How Much Bitcoin Will Be Worth in the Future

Bitcoin, the world's leading cryptocurrency launched in 2009, continues to dominate the financial landscape with its volatile yet promising potential. As we look ahead, understanding Bitcoin future price becomes crucial. This article delves into Bitcoin price predictions for the years 2024, 2025, 2030, 2040, and 2050, offering insights based on current trends, market analysis, and expert opinions.

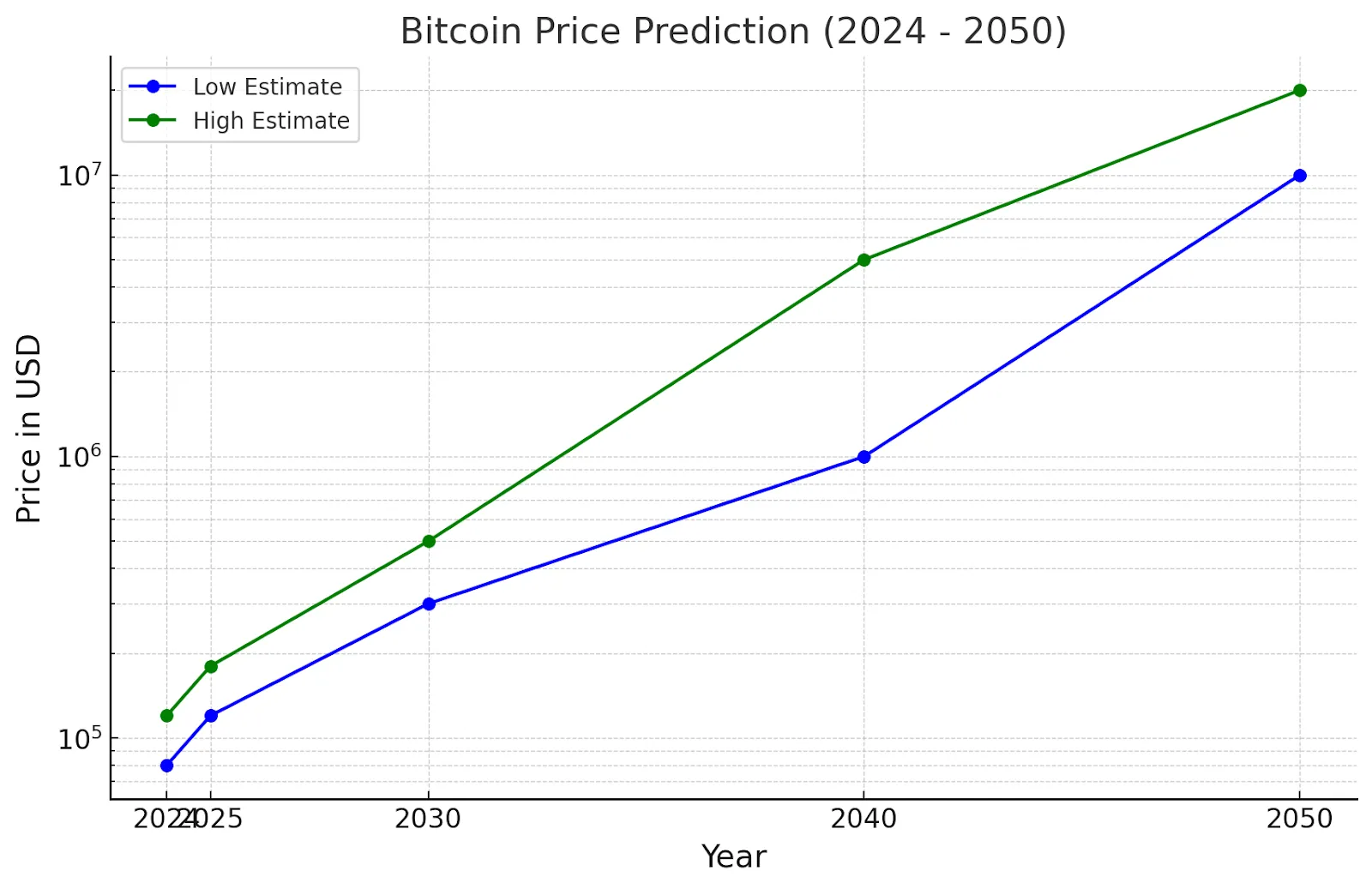

This chart showcases the projected Bitcoin price predictions from 2024 to 2050, highlighting both conservative and optimistic estimates for each year. It visually captures the potential growth path of Bitcoin over the next few decades, considering a range of influencing factors that could shape its future value.

Considering current market trends and historical data, Bitcoin's price in 2024 could be projected as follows:

Expected BTC Price Range: $70,000 to $120,000

Factors Affecting Bitcoin Value in 2024

U.S. Interest Rate Policies: Potential rate cuts could boost investor confidence and increase demand for Bitcoin as an alternative asset.

U.S. 2024 Presidential Election: Political uncertainty often drives volatility, impacting Bitcoin's price movements.

Regulatory Developments: Global regulations, especially in major markets like the U.S. and Europe, could significantly affect Bitcoin's adoption and price.

As we move into 2025, the post-halving effects will continue to influence Bitcoin's price. Additionally, the maturation of blockchain technology and its integration into various sectors will likely support further price appreciation.

Expected BTC Price Range: $120,000 to $180,000

Factors Affecting Bitcoin Value in 2025

Increased Utility: With more businesses accepting Bitcoin and advancements in Layer 2 solutions, Bitcoin’s utility is expected to rise.

Regulatory Environment: Clearer regulations and potential approvals for Bitcoin ETFs across major markets.

Continued Institutional Interest: The ongoing accumulation of Bitcoin by institutions as a long-term investment.

By 2030, Bitcoin is expected to have cemented its place as a global store of value, comparable to gold. The broader acceptance and integration into the financial system will likely drive Bitcoin's price to new heights.

Expected BTC Price Range: $300,000 to $500,000

Factors Affecting Bitcoin Value in 2030

Digital Gold: As Bitcoin becomes more widely regarded as a digital equivalent of gold, its market cap could approach or surpass that of gold.

Technological Advancements: Improvements in blockchain technology, such as increased transaction speeds and scalability, will make Bitcoin more appealing.

Global Adoption: Widespread adoption of Bitcoin in developing countries as a stable currency alternative.

Looking further into the future, by 2040, Bitcoin's fixed supply will likely play a crucial role in its price dynamics. With most Bitcoins mined and circulating, scarcity will drive the price significantly higher.

Expected BTC Price Range: $1 million to $5 million

Factors Affecting Bitcoin Value in 2040

Scarcity: With a capped supply of 21 million coins, Bitcoin's rarity will become more pronounced.

Global Economic Shifts: Potential shifts in global reserve currencies could position Bitcoin as a major asset.

Technological Integration: Continued integration into financial systems and possible use in smart contracts.

By 2050, Bitcoin may have achieved full global integration, serving as a backbone for various economic activities. Its role in the global financial system could be unparalleled, potentially becoming the world's reserve asset.

Expected BTC Price Range: $10 million to $20 million

Complete Global Integration: Bitcoin might be widely used for everyday transactions, store of value, and as a reserve currency.

Technological Evolution: The advent of quantum-resistant blockchains could secure Bitcoin’s future against emerging threats.

Macro-Economic Stability: Bitcoin could serve as a hedge against economic instability, leading to increased demand.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.