Solana (SOL) is showing signs of recovery after experiencing a weekly decline of 4.03%. Today, the Solana price has surged by 5.76%, currently trading at $132.88. With a market cap of $67.73 billion and a 24-hour trading volume of $3.23 billion, SOL appears to be regaining investor confidence.

Source: CoinMarketCap

One of the biggest reasons behind the Solana price surge is the upcoming launch of Solana Futures by the Chicago Mercantile Exchange (CME) on March 17. This marks a significant milestone for Solana, as it paves the way for Solana ETF news, making it more likely for the U.S. Securities and Exchange Commission (SEC) to approve spot Solana ETFs.

Crypto analyst Chris Chung believes that ETFs from VanEck and Canary Capital could be approved as soon as May. Historically, futures markets provide a benchmark for spot ETFs, as seen with Bitcoin (BTC) and Ethereum (ETH). With the CME already listing BTC and ETH futures, the addition of Solana strengthens its case for institutional adoption.

Additionally, Coinbase launched its Solana futures in February, signaling growing confidence in SOL’s potential. This institutional interest is a major driving force behind today’s price surge.

Another reason for the Solana price surge is the ongoing community vote on SIMD-0228, a proposal that aims to reduce Solana’s inflation rate by 80%. If approved, this change could reduce selling pressure, enhance scarcity, and attract long-term investors.

Early data from Dune Analytics shows 35.7% support for the proposal.

The proposal aims to shift from a fixed inflation schedule to a dynamic, market-based model.

If passed, it could significantly impact Solana price stability and long-term growth.

This move is expected to make SOL more attractive to institutional and retail investors, adding further momentum to the current rally.

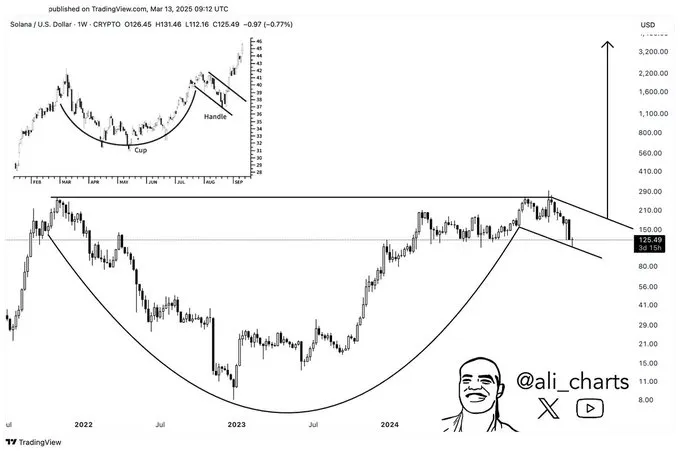

Crypto analyst Ali Martinez recently shared a Solana price prediction, noting that SOL is forming a classic “cup-and-handle” pattern. This bullish formation suggests a potential breakout above the $210 resistance level. If this happens, SOL could rally significantly, with an upside target of $3,800 based on historical price movements.

Source: X

Currently, Solana price is holding key support near $125. If buyers manage to push past $150, it could trigger further bullish momentum, attracting more traders. However, failure to break resistance might lead to a correction, with potential declines toward the $100-$105 range.

After experiencing a weekly decline, Solana is finally gaining momentum, driven by strong fundamentals such as the CME Solana Futures launch and the ongoing Solana vote on inflation reduction. While the current SOL price prediction suggests a bullish trend, traders should watch key resistance and support levels to assess future movements.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.