A crypto trader was targeted in a sandwich attack on March 12 while making a $220,764 stablecoin transfer. The attack resulted in the trader losing nearly 98% of their funds to a Maximum Extractable Value (MEV) bot.

The trader swapped $220,764 worth of USD Coin (USDC) for only $5,271 worth of Tether (USDT) in just eight seconds. The MEV bot successfully front-ran the transaction, pocketing over $215,500.

Ethereum’s blockchain data reveals that the attack targeted Uniswap v3’s USDC-USDT liquidity pool, which holds around $19.8 million in locked assets.

The MEV bot manipulated the transaction by first removing all USDC liquidity from the Uniswap v3 pool. It then reinserted the liquidity right after the victim’s transaction was completed.

Michael Nadeau, founder of The DeFi Report, revealed that the attacker tipped Ethereum block builder “bob-the-builder.eth” $200,000 from the swap. The MEV bot attacker kept $8,000 in profits.

DeFi researcher “DeFiac” suspects that the same trader, using different wallets, may have fallen victim to six sandwich attacks on the same day. Two Ethereum wallets, “0xDDe…42a6D” and “0x999…1D215,” suffered attacks at around 9:00 AM UTC on March 12. They lost $138,838 and $128,003, respectively. The transactions were made within minutes of the $220,762 swap.

There is growing speculation that these transactions could be connected to money laundering. Some experts suggest that the attack may have been orchestrated to disguise the movement of illicit funds. According to 0xngmi, the founder of the crypto data platform DefiLlama, the exploit might have been intentionally designed to allow an MEV bot to “clean” the funds while minimizing losses. This theory raises concerns about the potential use of DeFi protocols for financial crimes.

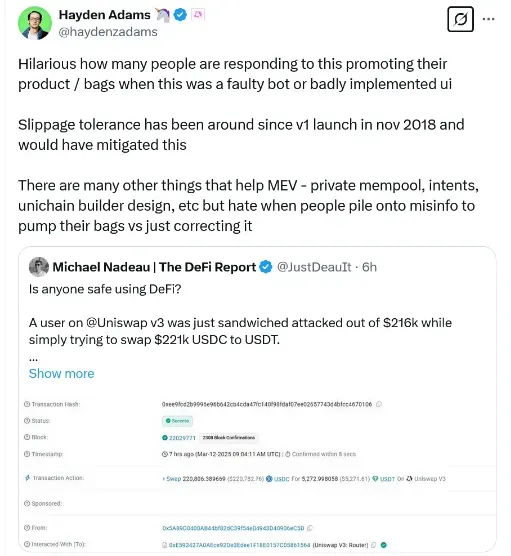

Uniswap CEO Hayden Adams has come forward to defend the platform after initial criticism from Michael Nadeau regarding a recent attack. Nadeau originally pointed fingers at Uniswap, suggesting that the exploit originated from its platform.

However, after receiving clarifications from him and other experts in the space, he acknowledged that the transactions in question did not originate from Uniswap’s front end.

He emphasized that Uniswap’s front-end interface is designed with multiple layers of security to protect users from malicious activities. One of these protective measures includes built-in MEV protection, which helps mitigate the risks of frontrunning and sandwich attacks.

With these safeguards in place, Uniswap continues to position itself as a secure and reliable decentralized exchange within the DeFi ecosystem.

Mohit Raghuwanshi is an Indian journalist working at Coin Gabbar’s news desk, passionately following the ever-evolving crypto market. With a keen interest in blockchain technology and digital assets, he delivers in-depth reports on industry trends, regulations, and market movements. He holds a bachelor's degree in Journalism and Mass Communication and previously worked as a content writer at a PR agency, honing his skills in crafting compelling narratives and analyzing financial markets.

1 month ago

If you have experienced substantial financial loss as a result of fraudulent binary option investments, it is important to file a complain about the scam broker to Barry white and obtain a chargeback service in getting back your asset, I recommend barrywhite4390@gmail.com a reliable recovery specialist proceeding with his assistance in recovering your asset. I have come across positive feedback about him, I have use his service and gain positive outcome in securing a legal chargeback service in regaining my funds.

1 month ago

If you have experienced substantial financial loss as a result of fraudulent binary option investments, it is important to file a complain about the scam broker to Barry white and obtain a chargeback service in getting back your asset, I recommend barrywhite4390@gmail.com a reliable recovery specialist proceeding with his assistance in recovering your asset. I have come across positive feedback about him, I have use his service and gain positive outcome in securing a legal chargeback service in regaining my funds.

1 month ago

I am incredibly grateful to Gavin Ray and his Team for helping me recover $175,000 in such a short period from an online scam investment platform. Their professionalism, expertise, and relentless dedication made the entire process smooth and stress-free. I highly recommend their services to anyone seeking reliable assistance in financial recovery. Email: (gavinray78( @)-g m a i lc o m