Bitcoin Price Gains Strength: Could This Be the Start of a Massive Rally?

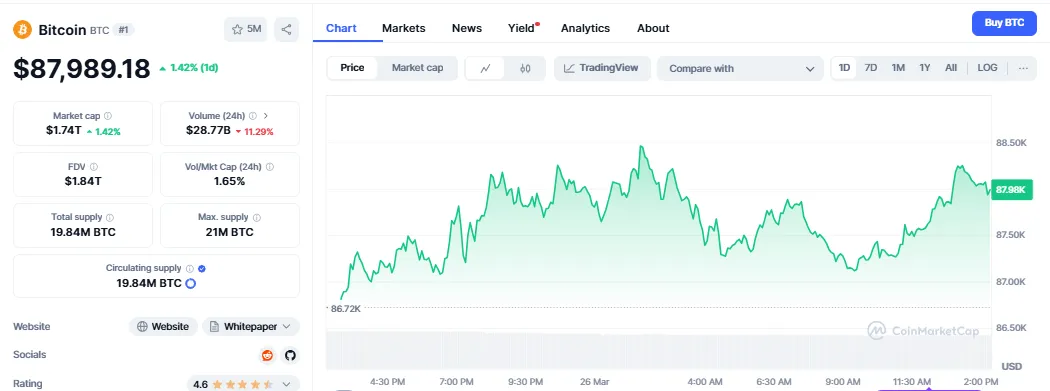

The biggest Cryptocurreny is gaining attention again as Bitcoin price reaches $87,989.18, showing a 1.42% increase in the last 24 hours. The market cap has grown to $1.74 trillion, and the token has jumped from a low of $77,467.63 earlier this month. Many believe this upward trend could push the $100K milestone soon.

Source: CoinMarketCap

Several key figures are fueling Bitcoin price momentum. Recently, former BitMEX CEO Arthur Hayes predicted that BTC could reach $110K, reflecting growing confidence among market analysts. Meanwhile, Senator Cynthia Lummis made a bold statement: "Sell the gold, buy Bitcoin!" This has led to speculation that the U.S. could swap its gold reserves for 1 million BTC, further strengthening Bitcoin price position as a major financial asset.

Today, Michael Saylor declared that the coin is "about to go vertical." It looks like His statement follows a major decision by the U.S. government to establish a Strategic BTC Reserve. An Executive Order signed on March 6 confirmed plans to store and never sell, showing strong policy support for the digital asset. Coingabbar crypto experts suggest that This move signals a shift toward BTC as a long-term national asset, increasing investor confidence.

Source: X

Another factor fueling optimism is GameStop’s strategy initiative. The gaming retailer has updated its investment plan to hold BTC as a treasury reserve asset. This mirrors MicroStrategy’s aggressive acquisition approach. GameStop’s board unanimously approved the decision, highlighting a growing trend of companies shifting towards cryptocurrency as a long-term store of value.

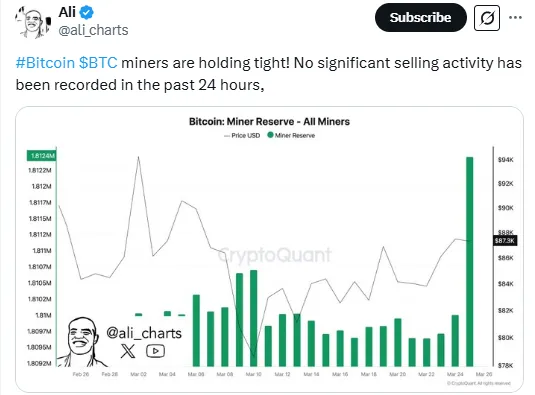

Miners—who earn new coins by processing transactions—are not selling their rewards right now. Market expert Ali pointed out that no major miner sell-offs have happened in the last 24 hours. This means fewer coins are being sold, which can help keep the Bitcoin price stable or even push it higher.

Source: X

Large companies and financial groups are also continuing to buy, adding more demand. Institutional investors are purchasing at record highs, and with supply tightening, this could drive the surge even further upward. Historically, strong institutional interest has played a key role in major price surges.

Higher belief is reflected in the rise of the global crypto market cap to $2.89 trillion, with BTC dominance at 63.67%. The Crypto Fear & Greed Index is at 47, indicating a sense of neutrality. Besides crypto, markets and commodities are gaining stability on the way to an economic recovery. Bitcoin price might be poised for more action with lower inflation fears and the emergence of favorable policies and as BTC rises with that market could also see a major upward momentum.

With governments, businesses, and investors all interested, Coin now appears to be substantially on the rise. If this momentum continues on this bullish trajectory, we will soon the $100,000 threshold and even beyond. On the other hand, the market is very volatile, making it all the more important to keep yourself informed and make needful decisions. Adopting institutions, the global market recovery moving ahead, and some strategic policies now turning define great coming weeks. Notably these weeks will be very landmark weeks for Bitcoin price action.