Last week (December 2 to December 6), Bitcoin spot ETFs experienced an extraordinary surge, with a weekly net inflow of $2.73 billion, marking the second highest weekly net inflow in history. BlackRock's Bitcoin ETF (IBIT) led the charge with an impressive weekly net inflow of $2.63 billion.

Bitcoin vs Ethereum ETFs have shown notable performances, highlighting the increasing interest in digital assets among institutional investors. The comparison between Bitcoin ETFs and Ethereum ETFs reveals significant trends and investment behaviors in the crypto market.

Bitcoin Spot ETF: Key Metrics

Daily Total Net Inflow: $376.59M (As of Dec 6)

Cumulative Total Net Inflow: $33.43B (As of Dec 6)

Total Value Traded: $4.08B (As of Dec 6)

Total Net Assets: $112.74B, representing 5.62% of Bitcoin's market cap (As of Dec 6)

Source: SoSoValue

Source: SoSoValue

At the time of writing, Bitcoin was trading at $99,474.86, following an intraday drop of 0.20%. Its market cap stood at $1.97T with a 24-hour trading volume of $53.28B.

In related news, El Salvador's President Nayib Bukele announced the country's Bitcoin portfolio data on December 5, revealing that the portfolio has accumulated investments of approximately $270 million, with unrealized gains exceeding $333 million. The country holds 6,180 bitcoins, purchased at an average price of $44,739.88, resulting in a return on investment of 122%.

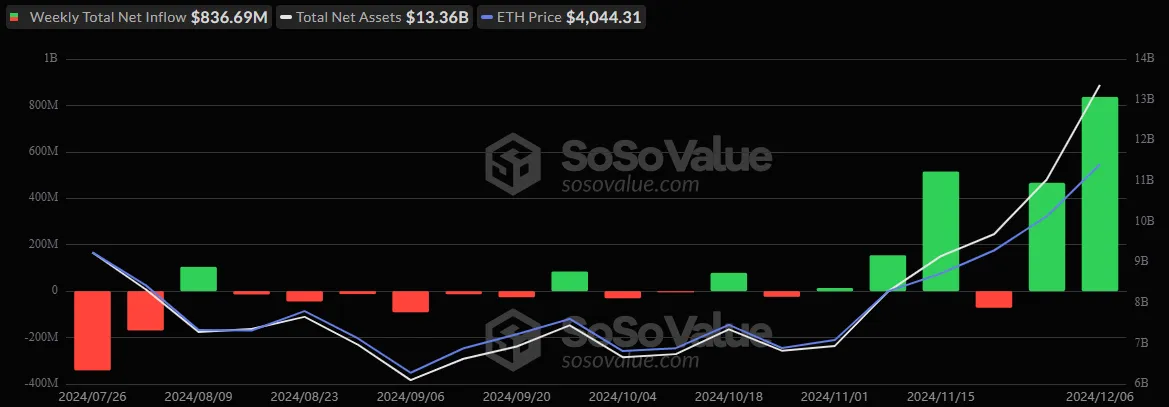

Ethereum spot ETFs also saw a remarkable performance last week, achieving a record high for weekly net inflows. From December 2 to December 6, Ethereum spot ETFs recorded a net inflow of $837 million. BlackRock's Ethereum ETF (ETHA) led the way with a weekly net inflow of $573 million.

Ethereum Spot ETF: Key Metrics

Daily Total Net Inflow: $83.76M (As of Dec 6)

Cumulative Total Net Inflow: $1.41B (As of Dec 6)

Total Value Traded: $992.49M (As of Dec 6)

Total Net Assets: $13.36B, accounting for 2.74% of Ethereum's market cap (As of Dec 6)

Source: SoSoValue

Source: SoSoValue

At press time, Ethereum's ETF was trading at $3,944.37, following an intraday drop of 0.82%. Its market cap was $475.12B with a 24-hour trading volume of $24.41B.

The significant weekly net inflows into both Bitcoin and Ethereum spot ETFs underscore the growing institutional interest and confidence in these digital assets. The performance of BlackRock's ETFs in particular highlights the leading role of major financial institutions in driving the adoption and investment in cryptocurrency markets.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.