Crypto Update, 06 March: BTC above $66K, ETH Momentum Builds

- The Fed's unclear signals complicate predicting rate cuts, while crypto markets prepare for potential effects.

- Bitcoin surpasses $66,000 in trading, while Ethereum exceeds $3,800.

- Cryptocurrency market sees 6.20% increase, totaling $2.64 trillion market capitalization.

Crypto currency market soared by 6.20% to $2.64 trillion

MicroStrategy CEO Michael Saylor praises the surprising triumph of recent Bitcoin ETFs, signaling a significant financial paradigm shift.

Well-known Bitcoin skeptic Peter Schiff unveils a Gold-backed NFT with a listing on the Magic Eden marketplace, priced in BTC.

Major Events To Watch

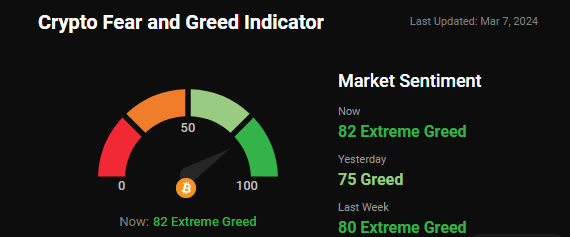

Crypto Fear and Greed Index:

Despite the 'Fear and Greed Index' reaching an exceptionally high level of 82 out of 100, indicating extreme market optimism over the past day.

Latest Market Update:

#Bitcoin ($BTC) maintains stability around $66,000 early Thursday, holding strong after hit $69000 in this week.

Other leading cryptocurrencies such as#Ethereum ($ETH), #Dogecoin ($DOGE), #Solana ($SOL), #Ripple ($XRP), and #Litecoin ($LTC) also experienced increases in value.

#Fetch.ai ($FET) token emerges as the biggest gainer, jumping nearly 50% in 24 hours.

Memecoin #BONK experiences the largest loss, dipping over 7% in 24 hours.

Total crypto market volume in the last 24 hours stands at $178.04 billion, marking a 29.14% decrease.

DeFi's total volume is presently $13.21 billion, constituting 7.42% of the total crypto market's 24-hour volume.

The volume of all stable coins has reached $164.72 billion, representing 92.52% of the total crypto market's 24-hour volume.

Bitcoin's dominance is currently at 51.98%, reflecting a decrease of 0.64% over the day.

Major Worldwide News Update:

El Salvador's government holds over $150 million worth of Bitcoin, surpassing its initial investment by 53%. President Bukele defends the move amid media skepticism, citing a 40% profit potential. With plans to hold rather than sell, El Salvador stands out globally for its pioneering adoption of a "Bitcoin standard."

Federal Reserve Chair Jerome Powell informed lawmakers that the central bank remains cautious about achieving its 2% inflation goal. He emphasized the need for confidence before considering interest rate cuts, highlighting stable inflation and a tight labor market despite increased immigration. Powell's remarks echo recent messages from Fed officials.

Bitcoin critic Peter Schiff ironically accepts BTC payments for his newly launched gold NFTs. Despite his previous skepticism, he promotes his "Golden Triumph" Ordinals, sparking reactions from the crypto community. Blockstream CEO Adam Back criticizes Schiff's stance, highlighting Bitcoin's dominance over gold ETFs. Schiff's evolving views on Bitcoin remain uncertain.

SEC's potential approval for a registered firm to custody Ether could classify it as a security, conflicting with US financial regulations, warns Commodity Futures Trading Commission chairman Rostin Behnam. He highlights the uncertainty surrounding Ether's classification and stresses the need for legislative action to address regulatory gaps in digital asset markets.

Kenny Li of Manta Pacific predicts that only a few of the current 44 active Ethereum Layer 2 blockchains will endure in five years. Critics dismiss the notion of "modular" blockchains like Manta, Celestia, and Cosmos as a marketing ploy, favoring the single-system architecture of monolithic blockchains. The debate continues over the future of Layer 2 networks.

Commodity Futures Trading Commission Chair Rostin Behnam urges legislative action to regulate the surging cryptocurrency market. He advocates for the Financial Innovation and Technology for the 21st Century Act, citing strain on resources due to increased enforcement actions. Behnam emphasizes the need to protect investors amid market growth.

BlackRock's Bitcoin ETF, IBIT, attracts record daily inflows of $788.3 million, totaling over $9.1 billion in less than two months. IBIT ranks 2nd in various flow metrics, marking a successful launch. Tuesday also saw $10 billion in ETF trading volume.

Russian economist Alexander Razuvaev predicts Bitcoin's downfall with the introduction of digital ruble and other major CBDCs, foreseeing crypto becoming marginalized. He criticizes crypto's overheated market and compares it to Dutch tulip mania, though he believes it won't vanish entirely but become a marginal phenomenon. Razuvaev supports CBDC adoption for investors.

COIN GABBAR Views: Is it time for Bitcoin to go long after testing $69K ATH? Will March see a new all-time high with prices predicted to double? Should investors buy now? Can bulls prevent BTC from dropping below $60K again? To get latest news Stay tuned us at coingabbar

Disclaimer: Coingabbar's guidance and chart analysis on cryptocurrencies, NFTs, or any other decentralized investments is for informational purposes only. None of it is financial advice. Users are strongly advised to conduct their research, exercise judgment, and be aware of the inherent risks associated with any financial instruments. Coingabbar is not liable for any financial losses. Cryptocurrency and NFT markets could be highly volatile; users should consult financial professionals and assess their risk tolerance before investing.