The US stock market suffered a massive blow, losing over $1.5 trillion in a single day, with the crypto market following suit. This sell-off has been triggered by a series of events, including the Federal Reserve’s rate cuts and growing global tensions, sending shockwaves through both traditional and digital markets.

On Wednesday, the US Federal Reserve announced a 25 basis point rate cut, accompanied by guidance on monetary policy for 2025. This move triggered a sharp reaction in the markets, with Bitcoin plummeting below the crucial $100K support level, dragging the broader crypto market down.

Bitcoin, which recently hit an all-time high above $108K, has now lost all its weekly gains, reflecting the market's heightened vulnerability to macroeconomic events.

1. Market Unease Over Fed’s Guidance

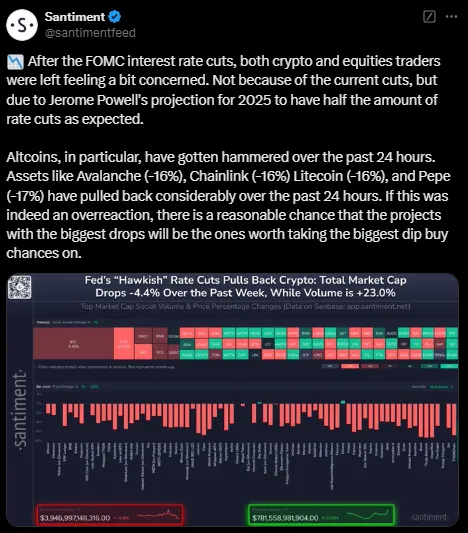

A report by Santiment indicates growing unease among traders. While the interest rate cuts themselves were not the primary concern, the Fed’s projection of fewer rate cuts in 2025 unnerved both stock and crypto traders. This uncertainty, combined with a shift in sentiment from Extreme Greed to Fear, drove the recent sell-off.

2. Surging Liquidations and Speculative Trading

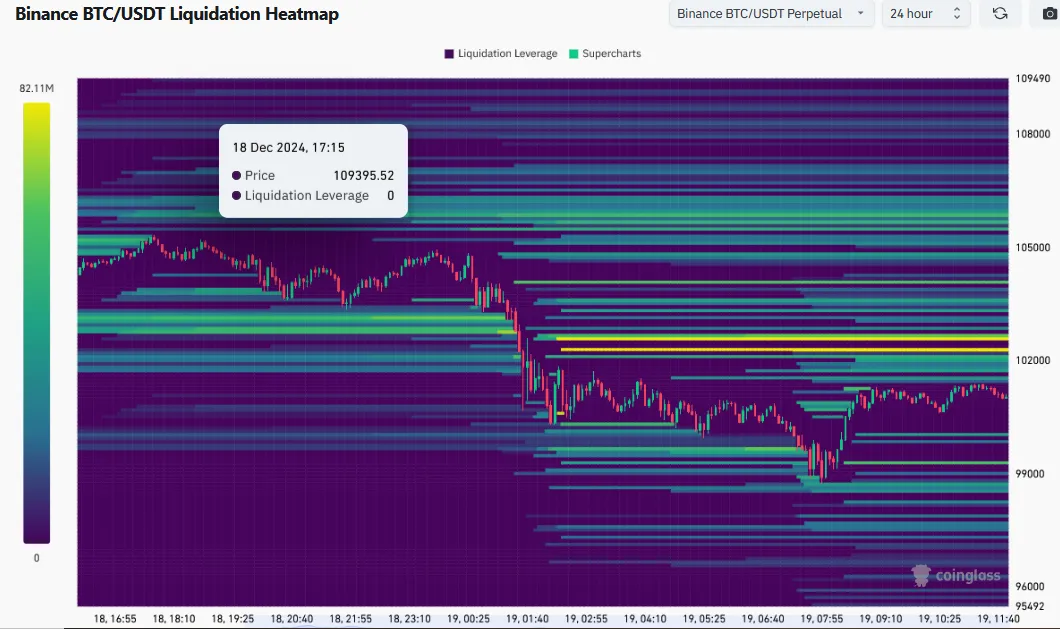

The crypto market saw 270,868 traders liquidated in the past 24 hours, with total liquidations reaching $781.31 million. The BTC Futures Open Interest hit $68.14 billion, signaling a surge in speculative activity even as prices continued to drop.

The Binance BTC/USDT Liquidation Heatmap highlights concentrated liquidation activity around the $102,000 mark, with heavy pressure zones below $100,000. This trend reflects aggressive trading, with leveraged positions being forcefully closed, further amplifying Bitcoin’s price swings and overall market volatility.

Despite the downturn, the Fear and Greed Index remains at 75, suggesting persistent market optimism. However, this elevated greed sentiment could exacerbate risks, especially during periods of heightened volatility and rapid price movements.

What’s Next for the Crypto Market?

1. Another Potential Sell-Off in January

Former BitMEX CEO Arthur Hayes warns of a potential market sell-off around Donald Trump’s inauguration on January 20, 2025. Hayes anticipates delays in regulatory policies due to political clashes, which could add further uncertainty and pressure on the market.

2. A Buying Opportunity Despite the Bloodbath

Despite current challenges, analysts believe that 2025 could be the year of Bitcoin, with the potential for new all-time highs. The recent sell-offs may present a buying opportunity, especially with rumors of a new Bitcoin ETF launch next year, which could act as a catalyst for market recovery.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.

1 month ago

New cryptocurrency releases