Imagine a world where owning a fraction of a Picasso or a share in a luxury apartment halfway across the globe is as simple as owning a stock.

Where inefficiencies in traditional finance are replaced by lightning-fast, cost-effective transactions.

Tokenization promises exactly this—a world of boundless opportunities.

2025 is shaping up to be a landmark year for tokenized assets. Financial institutions, driven by regulatory clarity and institutional demand, are accelerating their tokenization initiatives.

But is this the paradigm shift we’ve been waiting for? Or just another overhyped narrative?

At its core, tokenization is about creating digital representations of real-world assets on a blockchain.

Think of it as slicing your favorite pie into tradeable, digital pieces—but instead of pie, we’re talking about bonds, real estate, or even Picasso paintings.

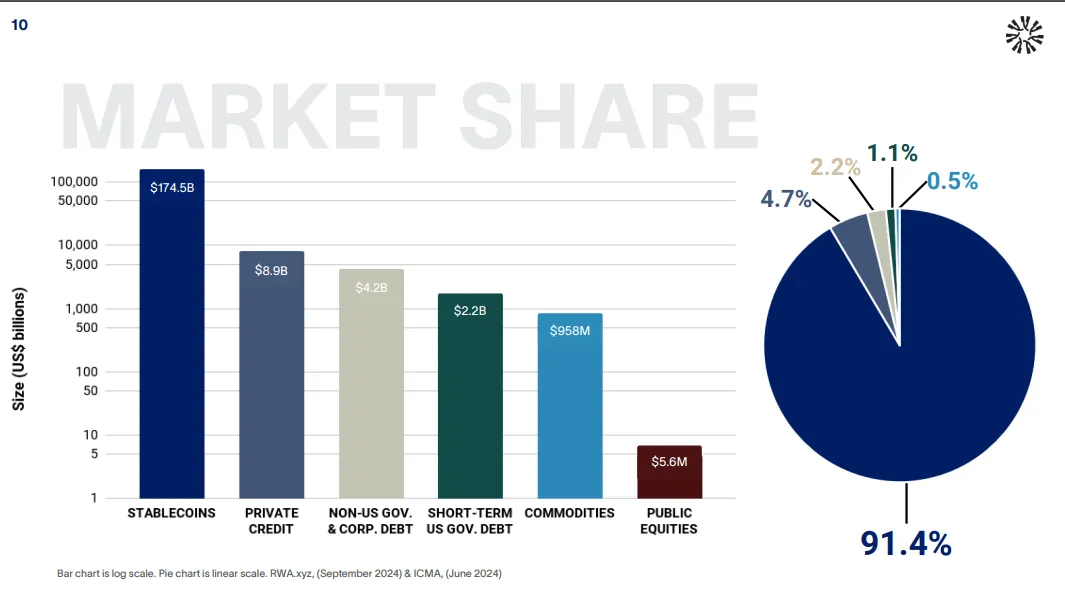

Despite its potential, tokenization is still in its infancy.

