The Web3 gaming ecosystem is one of the sub sectors that has weathered the crypto winter exceptionally well. According to Coingecko, the total market cap of GameFi tokens currently stands at $25 billion; as for the number of active gamers, the latest report by DApp Radar shows there were over 6.8 million daily active wallets interacting with the blockchain gaming ecosystem.

These numbers are not only an indication that Web3 gaming has managed to sustain its momentum, but a foresight that this crypto sub-sector will likely continue to thrive or even grow much bigger in the next bull run. For context, the total crypto market cap has more than doubled in 2024, opening the year at $1.7 trillion and now at $3.5 trillion. To add to it, macro and political factors such as a Trump presidency are expected to be tailwinds in 2025.

With the overall prospects looking good, the big question is no longer whether the Web3 gaming space will benefit from the positive outlook, but rather which factors will propel it to mainstream adoption? The next section of this article will highlight the main reasons why this space is likely to continue with its on-chain dominance and probably become bigger.

Non-fungible tokens (NFTs) came with a bang in 2021, and even went ahead to become the word of the year as per the Collins dictionary. More importantly, these unique digital assets have transformed the value of in-game assets by making it possible for gamers to buy or sell them through decentralized NFT marketplaces such as blur and opensea, which has a cumulative volume of $39 billion to date.

Popular NFT games such as Illuvium and Gods Unchained feature collectibles that are designed as NFTs; what this means is that Illuvium’s collectible creatures (Illuvials) and Gods Unchained NFT cards can both be sold in NFT marketplaces for other crypto assets and eventually be liquidated into fiat. This is not the case with traditional Web2 games like Fortnite and Call of Duty where the in-game items are not easily tradable for real money.

Another important factor as to why Web3 games are likely to continue gaining popularity is the play-to-earn approach. More nascent Web3 gaming ecosystems such as Funtico are now introducing incredible reward models through high quality competition based games like Formula Funtico. This Web3 chain agnostic gaming platform holds several tournaments for the games within its platform, with prize pools going up to 5000 USDT.

While the Web3 gaming incentive model has in some instances proven to be unsustainable, it is quite evident that rewards are what have contributed to the largest share of adoption. Another good example backing this theory is the rise of TON’s tap-to-earn gaming ecosystem where users simply tap on their screens and earn some form of digital asset. This sector is now worth $1.8 billion in market cap, with notable names such as Hamster Kombat leading the space.

The interest by Web2 game publishers will also play a role in the next phase of Web3 gaming adoption. Several established brands are already building games or infrastructures to support Web3 gaming innovations within their ecosystem. One such example is Ubisoft which launched a Web3 game on the Oasys blockchain dubbed Champions Tactics: Grimoria Chronicles.

Atari on the other hand has its own blockchain initiative ‘Atari X’ which is designed to enable the ownership and trade of in-game assets. This game publisher also has an established presence on the Sandbox metaverse where it owns the Atari Sunnyvale, a metaverse ecosystem where players can engage with Atari themed environments.

Besides these advancements, it is also interesting to note that the reluctance by Web2 gaming publishers to embrace Web3 has reduced over time.

