Crypto market Slumps Following U.S. PPI and Retail Sales

- BTC and ETH declined in a bearish crypto market in 24 hours, possibly due to bearish CPI, PPI data, and profit booking.

- Bitcoin price is trading below $68,000, contrasting with Ethereum's dip below $3,700.

- The cryptocurrency market witnesses a 7.30% downtick, propelling the total market capitalization to $2.69 trillion.

Crypto market dropped 7.30% to $2.69 trillion valuation

Peter Schiff, known for championing gold, expressed regret for not investing in Bitcoin since 2010, previously dismissing it as a Ponzi scheme.

Ethereum dipped post-Dencun upgrade, alongside reduced transaction fees on layer-2 solutions, potentially triggering a "sell the event" scenario.

Major Events To Watch

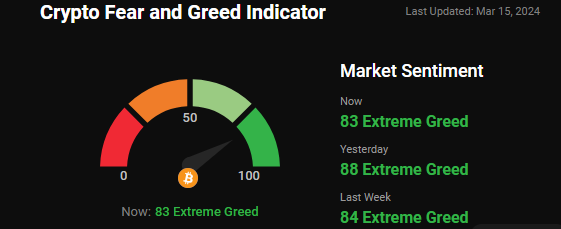

Crypto Fear and Greed Index:

The Fear & Greed index currently sits at 83, indicating Extreme Greed among investors and reflecting a favorable market sentiment.

Latest Market Update:

#Bitcoin ($BTC), the oldest and most esteemed cryptocurrency globally, halted its upward trajectory, witnessing a drop from $73,000 to below $69,000 early Friday.

Other prominent altcoins such as #Ethereum ($ETH), #Dogecoin ($DOGE), #Ripple ($XRP), #Solana ($SOL), and #Litecoin ($LTC) experienced widespread declines.

Notably, memecoin #dogwifhat ($WIF) emerged as the top performer, recording a 24-hour surge exceeding 14%.

Conversely, #Bitcoin SV ($BSV) suffered the most significant losses, plummeting over 15% within the same 24-hour period.

Total crypto market volume in the last 24 hours stands at $189.02B, marking a 38.20% increase.

DeFi's total volume is presently $15.58B, accounting for 8.24% of the total crypto market's 24-hour volume.

Stable coins collectively represent $171.18B in volume, comprising 90.56% of the total crypto market's 24-hour volume.

Bitcoin's dominance stands at 51.59%, reflecting a decrease of 0.42% throughout the day.

Major Worldwide News Update:

Following the US PPI inflation report on March 14, Bitcoin and the wider crypto market saw a 6.75% drop, trading at $67,900 with a $1.342 trillion market cap. With the FOMC meeting approaching on March 20, traders brace for volatility. QCP Capital notes increased perpetual swap open interest, but risk reversals lean towards put options, reflecting cautious investor sentiment.

US weekly unemployment fell amid disappointing PPI inflation data, setting the stage for the Fed's interest rate decision. The Labor Department reported 209,000 new claims, beating expectations. PPI inflation spiked to 0.6% in February, influencing the Fed's upcoming meeting. Despite lower Bitcoin prices, decreased trade volume signals investor caution amid potential interest rate adjustments.

A Paradigm survey reveals US crypto holders favor Donald Trump over Joe Biden for the 2024 presidential election, with 48% supporting Trump and 39% for Biden. Nearly half distrust both parties on crypto policies. Younger demographics show increased crypto usage, signaling potential electoral impact and policy significance.

Morgan Stanley elevates Jeff McMillan, a tech executive from its wealth management division, to head its AI Division, aligning with its growth strategy. McMillan's role involves fostering AI governance and strategies firm-wide while identifying AI-driven opportunities in collaboration with business units. The move underscores Wall Street's increasing openness to AI adoption amid industry innovation.

Eleanor Terrett of Fox Business sees Custodia Bank's lawsuit against the Federal Reserve as a significant crypto case following the Craig Wright-Satoshi Nakamoto identity dispute. If successful, it could mark a milestone for the crypto industry, with CEO Caitlin Long potentially becoming the first woman to defeat the central bank.

Senators Reed and Butler urge SEC Chair Gensler to halt further crypto ETF approvals, citing risks to retail investors due to market manipulation and fraud. They emphasize concerns over thinly traded cryptocurrencies and request increased scrutiny on Bitcoin ETF brokers and advisors. Political pressure mounts on Gensler.

Peter Schiff, a longtime Bitcoin critic, admitted regret for not investing in it when introduced in 2010. The stockbroker, known for advocating gold, dismissed Bitcoin as a Ponzi scheme. He acknowledged potential gains, estimating over $100 million if invested. Schiff still questions Bitcoin's future despite its remarkable growth, wary of its impact on gold markets.

COIN GABBAR Views: Is it time to retrace as Bitcoin (BTC) price cracks 7% with $576 million liquidated? What can we expect from upcoming Federal Reserve meetings? Will the market pump or dump? To get latest news Stay tuned us at coingabbar

Disclaimer: Coingabbar's guidance and chart analysis on cryptocurrencies, NFTs, or any other decentralized investments is for informational purposes only. None of it is financial advice. Users are strongly advised to conduct their research, exercise judgment, and be aware of the inherent risks associated with any financial instruments. Coingabbar is not liable for any financial losses. Cryptocurrency and NFT markets could be highly volatile; users should consult financial professionals and assess their risk tolerance before investing.

Also Read: Dogecoin Will Buy You a Tesla Car Hints Elon Musk