As the FOMC meeting on January 29, 2025 approaches, crypto town is as abuzz with expectations as one can imagine. Every trader and investor is looking out keenly for what will happen next from the Federal Reserve’s next move. The question remains: Will the Fed spark a rally in Bitcoin or trigger a market dip?

A total of 97.3% of market participants, according to the CME FedWatch Tool, believe that the Fed will keep its rates steady during the FOMC meeting. Only a slim 2.7% minority hopes for a surprise rate cut, which is still unlikely. The consensus is clear: the Fed appears poised to hold its rates steady and watch inflation and broader economic data.

However, the crypto market doesn’t wait. Bitcoin and altcoins are already showing bullish momentum ahead of the FOMC rate decision.

The real excitement is in what might happen later this year. Analysts like CFRA Research's Sam Stovall are expecting two rate cuts in 2025—one in Q2 and another in Q4.

As Stovall noted on Monday, "The Fed's likely to stay put tomorrow, but rate cuts later this year could inject fresh energy into equity and crypto markets. Such an environment may bring about liquidity inflow and lower borrowing costs to crypto investors, hence increasing the risk appetite for various asset classes, such as high-risk Bitcoin.

After Yesterday's sell-off, a sharp recovery was seen from lower levels. Bitcoin is rebounding from a dip below $100K. As of now, BTC is up 2.89% in the last 24 hours, sitting at $102,839.94. Its market cap has climbed to a staggering $2.03 trillion, with a trading volume of $78.65 billion—a 96.98% increase. The FOMC meeting has already stirred activity in the crypto space.

This surge comes amidst the broader market ripples, including China's AI-driven DeepSeek technology making waves in traditional markets. Should the Fed remain steady on its interest rates, Bitcoin's Price momentum might solidify because lower yields push investors toward high-reward assets, like cryptocurrency. However, the crypto market is synonymous with volatility, so there is always a warning.

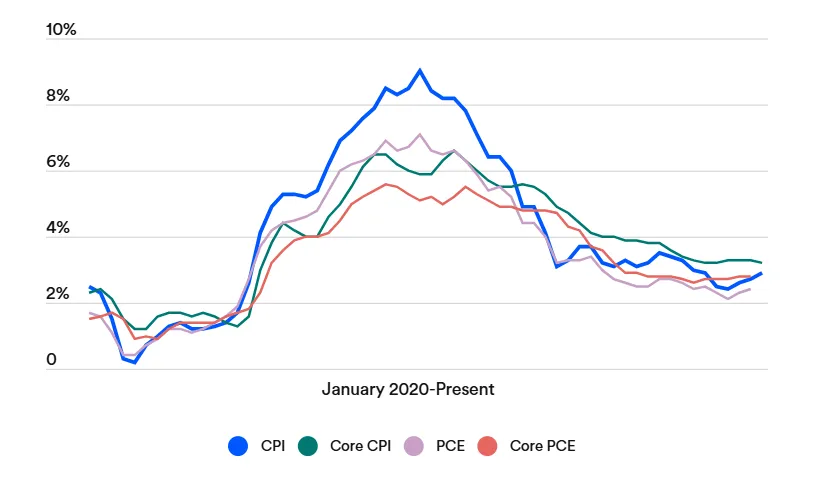

While all measures of inflation have greatly recovered since their summer 2022 peak, it is the last leg of taking inflation down to the Federal Reserve's 2% target that is proving the hardest. The last numbers reveal that the perceived chances of a March rate cut are at 28%, based on CME Group's tool, dated January 24.

The post-meeting statement from Jerome Powell is the definitive market mover. If Powell gives a hint of easing for later in the year or takes a dovish approach, then the crypto market will be quick to respond. A dovish outlook would reinforce the upbeat sentiment for Bitcoin, while a hawkish approach may temporarily cool any enthusiasm.

For now, Bitcoin appears to mirror the market's confidence, but traders know that the tide can change quickly. Be it a rally or a retrace from the FOMC meeting, crypto enthusiasts are bracing for action. Stay tuned for more updates on FOMC news and how it may affect Bitcoin and other cryptocurrencies.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

1 month ago

Cryptocurrency mining news

1 month ago

Top crypto influencers

1 month ago

New cryptocurrency releases

1 month ago

Crypto news and analysis

1 month ago

Blockchain technology news