24 Crypto Update, 1 March: BTC Stability Fuels Altcoin Rally

- Bitcoin trades above $62,000, while Ethereum maintains its position above $3,400.

- Positive market sentiment is also driving the value of popular meme coins such as Shiba Inu, Pepe Coin, and Dogecoin.

- The cryptocurrency market as a whole observes a modest 2.60% increase, reaching a total market capitalization of $2.45 trillion.

Crypto currency market climbed by 2.60% to $2.45 trillion

In February, the US manufacturing sector contracted faster, with the ISM Manufacturing PMI falling to 47.8 from January's 49.1, well below the expected 49.5.

Cryptocurrency losses due to hacks and rug pulls have surpassed $200 million across 32 separate incidents in the current year.

Major Events To Watch

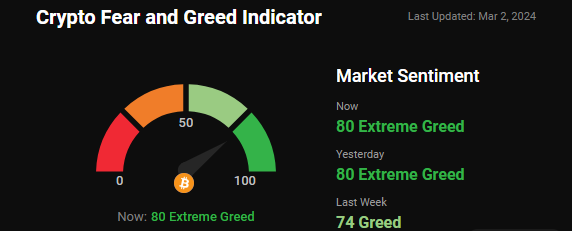

Crypto Fear and Greed Index:

Over the past day, the "Fear and Greed Index" remained stagnant, settling at 80 out of 100. Nevertheless, market sentiment continues to strongly favor optimism.

Latest Market Update:

Bitcoin ($BTC) surpasses the $62,000 mark, maintaining its status as the oldest and most valuable cryptocurrency.

Ethereum ($ETH), Bitcoin Cash ($BCH), Ripple ($XRP), and Cardano ($ADA) witness a notable surge in the market.

Shiba Inu ($SHIB) emerges as the top gainer with an impressive 24-hour surge of over 57%.

Conversely, Jasmycoin ($JASMY) experiences the most significant loss, dropping nearly 4.65% within the same 24-hour period.

Total crypto market volume over the last 24 hours: $109.43B, marking a 25.18% decrease.

DeFi total volume stands at $8.59B, accounting for 7.85% of the total crypto market 24-hour volume.

The volume of all stable coins reaches $97.42B, representing 89.03% of the total crypto market 24-hour volume.

Bitcoin dominance sits at 52.30%, experiencing a decrease of 0.44% within the day.

Major Worldwide News Update:

Grayscale, a top cryptocurrency asset manager, warns of inflation's impact on crypto values amid Bitcoin's 45% surge in February. They emphasize Federal Reserve policy's sway on crypto markets, anticipating potential rate cuts. Despite record inflows into crypto funds and Bitcoin ETF interest, caution persists due to macroeconomic uncertainties and upcoming inflation reports.

The US Energy Information Administration (EIA) halts energy consumption data collection from crypto mining following a lawsuit from industry players like The Texas Blockchain Council and Riot Platforms. EIA agreed to cease data collection, destroy received information, and seek public comments, amidst growing regulatory and environmental concerns in the sector.

Nvidia surges past Saudi Aramco to become the third-largest global company by market capitalization, valued at $2.053 trillion. With a dominant role in AI chip manufacturing, Nvidia benefits from the growing demand for AI technologies, further solidifying its position in the tech industry. Strategic initiatives, including AI-based applications and expansion into markets like China, contribute to its continued success.

FTX Derivatives Exchange, bankrupt since 2022, appoints Galaxy Asset Management as the sole investment manager for creditors' asset sales. Unauthorized bids are warned against, with a focus on compliance with legal regulations. FTX aims to repay creditors, leveraging asset sales, including a $1 billion stake in Anthropic, pending approval.

Nigeria refutes claims of a $10 billion fine for Binance, citing misquotation by Premium Times. Amid regulatory scrutiny, Nigerian authorities banned major crypto exchanges, escalating tensions with the industry. Recent events, including the detention of Binance executives, highlight the growing conflict. Binance pledges to resolve issues with Nigeria, denying knowledge of the alleged fine.

February report reveals a $200 million loss from crypto hacks and frauds, emphasizing the need for enhanced security in DeFi. Hacks dominated, comprising 97.54% of losses, with Ethereum as the prime target. Strengthening security measures is imperative to safeguard the crypto ecosystem against such risks.

Solana's native token, SOL, surged to a 23-month high on March 1. The rally, outpacing competitors like BNB, raises questions about sustainability. Notably, recent gains coincide with increased demand for Solana SPL memecoins and reports linking SOL to former FTX CEO's recommendations, though correlation remains speculative.

COIN GABBAR Views: When will BTC make its next attempt at new highs as it takes a tumble? Are ETF inflows driving the BTC rally? Is ETH poised to reach $5,000 in the mid-term? Can the crypto market cap hit $3 trillion? To get latest news Stay tuned us at coingabbar

Disclaimer: Coingabbar's guidance and chart analysis on cryptocurrencies, NFTs, or any other decentralized investments is for informational purposes only. None of it is financial advice. Users are strongly advised to conduct their research, exercise judgment, and be aware of the inherent risks associated with any financial instruments. Coingabbar is not liable for any financial losses. Cryptocurrency and NFT markets could be highly volatile; users should consult financial professionals and assess their risk tolerance before investing.

Also Read: Crypto Roundup, 01 March: Market holds breath ahead US Data