Solana has been struggling for the past five weeks, steadily losing value since hitting its all-time high of $295.83 on January 19. In just a month, it’s dropped over 36.75%, showing strong bearish momentum. By February 24, SOL had sunk to $157, marking its lowest price so far this year.

Source: TradingView

Source: TradingView

Heavy Selling Pressure

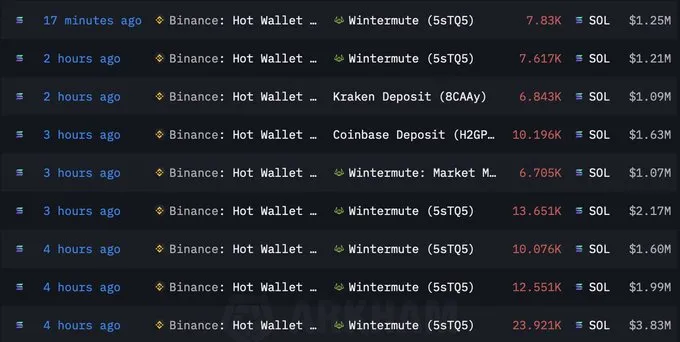

Massive sell-offs have been a critical factor in Solana’s downturn. Binance has been offloading substantial amounts of $SOL through market maker Wintermute, increasing the downward pressure.

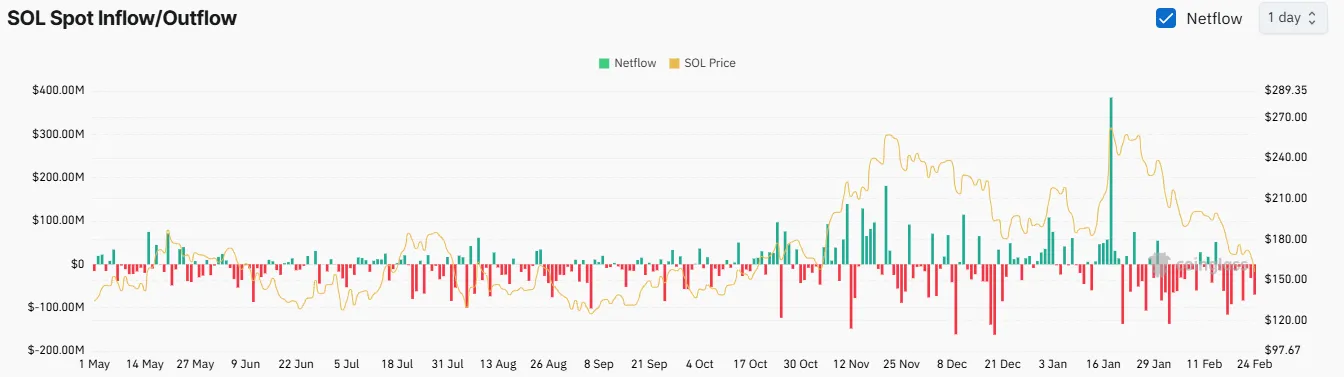

This selling spree, coupled with $494.37 million in outflows since February 15, has intensified downward pressure.

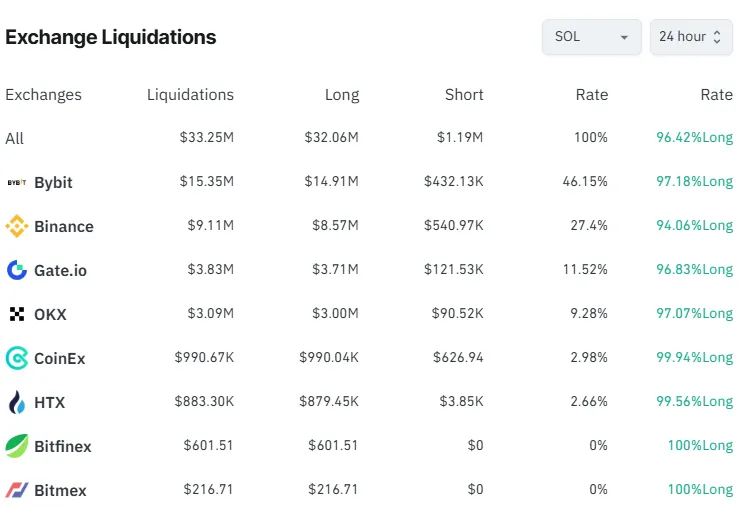

The price correction has triggered widespread liquidations. In the past 24 hours alone, over $33.25 million in liquidations occurred, according to CoinGlass. This adds to the volatility and accelerates the decline.

FTX's bankruptcy proceedings have cast a shadow over Solana. The defunct exchange plans to unlock 11.2 million SOL (worth $1.76 billion) on March 1. Historically, token unlocks have led to market corrections, and this significant release raises concerns of added selling pressure.

Technical Analysis: Are Bears in Full Control?

SOL is currently hanging around a key support level at $155. If the downward trend keeps up, the next major support is around $120. Dropping below that could open the door for even bigger losses.

The daily RSI sits at 31, signaling strong bearish momentum but not quite in oversold territory yet. At the same time, the MACD is flashing red histograms below the zero line, reinforcing the ongoing downtrend.

LIBRA Memecoin Controversy

The Solana ecosystem has faced setbacks beyond price action. The LIBRA memecoin scandal, involving alleged ties to the MELANIA token and Argentina’s President Javier Milei, wiped out millions from Solana's market cap.

FTX’s ongoing repayments to creditors have fueled market uncertainty. The use of older price valuations has sparked debates among stakeholders, adding to the market’s bearish sentiment.

Bearish Scenario

If bearish momentum persists, SOL could decline toward the $120 support level. The FTX token unlock on March 1 could exacerbate selling pressure, potentially leading to a double-digit correction.

Bullish Reversal Potential

On the flip side, if demand outpaces the influx of new tokens, SOL could rebound. A break above the $160 resistance and a breach of the trendline could propel SOL toward the $220 level.

While SOL is nearing oversold levels, caution is essential. The upcoming token unlock could lead to a sharp correction. However, long-term investors closely watching Solana’s next move, SOL’s sharp 36% drop this month has many wondering if now is the time to buy—or brace for further losses.

Solana faces significant bearish pressure, but the coming weeks will be crucial. Will it break below $120, or can bulls turn the tide? Keep an eye on the March 1 token unlock—it could set the tone for Solana’s next big move.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.