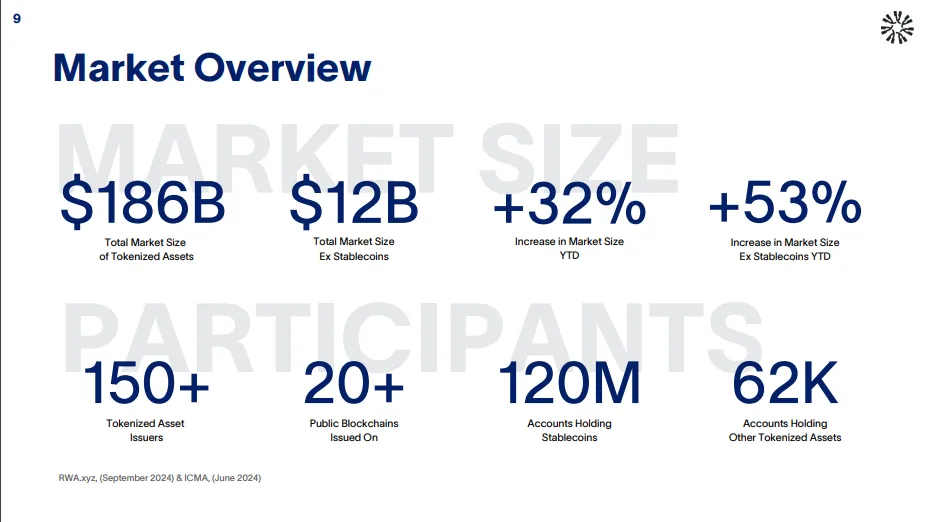

According to the Tokenized Asset Coalition’s (TAC) State of Asset Tokenization 2024 report, only 0.003% of global assets have been tokenized, representing just $12 billion excluding stablecoins.

For context, the global equity market alone stands at $109 trillion, while real estate investments add up to $11 trillion.

This stark contrast underscores how far tokenization must go to become mainstream.

But here’s the good news: the market is growing.

In 2024, tokenized assets grew 53% year-to-date, driven by increasing adoption, regulatory clarity, and the participation of financial heavyweights.

Regulation has long been the elephant in the room for blockchain. For years, unclear policies stifled tokenization’s growth, forcing projects to navigate a fragmented legal environment.

But 2025 is shaping up to be a turning point.

With Donald Trump’s re-election, the crypto market is brimming with optimism.

Bitcoin has surged past $100K, institutional adoption is rising, and the incoming administration’s stance on financial innovation could reshape tokenization’s future.

Key regulatory shifts include:

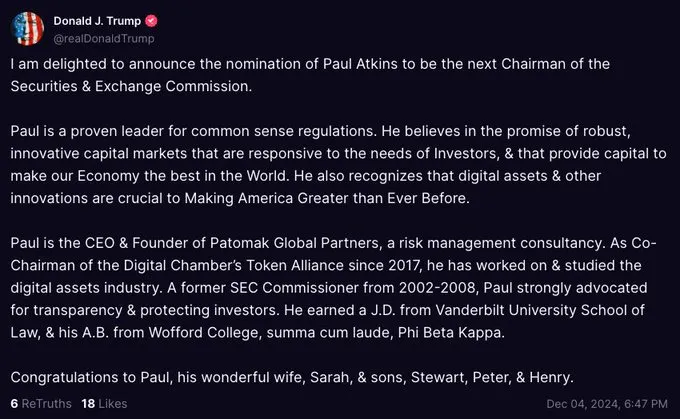

Paul S. Atkins has taken over as the new SEC chairman, signaling a pro-crypto stance.

Under his leadership, the focus is likely to shift from enforcement-driven regulation to a more innovation-friendly approach.

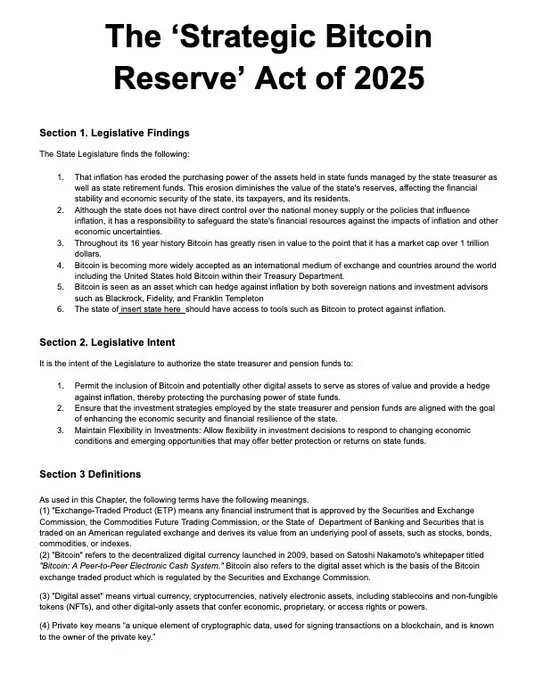

The U.S. government is now actively considering accumulating Bitcoin as part of its national reserves—a move that could reinforce America’s leadership in digital finance.

