Bitcoin and Ethereum Rebound; DOGWIFHAT Sparks Crypto Rally

- CME FedWatch Tool indicates a decrease in the likelihood of a May rate cut from 23.2% to 6.4%. Conversely, chances of June rates staying at 5.50% surged from 26.6% to 41.2%.

- Bitcoin price exceeds $68,000, while Ethereum holds above $3,600.

- The cryptocurrency market experiences a 2.10% uptick, driving the total market capitalization to $2.70 trillion.

Crypto experienced a 2.10% increase, reaching $2.70 trillion

Crypto prices saw a significant rebound with Bitcoin surpassing $68,000, accompanied by recovery in Ethereum, Solana, XRP, and PEPE.

Solana's DeFi Total Value Locked (TVL) achieves its highest level in two years, marking an 80% increase over the past month.

Major Events To Watch

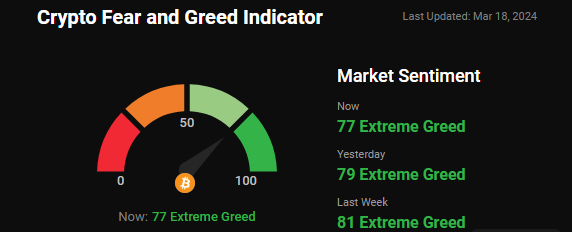

Crypto Fear and Greed Index:

The current Fear & Greed index stands at 77, signaling Extreme Greed among investors and highlighting a positive market sentiment.

Latest Market Update:

#Bitcoin ($BTC) surpassed $68,000 after briefly dipping below $65,000.

Altcoins like #Ethereum ($ETH), #Render ($RNDR), #Avalanche ($AVAX), #Toncoin ($TON), and #Solana ($SOL) surged by 15-25%.

Notably, memecoin #dogwifhat ($WIF) emerged as the top performer, recording a 24-hour surge exceeding 27.35%.

Conversely, #Pancakeswap($CAKE) suffered the most significant losses, plummeting over 3.40% within the same 24-hour period.

Total crypto market volume over the last 24 hours stands at $126.44 billion, indicating a decrease of 13.67%.

DeFi's total volume is presently $11.27 billion, constituting 8.91% of the total crypto market's 24-hour volume.

The volume of all stable coins now amounts to $113.63 billion, representing 89.87% of the total crypto market's 24-hour volume.

Bitcoin's dominance has risen to 51.90%, marking a 0.11% increase over the day.

Major Worldwide News Update:

The crypto market recently experienced volatility, with Bitcoin dropping from highs but rebounding. Attention is on the upcoming FOMC decision and Jerome Powell’s speech due to inflation concerns. Investors speculate on Fed actions, leading to cautious trading. Despite short-term uncertainty, optimism persists fueled by Bitcoin halving and ETF inflows.

Over the weekend, Solana surpassed Ethereum in network activity fueled by demand for Solana-based memecoins. Despite trading volume surpassing Ethereum by $1.1 billion, Solana encountered transaction issues. The surge was driven by memecoins like Book of Meme and $NAP. SOL price increased by 48% in a week, ranking it as the fourth-largest cryptocurrency by market cap.

Daily transactions on Coinbase's Ethereum layer-2 network Base surged to a record 2 million on March 16 post the Dencun upgrade, up from 440,000 before. Daily new users spiked 3,200% to 666,866. The upgrade slashed Base's transaction fees by over 60%, attributing to a 350% rise in transactions. Arbitrum and Optimism remain dominant in layer-2 with $23 billion locked.

Vanguard CEO Tim Buckley dismissed engagement with spot Bitcoin ETFs, prompting criticism. Financial advisor Jim Bianco defended Buckley, highlighting Vanguard's success without such ETFs. Bianco debunked rumors of Buckley's firing and emphasized his significant legacy in asset management, ridiculing claims of failure over Bitcoin ETFs.

UK lawmakers aim to regulate AI to combat Deepfake proliferation. The Labour Party proposes banning AI tools for generating nonconsensual explicit content. A policy paper suggests criminalizing such tools' use. The UK seeks to hold developers and web hosts accountable to prevent harmful Deepfakes, prioritizing citizen safety.

Cardano introduces USDM, its first fiat-backed stablecoin, amidst a market dominated by USDT and USDC. Mehen Finance launched USDM on March 17, facing challenges with U.S. banks in 2023. Now utilizing Plaid's services, Mehen plans expansion into the UK and Europe. USDM's launch garnered optimism from the Cardano community.

This week, major central banks, including Japan's BoJ, are expected to announce key interest rate decisions, potentially ending Japan's 17-year negative interest rate policy. The anticipation has led to market movements, with a slight decline in the yen and mixed performances in equities. Cryptocurrency markets show signs of volatility, with Bitcoin's recovery and growing optimism contrasted by concerns over Ethereum's performance.

COIN GABBAR Views: Are these healthy retracement points indicating a crypto rebound? What factors are driving Solana's surge amidst Bitcoin's decline? Will the RBA meeting and FOMC decision significantly impact currency movement? To get latest news Stay tuned us at coingabbar

Disclaimer: Coingabbar's guidance and chart analysis on cryptocurrencies, NFTs, or any other decentralized investments is for informational purposes only. None of it is financial advice. Users are strongly advised to conduct their research, exercise judgment, and be aware of the inherent risks associated with any financial instruments. Coingabbar is not liable for any financial losses. Cryptocurrency and NFT markets could be highly volatile; users should consult financial professionals and assess their risk tolerance before investing.

Also Read: Solana Prediction:Can Momentum Hold Amidst Market Volatility