24 Crypto Update, 07 March: Ethereum Edges Closer to $4,000

- Federal Reserve Chair Jerome Powell suggests that the central bank is approaching the confidence threshold needed to start reducing interest rates.

- Bitcoin trading above $67,000, with Ethereum surpassing $3,900.

- The cryptocurrency market experiences a 2.50% increase, reaching a total market capitalization of $2.68 trillion.

Crypto currency market raised by 2.50% to $2.68 trillion

Ethereum (ETH) is edging closer to the $4,000 milestone amid an 'Extreme Greed' market sentiment.

U.S. jobless benefit applications remained steady last week, reflecting a robust labor market despite high interest rates.

Major Events To Watch

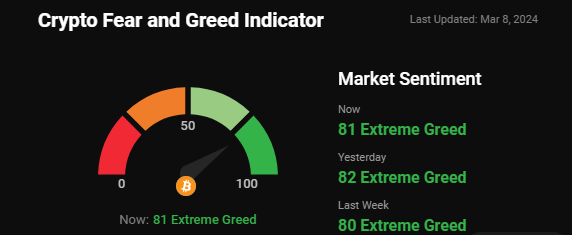

Crypto Fear and Greed Index:

Despite the 'Fear and Greed Index' surging to an exceptionally high level of 81 out of 100, signaling rampant market optimism over the past day.

Latest Market Update:

#Bitcoin ($BTC) surpassed the $67,000 mark on Friday, edging closer to it's all-time high of $69,000, indicating a potential consolidation phase.

As Ethereum steadily sails towards the $4,000 milestone, investor sentiment remains entrenched in 'Extreme Greed'.

Altcoins such as #Dogecoin ($DOGE), #Ripple ($XRP), #Solana ($SOL), and #Litecoin ($LTC) all recorded gains.

Memecoin #FLOKI saw the most significant increase, with a 24-hour surge of over 32%.

Conversely, #FLOW experienced the largest decline, dropping by over 6% within the same timeframe.

The total volume of the crypto market in the last 24 hours stands at $132.62 billion, reflecting a decrease of 25.54%.

DeFi's total volume is currently $12.29 billion, constituting 9.26% of the total crypto market volume over 24 hours.

The volume of all stable coins has reached $118.41 billion, comprising 89.28% of the total crypto market volume over 24 hours.

Bitcoin's dominance is presently at 51.67%, experiencing a decline of 0.31% within the day.

Major Worldwide News Update:

U.S. jobless benefit applications held steady at 217,000, unchanged from the previous week's revised figure, reported by the Labor Department. The four-week average dropped by 750 to 212,250. Reflecting the resilient labor market amidst elevated interest rates, these figures indicate stability, with claims remaining historically low since the pandemic-induced job losses in 2020.

Federal Reserve Chair Jerome Powell concluded his two-day testimony on Capitol Hill, reiterating expectations for interest rate cuts this year to both the House Financial Services Committee and the Senate Banking Committee. Powell emphasized that rate cuts would only occur when the central bank is confident in achieving its 2% inflation target. He highlighted easing inflation and a relatively tight labor market despite increased immigration.

Bitcoin surged towards $68,000 after the roller coaster. Market awaits 29,000 BTC options expiration, with a Put Call Ratio of 0.86. Volatility hit year-long highs. Despite turbulence, whales accumulate while small traders reduce holdings. SEC delays decisions on Bitcoin ETF options trading, including BlackRock's and Cboe Exchange.

BlackRock files with the SEC to expand Bitcoin ETF positions, aiming to incorporate them into its Global Allocation Fund. The move reflects a cautious yet optimistic stance towards cryptocurrency. BlackRock's existing Spot BTC ETF leads in performance. Bitcoin ETFs saw record highs last week, with BTC stable around $68,000.

Fed Chair Powell indicates central bank digital currency not imminent, citing privacy concerns and regulatory hurdles. IMF warns CBDC vulnerabilities could jeopardize financial systems. Fed previously engaged in CBDC discussions but emphasizes need for legislative approval. Global governments monitor CBDC developments, taking varied regulatory approaches.

SEC postpones decision on Bitcoin ETF options trading proposals, affecting major institutions like BlackRock and Cboe. New deadline set for April 24 allows for thorough market impact investigation. SEC seeks public input, signaling varied opinions on ETFs' potential benefits. Cryptocurrency investment landscape evolves amid regulatory scrutiny.

NTC begins disrupting unlicensed crypto trading platforms in the Philippines, following SEC's call for investor protection. Despite warnings, Binance remains accessible, raising questions about regulatory effectiveness. Measures aim to prevent illicit financial activities, with SEC stressing legal consequences for involvement with unauthorized platforms.

COIN GABBAR Views: Is the crypto market awaiting the non-farm payroll report for a new direction? What's expected as 29,000 Bitcoin (BTC) options expire today? Will Bitcoin (BTC) price see a $75k breakout or a shocking $50k reversal? Where does the crypto market head post-Fed testimony? To get latest news Stay tuned us at coingabbar

Disclaimer: Coingabbar's guidance and chart analysis on cryptocurrencies, NFTs, or any other decentralized investments is for informational purposes only. None of it is financial advice. Users are strongly advised to conduct their research, exercise judgment, and be aware of the inherent risks associated with any financial instruments. Coingabbar is not liable for any financial losses. Cryptocurrency and NFT markets could be highly volatile; users should consult financial professionals and assess their risk tolerance before investing.

Also Read: Crypto Daily Roundup, 07 March: All Eyes on Powell Testimony