In addition, a new executive order—"Strengthening American Leadership in Digital Financial Technology"—aims to position the U.S. as the global hub for blockchain and tokenization.

The order focuses on regulatory clarity, stablecoin integration, and public blockchain access, setting the stage for institutional participation at an unprecedented scale.

When industry giants like BlackRock and Visa step in, you know the tide is shifting.

BlackRock’s tokenized Treasury fund, BUIDL, crossed $500 million in market cap within five months, delivering $7 million in dividends.

Visa launched platforms enabling banks to issue fiat-based tokens, while Mastercard partnered with JPMorgan’s Kinexys platform to process $2 billion daily in blockchain-based transactions.

Even beyond traditional finance, companies like Franklin Templeton and Ondo Finance are driving innovation.

Ondo’s tokenized treasury products now boast over $560 million in total value locked (TVL).

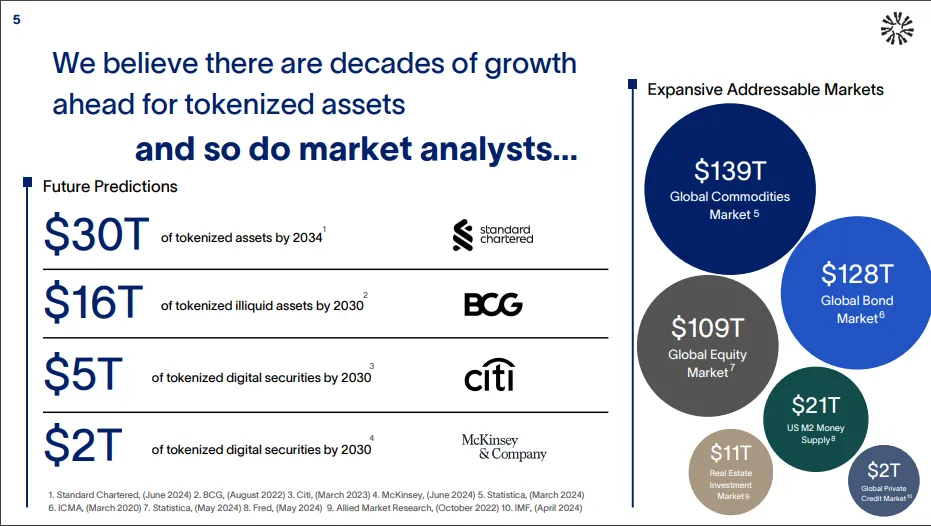

According to TAC, the addressable market for tokenized assets is enormous.

By 2030, predictions include:

$16 trillion in tokenized illiquid assets.

$5 trillion in tokenized digital securities.

$30 trillion in total tokenized assets by 2034.

These numbers aren’t just optimistic projections.

They’re backed by the real-world utility of tokenization—unlocking liquidity, reducing inefficiencies, and democratizing access to investments.

