VanEck observed that many Bitcoin conference attendees were curious about SOL, suggesting a Solana ETF could be on the horizon.

The SEC has approved Grayscale's Bitcoin Mini Trust ETF, launching next week with a low 0.15% fee, following the successful Ethereum Mini Trust model.

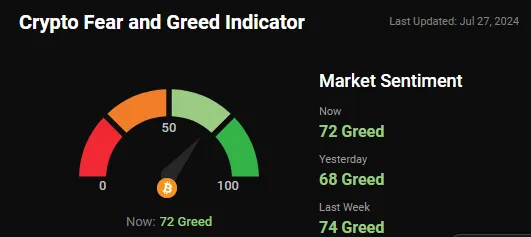

The Crypto Fear and Greed Indicator shows a current sentiment of 72 (Greed), up from 68 yesterday but down from 74 last week.

TOP 5 Gainers Coins

| Indices | LTP | Change (%) |

|---|---|---|

| Conflux | $0.1772 | 17.33% |

| eCash | $0.00003802 | 11.32% |

| Popcat | $0.9287 | 9.66% |

| Filecoin | $04.61 | 7.51% |

| Jupiter | 1.08 | 6.47% |

#Bitcoin has sustained its gains, staying firmly near the $68K mark.

Major altcoins like #Filecoin (FIL), #Cats in a Dog World ($MEW), #Worldcoin ($WLD), Solana ($SOL), and #Bitcoin Cash ($BCH) are seeing gains.

#Conflux ($CFX) has surged significantly, up over 17.50% in the past 24 hours.

#Monero ($XMR) has dropped by more than 7.96% in the last 24 hours.

Total crypto market volume in the last 24 hours is $60.49B, reflecting a 26.91% decrease.

DeFi volume stands at $3.79B, accounting for 6.27% of the total crypto market volume.

Stablecoin volume is $55.19B, making up 91.24% of the total crypto market volume.

Bitcoin’s dominance is currently 55.40%, marking a 0.09% increase over the day.

With spot Ethereum ETFs trading for nearly a week, investors are eyeing a potential Solana ETF, with VanEck hinting at its possibility. Despite VanEck's optimism, BlackRock's Robert Mitchnick doubts the need for more crypto ETFs, citing low altcoin market cap contributions. Meanwhile, Solana (SOL) has surpassed Binance Coin (BNB) as the fourth-largest cryptocurrency, gaining 35% over two weeks.

Grayscale Investments has secured SEC approval for its Grayscale Bitcoin Mini Trust, launching next Wednesday. Designed as a cost-effective alternative to GBTC, it will transfer a portion of GBTC's bitcoin to this new fund. The mini trust will have a 15 basis point fee, aiming to attract investors by reducing costs and enhancing market transparency.

On July 26, 2024, the Federal Reserve Board ended its enforcement action against Silvergate Bank and Silvergate Capital Corporation, following the bank's successful wind-down and customer reimbursement. Despite this, Silvergate faces ongoing legal issues, including a class-action lawsuit for alleged involvement in FTX fraud and an SEC lawsuit accusing complicity in the FTX scandal.

Charles Hoskinson criticized Peter Schiff's understanding of Bitcoin, dismissing Schiff's claims of BTC being a "pyramid scheme" as misinformed. Schiff argues that Bitcoin is a speculative asset with risks, while Hoskinson believes Schiff lacks insight into BTC’s value and potential. The debate highlights the ongoing clash between crypto advocates and skeptics.

US Senator Bill Hagerty plans to introduce pro-Bitcoin legislation, announced at the Nashville Bitcoin Conference 2024. His commitment reflects Bitcoin’s growing political influence, aiming to foster a favorable regulatory environment for digital assets. Hagerty’s move aligns with increasing bipartisan support for cryptocurrency innovation, amid rising market confidence.

Laser Digital, a Nomura Holdings subsidiary, plans to launch a high-yield Ether ETF by September. Partnered with Galaxy Digital and Dinero, this fund will offer institutional investors access to Ethereum staking, unlike other US ETFs that exclude staking to comply with SEC regulations. The ETF aims to enhance returns with staking benefits.

COIN GABBAR Views: Are experts predicting new all-time highs for Bitcoin in 2024 according to Finder’s report? Will BTC recover from recent market turmoil? Could explosive moves be on the horizon, especially with the Hash Ribbon indicator signaling a buy? Might we see Bitcoin reach $74,000 soon? To get latest news Stay tuned us at coingabbar

Disclaimer: Coingabbar's guidance and chart analysis on cryptocurrencies, NFTs, or any other decentralized investments is for informational purposes only. None of it is financial advice. Users are strongly advised to conduct their research, exercise judgment, and be aware of the inherent risks associated with any financial instruments. Coingabbar is not liable for any financial losses. Cryptocurrency and NFT markets could be highly volatile; users should consult financial professionals and assess their risk tolerance before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.