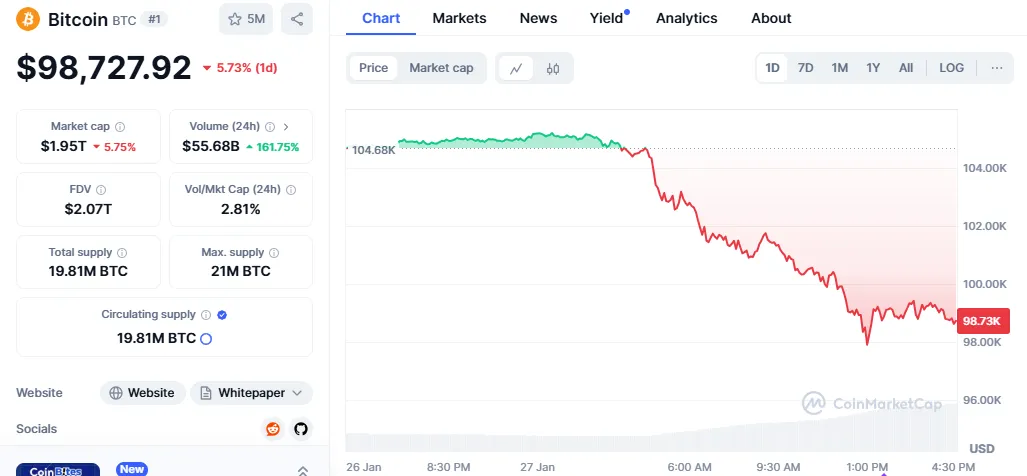

Bitcoin, the world’s most popular cryptocurrency, tumbled below the psychological $100,000 mark early Monday, sending shockwaves across the crypto market. At the time of writing, Bitcoin (BTC) is priced at $98,736.09, reflecting a sharp 5.60% drop in the past 24 hours. Its market capitalization now sits at $1.95 trillion, while trading volume has skyrocketed to $54.46 billion—an extraordinary 154.93% increase in just one day. This has sparked widespread discussions about the Bitcoin price crash and why Bitcoin is falling today.

The sell-off comes as traders take profits ahead of the U.S. Federal Open Market Committee (FOMC) meeting scheduled for January 29-30. Investors expect no indication of a rate cut during this two-day meeting, fueling cautious sentiment across financial markets. This Bitcoin crash has raised questions about whether the crypto market is down today due to broader economic trends or internal dynamics.

Adding to the market unease, U.S. stock futures dipped as investors digested news about China-based AI firm DeepSeek, whose cost-efficient capabilities pose a significant challenge to U.S. tech giants like OpenAI. This sentiment spilled over into the crypto market, further weighing on Bitcoin prices and contributing to the perception of a Bitcoin price falling today.

Market jitters spread as China-based AI giant DeepSeek challenged U.S. tech dominance. This uncertainty bled into Bitcoin, which has increasingly mirrored trends in the tech sector. The Bitcoin crash today serves as a reminder of how interconnected the cryptocurrency market is with global economic developments.

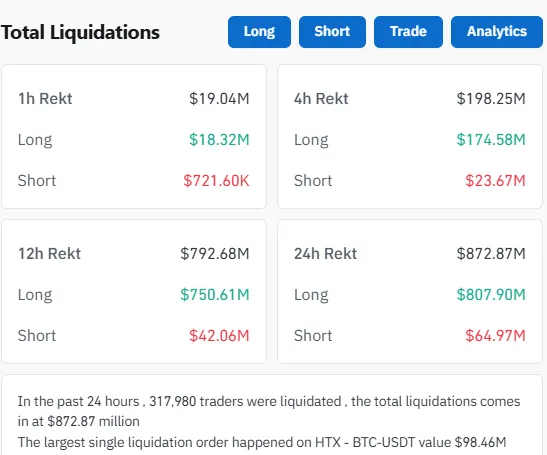

Over 317,807 traders were liquidated in the past 24 hours, resulting in total liquidations of $872.87 million. The largest single liquidation occurred on HTX, where a BTC-USDT order worth $98.46 million was wiped out. Long positions accounted for a staggering $807.90 million of the liquidations, as traders failed to anticipate the swift downturn. This wave of liquidations has further exacerbated the Bitcoin price crash, leaving many to wonder how the crypto market downturn might evolve.

Crypto heavyweight and former BitMEX CEO Arthur Hayes has warned of a further dip, predicting Bitcoin could slide to the $70,000-$75,000 range in the short term, labeling it a “mini financial crisis.” However, Hayes remains optimistic about a strong recovery, suggesting Bitcoin could rally to $250,000 later this year. This forecast underscores the Bitcoin price volatility and ongoing speculation about Bitcoin halving and its impact on the market.

Some analysts believe this is merely a small dip, with potential for Bitcoin to surge higher as the year progresses, driven by increasing adoption and improving macroeconomic conditions.

Despite the recent dip, analysts are optimistic about Bitcoin’s future. If sentiment improves and trading volumes sustain their current surge, Bitcoin could recover above $100,000 in the coming weeks. For now, cautious optimism dominates, with traders closely monitoring global market trends.

As Bitcoin dips below $100K, the crypto world is divided: is this a temporary correction or the start of a prolonged downturn? With a mix of caution and optimism, traders look to the FOMC meeting and global developments for direction. This recent Bitcoin price crash and the associated rise in Bitcoin liquidation numbers highlight the volatility of cryptocurrencies.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.

1 month ago

Altcoin news

1 month ago

Web3 news