Treasuries: The Star Performer

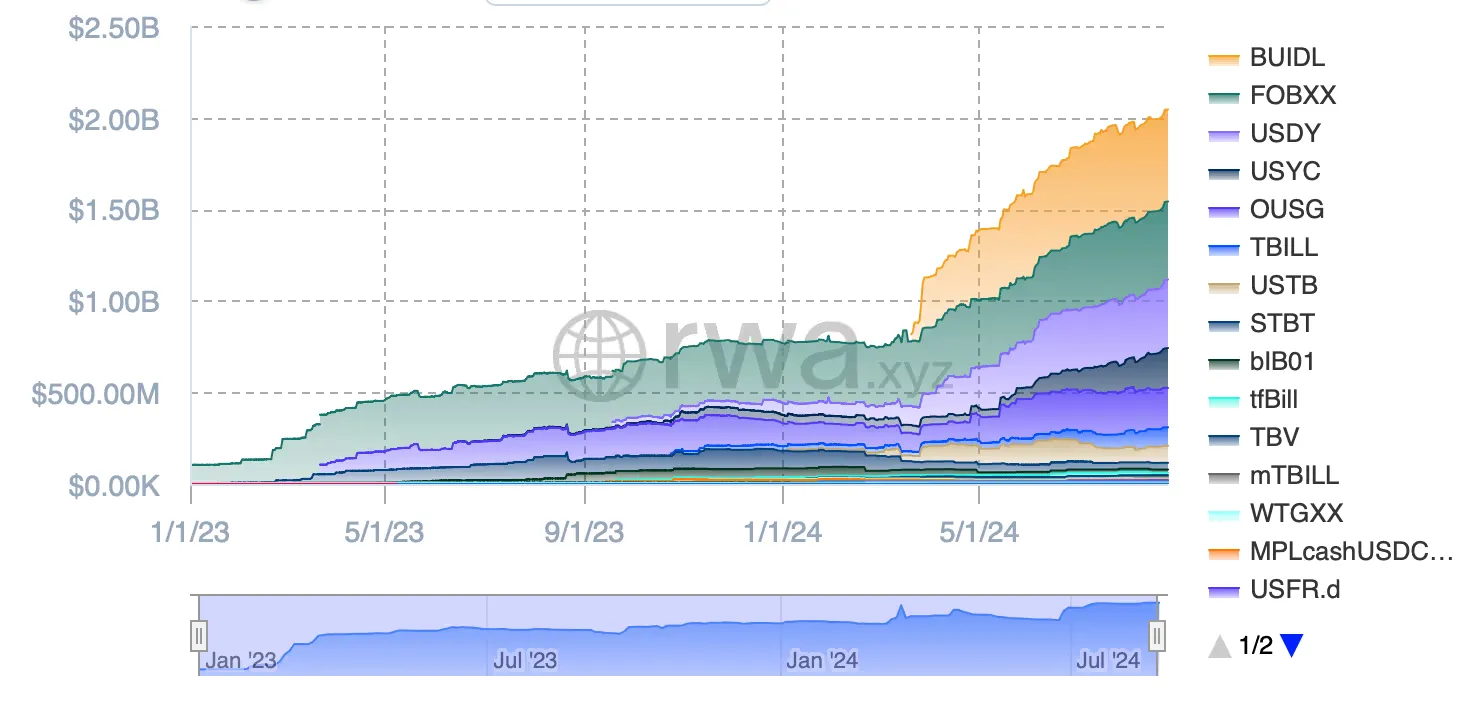

Tokenized treasuries have emerged as a flagship use case.

These products offer features traditional markets can’t match, such as 24/7 liquidity, programmable automation, and peer-to-peer transfers.

For instance, Ondo Finance’s USDY integrates seamlessly with DeFi, bridging traditional finance and blockchain.

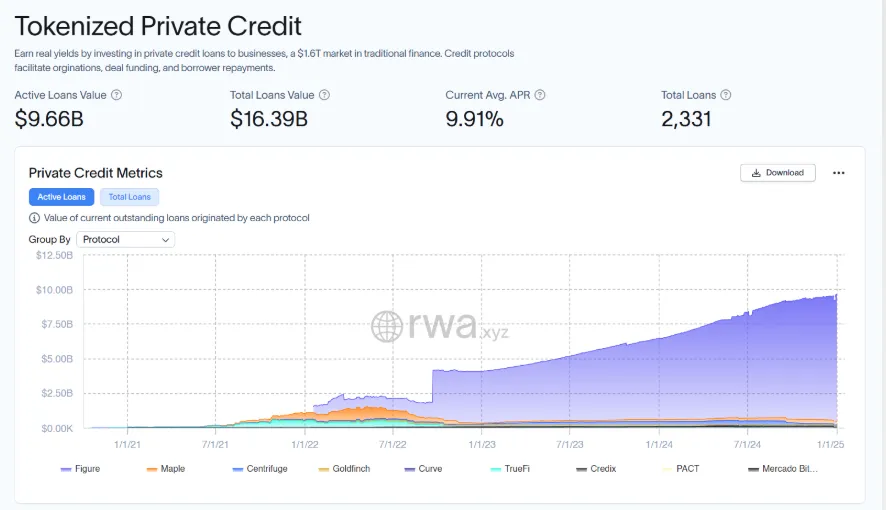

Private Credit: A $2 Trillion Market

Private credit tokenization is gaining momentum, with platforms like Centrifuge leading the charge.

