshi is an Indian journalist working at Coin Gabbar’s news desk, passionately following the ever-evolving crypto market. With a keen interest in blockchain technology and digital assets, he delivers in-depth reports on industry trends, regulations, and market movements. He holds a bachelor's degree in Journalism and Mass Communication and previously worked as a content writer at a PR agency, honing his skills in crafting compelling narratives and analyzing financial markets.

1 month ago

If you have experienced substantial financial loss as a result of fraudulent binary option investments, it is important to file a complain about the scam broker to Barry white and obtain a chargeback service in getting back your asset, I recommend barrywhite4390@gmail.com a reliable recovery specialist proceeding with his assistance in recovering your asset. I have come across positive feedback about him, I have use his service and gain positive outcome in securing a legal chargeback service in regaining my funds.