The global crypto market faced a significant downturn today, with the total market cap dropping by 8.37% to $2.87 trillion. Trading volume surged to $184.3 billion in the past 24 hours, marking a 112.50% increase. Despite the high trading activity, the market witnessed a massive sell-off, leading to widespread panic among investors. Bitcoin’s dominance rose slightly to 60.84%, reflecting investors' flight to the relatively safer crypto asset.

Trump Tariffs Announcement: The market sentiment took a hit after former U.S. President Donald Trump announced that tariffs on imports from Canada and Mexico would proceed. The 30-day pause on tariffs is nearing its end, creating concerns about economic instability. These Trump tariffs on Canada and Mexico sparked fears of a broader financial market downturn, with the crypto sector being one of the hardest hit. The uncertainty surrounding Trump tariffs 2025 has left investors worried about future market movements.

Bybit and Infini Hacks Shake Confidence: High-profile security breaches further fueled the crypto crashing trend. The Bybit hack resulted in the theft of $1.5 billion in Ethereum during a routine wallet transfer, revealing serious security flaws. Bybit has pledged full refunds to affected users and is working with cybersecurity experts to recover the funds, offering a 10% bounty.

Meanwhile, the Infini hack led to a $49.5 million loss when a former developer exploited the system after more than 100 days, using Tornado Cash to obscure the stolen funds. These incidents severely dented investor confidence, pushing more people to exit the market.

Spot ETF Bleeding: Massive outflows from Spot Bitcoin and Ethereum ETFs contributed to the crypto crash today:

Spot Bitcoin ETF saw a daily net outflow of -$516.41 million, with cumulative net inflows now at $39.04 billion.

Spot Ethereum ETF experienced a -$78.09 million daily net outflow, with total net inflows at $3.08 billion.

These outflows highlight reduced investor interest, contributing significantly to why is crypto crashing. After Bitcoin price crash, BTC is currently trading at $88,303.36 whereas Ethereum is hovering at $2,396.13.

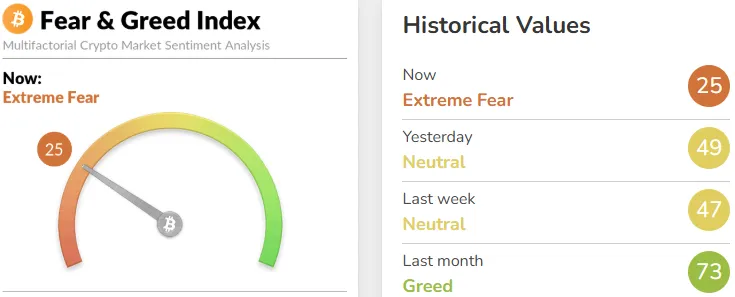

The Fear and Greed Index has shifted drastically, reflecting the current market panic:

This sharp drop into Extreme Fear indicates that investors are highly anxious, leading many to sell off their assets, further exacerbating why is crypto crashing today. Historically, extreme fear has sometimes signaled buying opportunities, but the current market turmoil has left most investors on edge.

Despite the current downturn, there are upcoming events that could spark optimism:

Major ETF Approvals in October 2025: New altcoin ETFs, including Litecoin, XRP, Solana, and Dogecoin ETFs, are set to debut, potentially drawing new investments and revitalizing the market.

FOMC Meeting 2025: The upcoming Federal Reserve meeting could bring policy changes that may positively impact the crypto sector. Investors are closely watching the event, hoping for favorable outcomes that could help the market bounce back.

While the market has taken a significant hit, these future developments raise hopes that the crypto market will rise again. Until then, investors remain cautious, waiting to see what's happening with crypto in the coming months.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.

1 month ago

Cryptocurrency industry insights

1 month ago

Environmental impact of crypto

1 month ago

Bitcoin news updates

1 month ago

Crypto market trends

1 month ago

Crypto investment news

1 month ago

Cryptocurrency trading news

1 month ago

Cryptocurrency scams and hacks

1 month ago

Latest cryptocurrency news

1 month ago

Cardano news

1 month ago

Central bank digital currency news