In 2024, Centrifuge tokenized over $8 billion in loans, offering investors exposure to high-yield assets traditionally reserved for institutions.

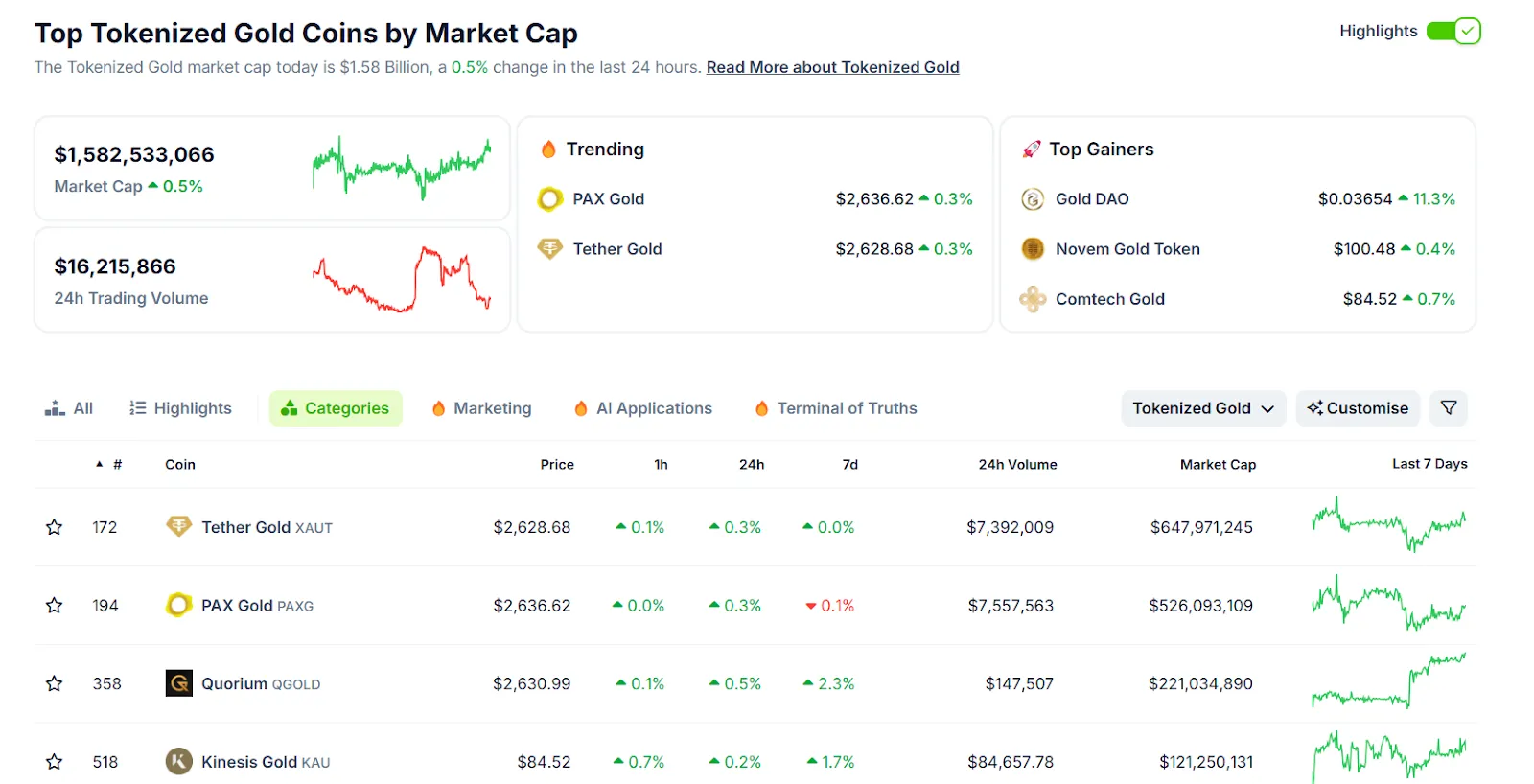

Tokenized gold-backed products like Paxos Gold and Tether Gold have a combined market cap nearing $1 billion.

