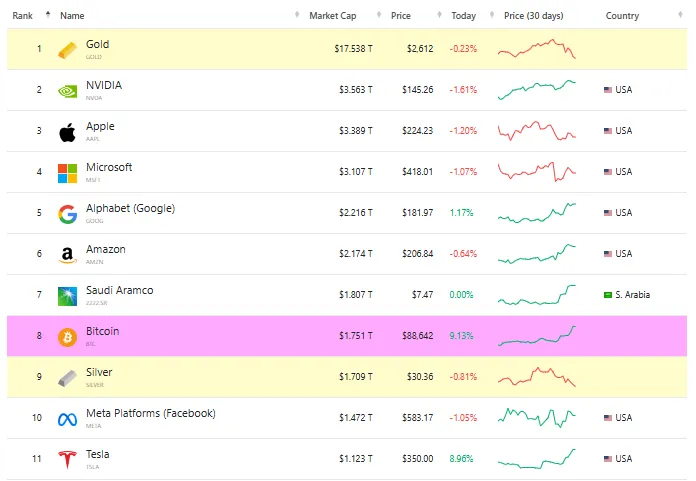

Bitcoin's remarkable surge has secured its place as the eighth most valuable asset globally, showcasing its strength in the financial market. Currently, the Bitcoin price USD is trading at $89,489.77 after an intraday increase of 10.77%, pushing its Bitcoin market cap to an impressive $1.77 trillion. This milestone places $BTC above prominent assets like Silver, which holds a market cap of $1.709 trillion, Tesla at $1.123 trillion, and Meta Platforms (Facebook) with $1.472 trillion, according to Companies Market Cap.

Source: Companies Market Cap

Source: Companies Market Cap

As of November 12, Bitcoin news reports an all-time high (Bitcoin ATH) of $89,604.50, highlighting its impressive growth of approximately 85% in 2024. The bullish momentum is backed by significant trading volume, with $134.64 billion in 24-hour trades. Analysts have noted that the surge in BTC price correlates with increased open interest on major derivatives platforms like Deribit, surpassing $2.8 billion as Bitcoin price today moves above $90,000.

Bitcoin chart analysis indicates that the cryptocurrency has experienced a steady climb throughout the year.

Market experts anticipate that continued demand will support Bitcoin price prediction for further gains.

The US election 2024 has also contributed to Bitcoin price optimism. Former President Donald Trump has expressed strong support for the crypto sector, proposing a pro-Bitcoin administration that would safeguard digital assets and create a regulatory framework encouraging growth. His plans include establishing a US Bitcoin strategic reserve, which, if implemented, could be a game-changer. The prospect of such a reserve has heightened investor confidence and could prompt other nations to devise their own Bitcoin strategies.

Bitcoin ATH Price achievements, coupled with supportive policies from the upcoming US election results, could fuel more bullish sentiment. Should Trump's vision materialize, Bitcoin’s role as “digital gold” will solidify further, potentially enabling it to surpass tech giants like Microsoft, Nvidia, and Apple in market value.

Bitcoin's ascent in 2024 reflects not only its intrinsic value but also a broader shift in global financial strategies. The Bitcoin price surge underscores its growing relevance, with the potential to disrupt traditional economic structures if current trends persist.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.