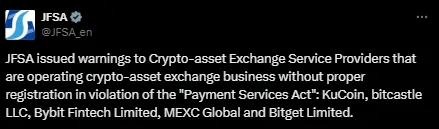

The Japanese Financial Services Agency (JFSA) has issued warnings to five unregistered overseas cryptocurrency exchanges for providing services to Japanese users without proper registration. The exchanges include KuCoin, bitcastle LLC, Bybit Fintech Limited, MEXC Global, and Bitget Limited, marking a significant development in Japan crypto exchange news.

Source: X

Source: X

In an official announcement, the Japan FSA news highlighted that these exchanges were operating in violation of Japan’s Payment Services Act (PSA), which mandates registration with the JFSA and the Financial Bureau to legally provide crypto-asset exchange services in the country.

Key exchanges targeted by the warning include:

KuCoin

Bitcastle LLC

Bybit Fintech Limited

MEXC Global

Bitget Limited

The Japanese FSA emphasized the risks associated with unregistered exchanges, including:

Lack of supervision by the JFSA regulatory reporting framework.

No assurance of proper customer asset segregation.

Absence of asset protection or compensation under Japanese law.

Vulnerability to unforeseen circumstances and user disputes.

While these exchanges may operate in other countries with registration, Japan's stringent laws prioritize market integrity and investor safety.

Japan has strengthened its regulatory framework following past incidents like the Coincheck heist, which highlighted security vulnerabilities in the sector. Key updates in Japan FSA news include:

Amendments to the PSA, requiring exchanges to register and comply with cybersecurity and AML/CFT requirements.

Implementation of the crypto Travel Rule, with JFSA news signaling further revisions to ensure compliance by Virtual Asset Service Providers (VASPs).

These measures aim to make Japan’s cryptocurrency landscape secure and transparent. While international exchanges can operate under equivalent standards, the Japanese Financial Services Agency news serves as a stern reminder that unauthorized services will not be tolerated. With the JFSA regulatory reporting and the APTCP guidelines under review, Japan continues to set benchmarks for crypto exchange compliance globally.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.

1 month ago

Metaverse and crypto