These assets provide a new way to trade commodities, blending stability with digital convenience.

While real estate tokenization faces hurdles, it remains a promising sector.

Projects like tokenized REITs (Real Estate Investment Trusts) aim to make property investments more accessible and liquid.

Challenges: The Roadblocks Ahead

Tokenization isn’t without its challenges. Here’s what we’re up against:

While tokenization promises liquidity, poorly designed projects can lead to illiquid markets.

As TAC notes, many early tokenization projects struggled with low-quality assets and high fees, discouraging investors.

Despite progress, the regulatory landscape remains fragmented.

Countries are at different stages of adopting tokenization frameworks, creating compliance challenges for global projects.

Tokenization introduces new complexities. Educating investors—especially retail participants—is critical to ensure widespread adoption.

Insights from the TAC Report

The State of Asset Tokenization 2024 report by TAC offers invaluable insights:

1 - Market Growth

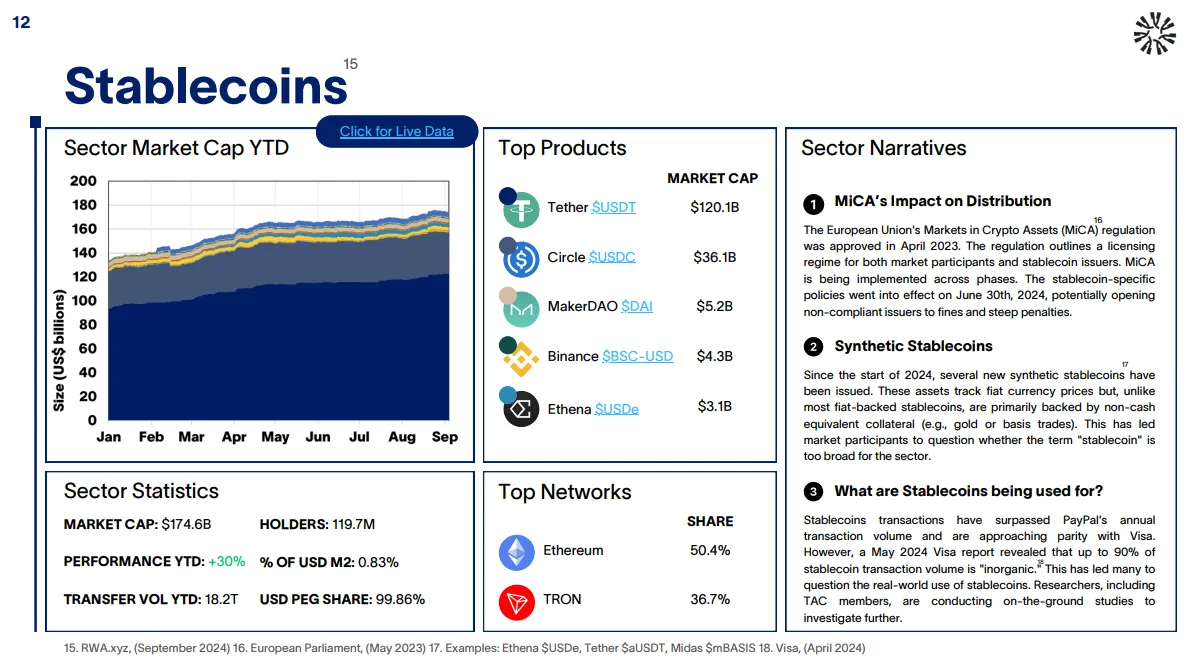

The total tokenized asset market, including stablecoins, reached $186 billion, showing a 53% year-over-year increase.

