Crypto News, 10 March: Bulls Losing Steam: Is the Rally Over

- SEC Chair Gary Gensler under pressure from anti-crypto lawmakers regarding Ethereum ETF approval

- Crypto prices saw a drop with Bitcoin below $69,000, Ethereum at $3,800, and other altcoins sliding.

- Overall cryptocurrency market declined by 1.00%, reaching $2.72 trillion in total market capitalization

Crypto currency market plummeted by 1.00% to $2.72 trillion

Bitcoin (BTC) price poised for new highs next week due to decreasing supply on centralized exchanges.

Crypto market anticipates a significant week with crucial events such as CPI and PPI inflation data releases, along with the impending Ethereum upgrade.

Major Events To Watch

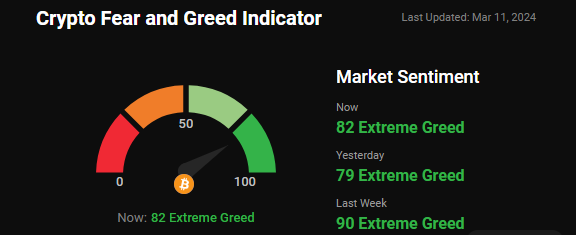

Crypto Fear and Greed Index:

Despite the 'Fear and Greed Index' soaring to an exceptionally high level of 82 out of 100, indicating widespread market optimism over the past day.

Latest Market Update:

#Bitcoin ($BTC) surpasses the $68,000 mark on Monday, aiming to consolidate around its all-time high of $69,000.

Popular altcoins like #Ethereum ($ETH), #Dogecoin ($DOGE), #Ripple ($XRP), #Solana ($SOL), and #Litecoin ($LTC) are demonstrating gains.

The #GALA token leads as the biggest gainer, with a 24-hour increase of over 21 percent.

#Jasmycoin experienced the largest decline, with a 24-hour dip of nearly 9.80 percent.

Total crypto market volume in the last 24 hours stands at $117.24 billion, reflecting a notable surge of 25.47%.

DeFi's total volume registers at $11.49 billion, constituting 9.80% of the overall crypto market's 24-hour volume.

Stablecoins contribute significantly to the market, with a volume reaching $105.08 billion, representing 89.63% of the total crypto market volume in the last 24 hours.

Bitcoin maintains dominance at 51.96%, experiencing a marginal increase of 0.01% throughout the day.

Major Worldwide News Update:

#Ethereum attempted a surge past $4,000 levels last week but faced selling pressure, trading at $3,850. Optimism for Ethereum ETF approval is waning. #SEC staff engagement contrasts with Bitcoin ETF evaluations. Analysts predict Ethereum could rally 25% to $5,000, but sustainability post-Dencun Upgrade remains uncertain amid SEC scrutiny and anti-crypto sentiments.

The #crypto market anticipates a crucial week with events like Federal Reserve announcements and inflation data. Powell's testimony hints at potential rate cuts, but timing remains uncertain. February CPI and PPI data releases on March 12 and 14 respectively will heavily influence future Fed policy and market sentiment.

Robert Kiyosaki, author of "Rich Dad Poor Dad," advises investing in Bitcoin amid growing US debt, projecting a potential price surge to $300,000. He suggests buying gold, silver, and Bitcoin as hedges against currency devaluation. With Bitcoin hitting ATH above $70,000, Kiyosaki emphasizes its long-term sustainability over the falling dollar.

President Biden hints at #Fed rate cuts, boosting belief in sooner-than-expected reductions. February job data surpassed expectations with 275,000 new nonfarm payroll jobs but also saw an increase in unemployment rate to 3.9%. Powell highlights uncertainty despite no signs of recession, influencing market reliance on Fed's rate decisions.

Pro XRP lawyer John Deaton gains crypto market support for his US Senate bid. Speculation rises on crypto-backed PACs backing him, particularly Fairshake. Support could prove crucial, especially in Massachusetts against Senator Warren. Deaton's fundraising campaign includes cryptocurrency donations, reflecting a growing demand for politicians understanding and embracing digital currencies.

Scam Sniffer reports over 57,000 victims lost $46.8 million to crypto phishing scams in February. Most victims were lured via impersonated Twitter accounts. Ethereum mainnet accounted for 78% of thefts, with ERC-20 tokens comprising 86%. Despite more victims, total stolen decreased from January, with reduced losses over $1 million.

Bill Ackman, famed short trader and billionaire investor, sparks discussion on crypto X by considering buying Bitcoin due to potential inflationary surge from increased mining energy consumption. Industry players offer to debate, including BTC bull Michael Saylor, urging Ackman to reconsider Bitcoin's role in energy consumption and economy collapse.

COIN GABBAR Views: Will Bitcoin reach $80k in the week ahead, despite rejecting $70k? Are the chances of a correction increasing? Could Ethereum be next as Bitcoin hits an all-time high? To get latest news Stay tuned us at coingabbar

Disclaimer: Coingabbar's guidance and chart analysis on cryptocurrencies, NFTs, or any other decentralized investments is for informational purposes only. None of it is financial advice. Users are strongly advised to conduct their research, exercise judgment, and be aware of the inherent risks associated with any financial instruments. Coingabbar is not liable for any financial losses. Cryptocurrency and NFT markets could be highly volatile; users should consult financial professionals and assess their risk tolerance before investing.

Also Read: Alan Kohler’s Bitcoin Prediction in the Financial Ecosystem