The cryptocurrency market saw mixed signals on November 25 as Bitcoin and Ethereum Spot ETFs exhibited contrasting movements. While Spot Bitcoin ETFs experienced significant outflows, Spot Ethereum ETFs continued to record steady inflows, highlighting a shift in investor sentiment. Here’s a detailed look at the day’s trends.

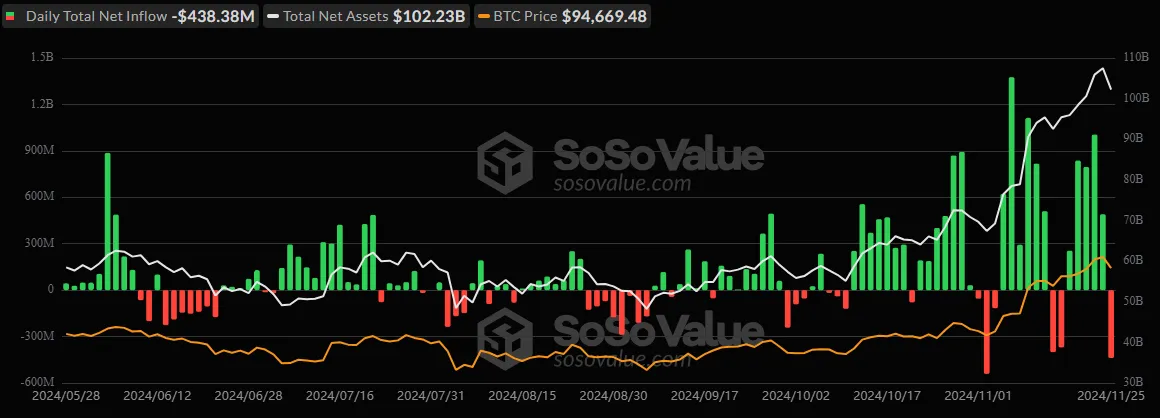

Bitcoin spot ETF market recorded a total net outflow of $438.38 million, marking the first outflow after five consecutive days of net inflows. This significant outflow coincides with Bitcoin’s price drop from $99,655.50 on November 23 to $94,719.36 today, reflecting a sudden change in investor sentiment.

Source: SoSoValue

Source: SoSoValue

Despite the overall outflow, BlackRock's iShares Bitcoin Trust (IBIT) stood out by registering a net inflow of $267.79 million, highlighting continued institutional interest in its product. Meanwhile, Grayscale’s Bitcoin ETF also posted a modest inflow of $420.46K, showing resilience amidst broader market uncertainties.

As of November 25, the total net asset value of Spot Bitcoin ETFs stood at $102.23 billion, accounting for 5.44% of Bitcoin's market cap. The cumulative total net inflow for Bitcoin spot ETFs reached $30.40 billion, with a total trading volume of $5.61 billion.

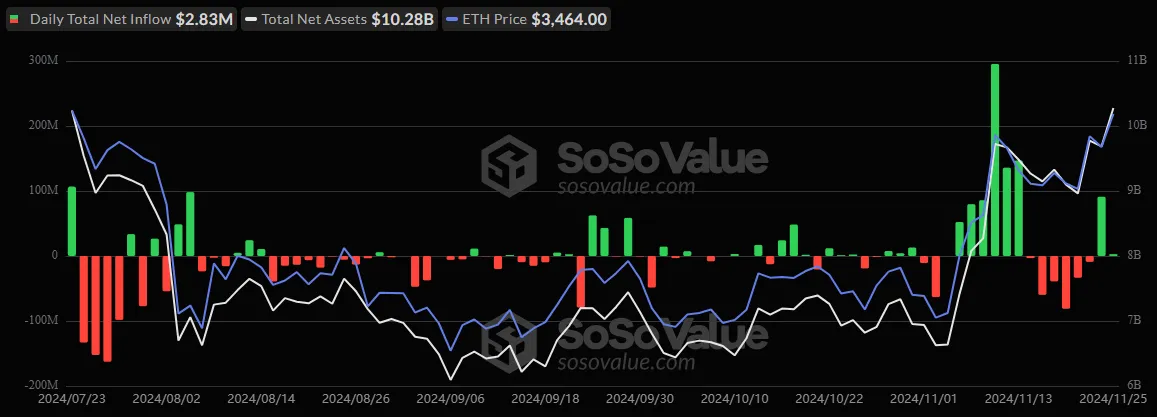

In contrast, Spot Ethereum ETFs reported a daily net inflow of $2.83 million, bringing their cumulative total net inflow to $109.63 million. The total net asset value of Spot Ethereum ETFs now stands at $10.28 billion, representing 2.44% of Ethereum's market cap.

Source: SoSoValue

Source: SoSoValue

Ethereum’s spot ETF inflows reflect the growing confidence in the asset as its price surged 1.45% in a day, reaching $3,430.25 with a $413.10 billion market cap and $53.53 billion in 24-hour trading volume.

The divergence between Spot Bitcoin ETFs and Spot Ethereum ETFs underscores the varying investor sentiment toward these major cryptocurrencies. Bitcoin's declining price led to heavy spot ETF Bitcoin outflows, while Ethereum’s consistent performance fueled spot ETF Ethereum inflows. The growing adoption of products like iShares Bitcoin Trust (IBIT) and Grayscale ETFs highlights the institutional demand for spot ETF crypto products, despite market volatility.

Both markets continue to play pivotal roles in shaping the future of cryptocurrency-based investments, with Spot Bitcoin Vs Spot Ethereum ETF comparisons offering valuable insights into investor preferences.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.