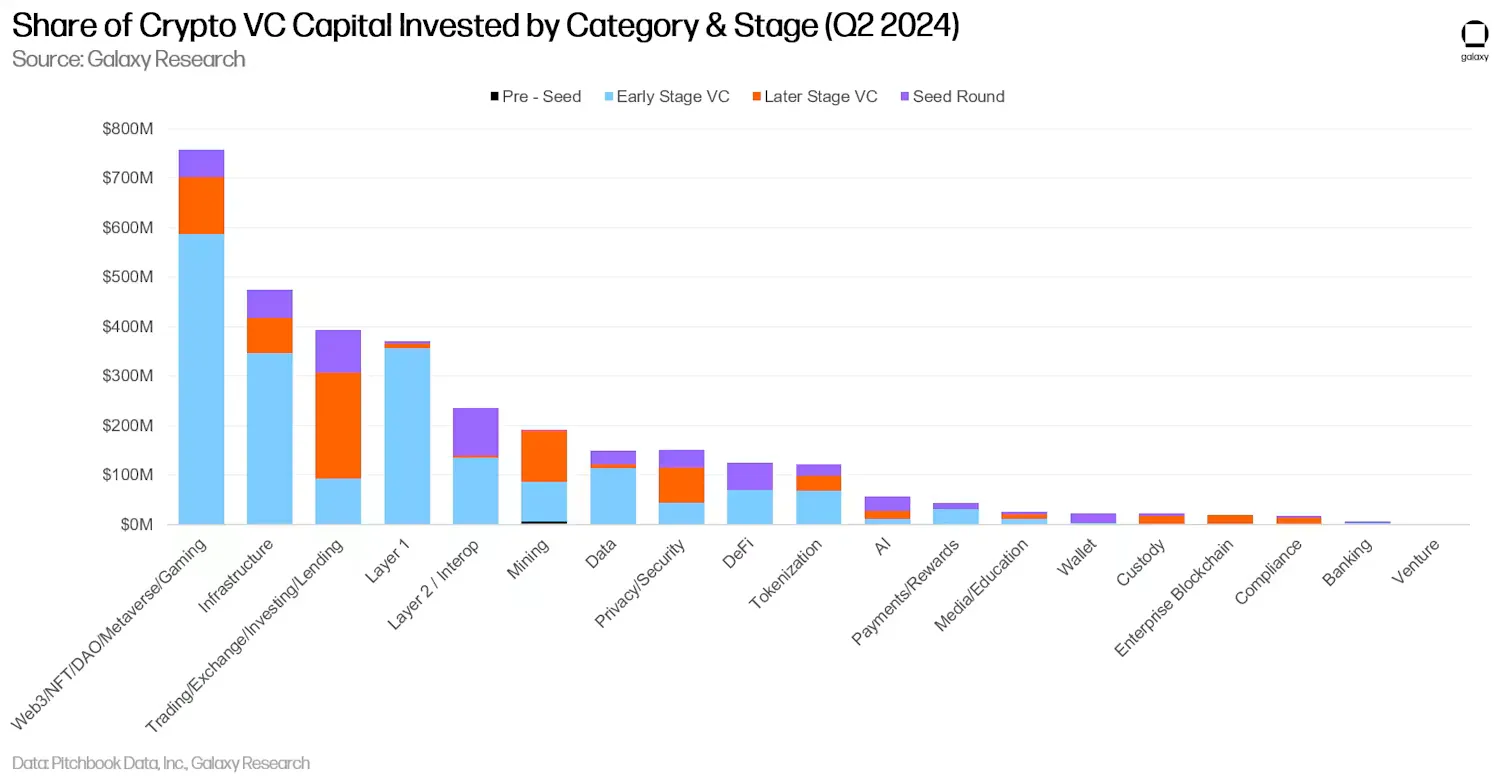

The funding towards Web3 gaming initiatives is another propelling factor as we enter into the second phase of the Bull run. According to Galaxy Digital’s Q2 2024 report, Web3 gaming, NFTs and the metaverse accounted for the largest share of VC deal count with over 100 deals while the capital invested in this niche exceeded $700 million.

Image source: Galaxy

These capital inflows will likely increase significantly as more money finds its way into the larger crypto ecosystem. A much needed boost for innovators to continue with the development of more advanced Web3 gaming ecosystems as well as run incentive models more effectively with a guarantee of sustainability.

Cross-Chain Accessibility

Last but not least, Web3 gaming infrastructures have improved since the 2021 era. Today, quite a number of games can be accessed through different blockchain networks; for example, ChainGuardians, a role-playing and strategy game, allows players to use the in-game NFTs across multiple chains, including Ethereum, Polygon and the BNB Chain.

Another cross-chain accessible Web3 game is Aurory which operates both on Solana and Ethereum blockchain. Players can therefore leverage the advantages of each chain to move around their play-to-earn items more securely and cheaply.

Looking Into the Future

As mentioned in the introduction, the best crypto market is likely headed for more gains. This will be a big catalyst for already thriving ecosystems such as Web3 gaming; more importantly, we’re likely to see advanced iterations of Web3 games that not only focus on rewards but also pay attention to the user experience. The factors mentioned in this article are just the tip of the iceberg, there are more reasons to be bullish on Web3 games given the already established fundamentals and technical outlook.

Pooja Lodwal is a skilled crypto writer with three years of experience in blockchain and digital currencies. She simplifies complex topics, making cryptocurrency easy to understand for all readers. Whether it’s Bitcoin, altcoins, NFTs, or DeFi, she breaks down the latest trends in a clear and engaging way. She stays updated on market news, price changes, and emerging developments to provide valuable insights. Her articles help both beginners and experienced investors navigate the ever-changing crypto landscape. Pooja believes in blockchain’s potential to transform the future of finance and is passionate about sharing her knowledge. Her writing is simple, informative, and accessible, ensuring that even newcomers can grasp key concepts with ease. By breaking down complicated terms, she makes learning about crypto enjoyable. Through her work, Pooja continues to educate and inspire readers, helping them stay informed about the exciting world of digital assets.