This is a significant leap considering the nascent stage of the industry.

2 - Diverse Applications

Tokenized assets span various categories, with stablecoins dominating at $120 billion, followed by tokenized treasuries and private credit.

3 - Participation Metrics

Over 150 issuers are now actively involved in tokenized asset projects, leveraging 20+ public blockchains to facilitate transactions.

4 - Regional Leaders

Asia and Europe are leading the tokenization charge, with regulatory sandboxes enabling pilots in markets like Singapore and Switzerland.

5 - Institutional Trust

Surveys conducted for the report reveal that 70% of financial institutions view tokenization as a viable solution for unlocking illiquid assets.

6 - Tokenized Treasury Growth

This category alone surpassed $2 billion in market cap, with innovative products offering unprecedented liquidity and efficiency.

As we look ahead, the trajectory of tokenization seems clear:

DeFi Integration: The fusion of tokenized assets with decentralized finance will unlock new opportunities for lending, staking, and trading.

Institutional Scaling: Expect more Fortune 500 companies to explore tokenization. A recent survey found that 35% of executives are planning tokenization projects, and 86% recognize its potential.

Emerging Markets: Tokenization can democratize access to global markets, particularly in emerging economies where traditional infrastructure is lacking.

At Kalp Studio, we are deeply invested in enabling the tokenization of Real-World Assets (RWA) to simplify asset management while unlocking liquidity and enhancing accessibility.

Our approach focuses on combining blockchain technology with real-world utility, offering robust tools and frameworks for enterprises across the globe.

Innovative Solutions for RWA Tokenization

1 - Liquidity Enhancement

By converting tangible assets into digital tokens, we help enterprises unlock new liquidity pools, making traditionally illiquid assets tradeable.

2 - Automated Compliance

Our smart contract solutions integrate regulatory requirements, ensuring seamless adherence to legal frameworks.

3 - Fractional Ownership

High-value assets like real estate can now be tokenized, enabling fractional ownership and democratizing access for smaller investors.

4 - Secure and Transparent Transactions

Blockchain-powered solutions ensure that every transaction is transparent, immutable, and secure, building trust among stakeholders.

5 - Rapid Deployment

With low-code capabilities, Kalp Studio enables swift deployment of blockchain networks, reducing complexity and time-to-market for enterprises.

We also focus on expanding the reach of RWA tokenization.

By leveraging blockchain’s decentralized nature, we provide global access to investment opportunities, breaking down barriers for diverse investor bases.

Enterprise-Grade Features

Single Sign-On (SSO) for secure access to supply chain data.

Smart Contract Templates for easy customization and deployment.

Interoperability through API gateways and IPFS storage integrations.

Our projects have empowered over 349 enterprises globally, ranging from real estate to financial services, to integrate tokenization into their ecosystems effectively.

Tokenization is more than a buzzword—it’s a paradigm shift.

But as with any revolutionary technology, success depends on execution. The potential to reshape finance is enormous, but so are the challenges.

The question isn’t whether tokenization will change finance.

It’s how we, as builders, regulators, and investors, will shape its future.

At Kalp Studio, we’re committed to making that future a reality—one token at a time.

Deepak Choudhary is a solid two years of writing experience and crypto enthusiast. He writes about blockchain games, Telegram games, and tap-to-earn platform. Like his audience, he writes with clarity, simplicity, and lots of useful tips in his articles. He helps those unfamiliar with various aspects of crypto world in a very simple way. He also provides regular updates on the fast growing world of blockchain, with great articles covering current and expected trends and guides. His writings on crypto games as well as crypto earning apps on Telegram are quite useful and informative for people novice and experienced. His aim is to help more people explore and profit from Web3 ecosystem.

8 months ago

Bitcoin market trends

8 months ago

Crypto news and analysis

8 months ago

Top cryptocurrency news sites

8 months ago

Cardano news

8 months ago

Bitcoin market trends

8 months ago

Ripple news

8 months ago

Cryptocurrency tax news

8 months ago

Cryptocurrency security updates